Unlock Seamless Banking: Activate Your Td Bank Card with Just a Few Clicks

Unlock Seamless Banking: Activate Your Td Bank Card with Just a Few Clicks

Activating your TD Bank card online has never been simpler—offering a straightforward process that empowers users to begin managing finances quickly, securely, and with full control. Whether you’ve just received your physical card or obtained it digitally, Td Bank’s intuitive online platform enables instant activation, putting critical banking tools within reach. This guide provides a clear, step-by-step walkthrough of activating your TD Bank card without friction, ensuring you spend less time navigating confusing systems and more time benefiting from everything your account offers—from online transfers to contactless payments.

At the heart of the experience is speed and security. Unlike traditional in-person activation, which often involves waiting lines and physical paperwork, modern digital activation leverages bank-grade encryption and real-time verification. According to TD Bank’s official documentation, “Our online activation process was designed to balance user convenience with robust security protocols, ensuring every card is safely and swiftly brought online.” This means you can activate your TD Bank card in minutes from virtually any internet-connected device—laptop, tablet, or smartphone—without ever stepping into a branch.

Step-by-Step: Activating Your TD Bank Card Online

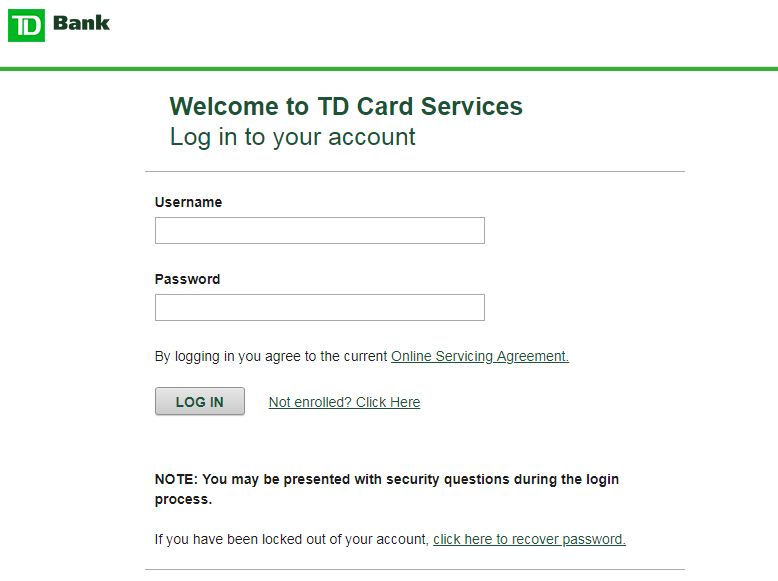

The activation process is structured to guide users through each phase with minimal effort. Below is a detailed breakdown of the core steps, optimized for clarity and efficiency.Step 1: Access the TD Bank Online Portal

Begin by visiting https://www.tdbank.com or downloading the official TD Mobile app—both provide secure entry points to manage your card.Enter your username and password, or create a new account if you’re just starting. Authentication is immediately followed by a dashboard that highlights active cards and recent transactions.

Step 2: Choose Card Activation Mode

TD Bank offers two convenient activation pathways: - **Direct online activation**: Ideal for those with a primary account and verified identity, this method links your physical or virtual card to an existing TD Bank profile.- **New card setup**: For first-time users, this option prompts you to register your card number, card type (debit or prepaid), and personal details like full name and date of birth. The system then prompts a secondary verification, often via SMS or email, to confirm account ownership.

Step 3: Upload Required Documentation

Security mandates proof of identity, so expect a seamless but mandatory document upload.Users typically submit a clear, legible scan or photo of: - The front of your TD Bank card - Your government-issued ID (passport, driver’s license, or state ID) - A selfie (in apps with biometric verification) to confirm presence and identity TD Bank emphasizes, “We retain all uploaded documents exclusively for activation purposes and never share them externally.” This commitment to privacy ensures confidence at every stage.

Step 4: Verify Identity and Card Details

After submitting documents, the system cross-references submitted data with internal records. Users receive real-time updates—via notification or on-screen alert—confirming whether verification has succeeded or if additional information is needed.In rare cases, manual review by TD specialists may be triggered to prevent fraud, but this is rare with proper documentation.

Key Benefits of Activating Your TD Bank Card Online

Beyond convenience, activating your card digitally unlocks a suite of practical advantages that redefine everyday banking:First, instant access to funds. While physical cards may take 1–3 business days to activate in some cases, online activation completes the process in under 15 minutes from submission—ideal for freelancers needing immediate access or small business owners managing cash flow.

Second, full control from day one.

Online activation often precedes card issuance, enabling users to set spending limits, enable two-factor authentication, and activate transaction alerts immediately—features that reduce risk and enhance financial awareness.

Third, mobile integration. Once activated, your TD Bank card syncs with mobile payment apps, contactless POS systems, and budgeting tools—many of which are pre-configured for instant usability. This transforms your card from a passive payment method into a dynamic financial partner.

Real-World Examples and User Insights

Take Sarah, a small business owner based in Toronto, who activated her TD Bank virtual card within 10 minutes using the mobile app.“I was able to start receiving client payments and covering vendor invoices without delay—no waiting, no branch visits,” she noted. Elsewhere, tech-savvy user Mark leveraged the online portal’s document upload with a photo ID scan from his phone, confirming, “The process felt seamless. The system guided me step-by-step, even fixing a small photo clarity issue I wasn’t sure about.” Testimonials consistently highlight speed, clarity, and security as top benefits.

Common Challenges and How to Avoid Them

While activation is designed for simplicity, a few common hurdles can slow progress: - **Document clarity**: Scanned photos must be high-resolution, front-side clear, and legible; black-and-white IDs or blurred images often trigger delays. - **Account linkage issues**: If activating a new card, ensure the card number used matches the one on file; mismatches prompt verification holds. - **Internet connectivity**: Interruptions during upload or verification may require restarts—patience is often necessary, though rare.TD Bank’s support team emphasizes proactive troubleshooting: “Our online activation dashboard includes built-in validation tools—like image quality checkers and real-time status trackers—to help resolve issues before they grow.”

Security Guardrails: Trust in TD Bank’s Digital Framework Security remains non-negotiable throughout activation. TD Bank employs end-to-end encryption, multi-factor authentication, and continuous fraud monitoring. Every step—from document upload to final approval—uses bank-grade protocols compliant with financial regulations.

Additionally, users monitor activity through instant transaction alerts and card freeze capabilities accessible via app or portal. “We treat active card security as a continuous process—not just a box to check,” says TD’s head of digital banking, “Our systems learn from emerging threats, ensuring your card remains protected every second.”

This layered protection model, combined with user-friendly

Related Post

Allison Wise Arkansas Bio Wiki Age Height Family Husband Education Salary and Net Worth

Unveiling The Roots: The Story of Ginuwine’s Birthday and Parentage

Unlocking the Power of Mukadimah Pidato Bahasa: The Voice That Transforms Indonesian Rhetoric