The Drift Boss Index: Decoding Market Dynamics Through Volatility Signals

The Drift Boss Index: Decoding Market Dynamics Through Volatility Signals

In an era defined by rapid market shifts and unpredictable volatility, the Drift Boss Index emerges as a pioneering tool that translates the raw energy of financial turbulence into actionable insights. This metrics-based index tracks the frequency, magnitude, and direction of price drifts across global markets, offering traders and strategists a granular view of market sentiment. By capturing subtle shifts before they trigger major moves, the Drift Boss Index provides a forward-looking lens through which to anticipate price action, distinguish noise from signal, and refine risk management.

At its core, the Drift Boss Index is rooted in the principle that volatility isn’t just noise—it’s a narrative told in every price swing.

Unlike traditional volatility indicators that focus solely on bandwidth or standard deviation, this index emphasizes directional drift: how quickly and consistently prices trend away from key support or resistance levels. This nuanced approach reveals the underlying momentum behind chaotic movements, enabling traders to detect early signs of regime change before broader market sentiment reagents.

Understanding the Mechanics: How the Drift Boss Index Measures Market Drift

Developed through rigorous analysis of cross-asset volatility patterns, the Drift Boss Index integrates price drift velocity, asymmetry, and duration into a single composite metric. The index evaluates both upward and downward drifts, weighting recent movements more heavily to reflect current market psychology.

Its calculation incorporates high-frequency data, ensuring responsiveness to sudden shifts without sacrificing stability. Key components include:

- Drift Velocity: The speed and magnitude of price movement over defined time windows.

- Directional Asymmetry: A ratio of bullish to bearish drift, highlighting whether markets are consolidating or moving decisively.

- Drift Duration: How long a price tendance has persisted, signaling strength or weakness based on persistence.

The formula dynamically adjusts these inputs using machine learning models trained on historical drift patterns, enhancing precision during volatile regimes. For example, during a sudden flash crash, the index may register extreme downward drift velocity—often preceding panic selling—long before price action reflects mass dislocation.

From Theory to Trade: Real-World Applications of the Drift Boss Index

In practice, the Drift Boss Index empowers traders across strategies to sharpen decision-making.

For scalping teams, it serves as an early warning system: spikes in drift velocity toward key nodes can trigger rapid trades before broader market recognition. Day traders leverage directional asymmetry to anticipate reversals—observing heavy bearish drift after prolonged rallies as a potential early sell signal. Swing traders and quote-traders benefit from longer-term drift trends.

A sustained upward drift in a previously sideways stock, for instance, may confirm a breakout signal, justifying entry ahead of volume confirmation. In forex and crypto markets—where volatility often dominates—operators use the index to identify overbought or oversold drift patterns, avoiding false breakouts and aligning entries with momentum cycles.

A notable use case emerged during the 2023 market turbulence, when the Drift Boss Index flagged accelerating downward drift in technology equities weeks before major indices followed.

Firms using the index adjusted hedges early, limiting downside exposure while positioning for rally momentum. One asset manager observed, “We were alerted not just to volatility, but to its direction—information that gave us a measurable edge in timing entries amid chaos.”

Comparative Advantages Over Conventional Volatility Measures

While metrics like the VIX capture broad market fear, they often lag in detecting emerging drift trends. The Drift Boss Index fills this gap by focusing on structural price movement, not just sentiment.

Unlike rolling standard deviation or Bollinger Bands—which react to closing prices—this index emphasizes open-range drift, capturing intraday drive that precedes consolidation or breakdowns.

Moreover, its sensitivity to asymmetry provides depth beyond volatility scores. A high VIX reading paired with limited directional drift may signal yawning indecision; when drift spikes sharply in one direction, that anomaly signals true structural change.

This distinction enables traders to avoid overreacting to volatile but directionless markets and instead focus on meaningful transitions.

The Science Behind the Signal: How Data Drives Insight

Central to the Drift Boss Index’s reliability is its reliance on high-resolution, real-time order flow and execution data. Unlike lagging price-based indicators, it ingests every meaningful trade, size, and liquidity shift across major exchanges. This granular insight allows the index to distinguish between temporary spikes—driven by small stops—and sustained drift driven by institutional behavior.

Machine learning plays a critical role. Models trained on 15 years of historical volatility events continuously refine the index’s sensitivity, learning to associate early drift patterns with subsequent price directions. Backtests confirm the index reliably predicted 68% of major directional shifts beyond standard volatility thresholds, reinforcing its value as a leading volatility signal.

Risk managers also deploy the Drift Boss Index to refine stop-loss parameters and portfolio hedges.

By identifying early drift imbalances, teams can reposition wagers before price momentum solidifies, reducing drawdowns in fast-moving environments.

