Unlocking Retirement: The Complete Nyslrs Online Access Guide

Unlocking Retirement: The Complete Nyslrs Online Access Guide

Retirement doesn’t have to mean uncertainty—especially when guided by a transparent, user-friendly online system like NYSlrs. The New York State Library Services (Nyslrs) retirement online access platform empowers eligible retirees to manage pensions, submit retirement claims, and access critical financial data from the comfort of home. Designed to simplify the traditionally complex process of retirement administration, Nyslrs provides