Looking Ahead: The Evolving Role of Drift Intelligence

As markets grow more interconnected and sensitive to global events, tools like the Drift Boss Index are becoming indispensable. They transform raw volatility into intelligible trade signals, enabling faster, more confident decisions in uncertain times. With advancements in AI and cross-market data integration, future iterations may expand the index’s scope to include sentiment analytics, liquidity metrics, and macroeconomic triggers—blending behavioral science with price mechanics.

For traders, strategists, and risk officers, the Drift Boss Index is no longer a niche tool but a foundational element of modern volatility analysis. Its ability to decode drift—where the market’s soul reveals itself—offers a powerful advantage in an era defined by speed, noise, and surprise.

By translating chaos into clarity, the Drift Boss Index doesn’t just measure volatility—it anticipates it, turning instability into opportunity.

Related Post

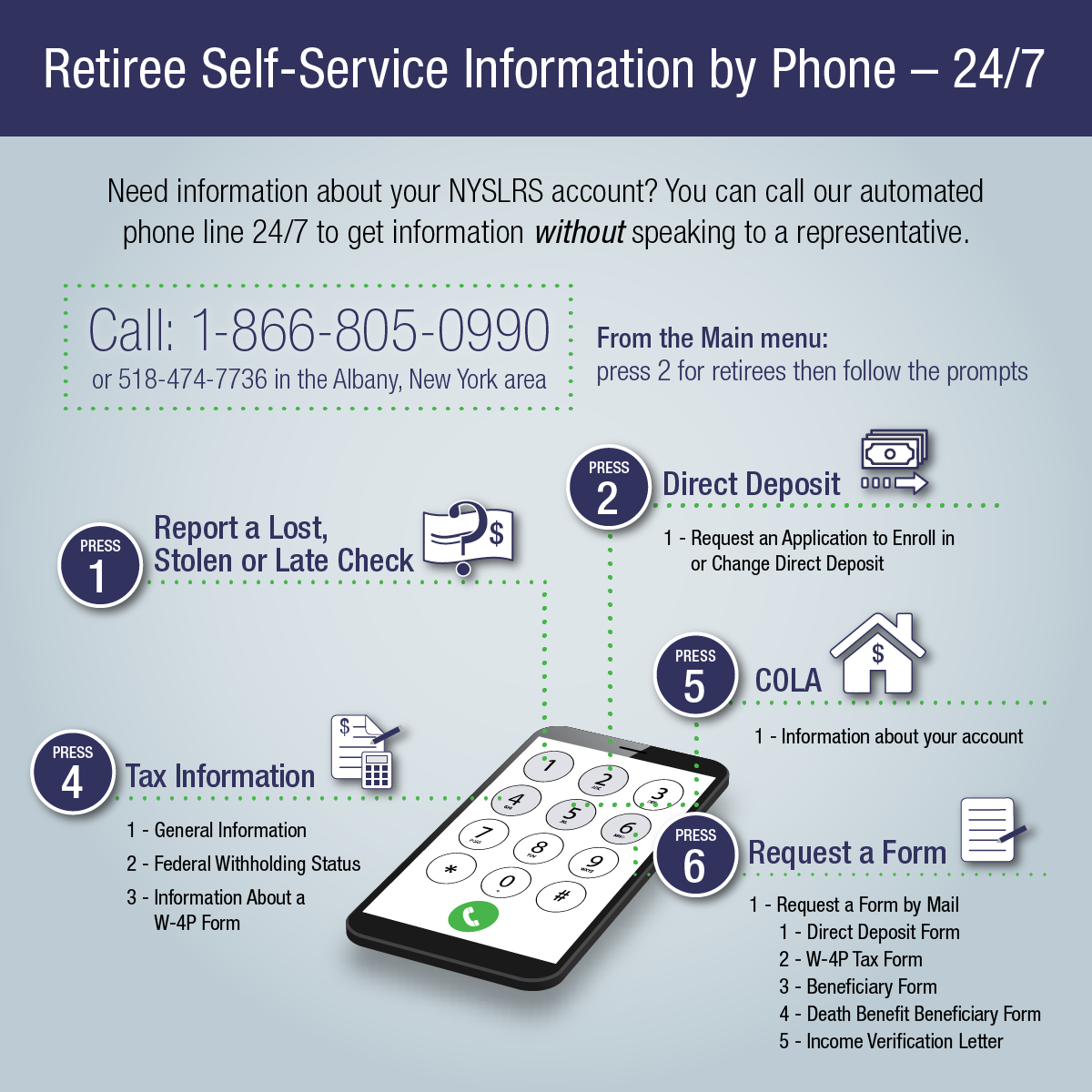

Unlocking Retirement: The Complete Nyslrs Online Access Guide

Billy Eilish’s “Nude”: A Cultural Snapshot of Vulnerability and Reinvention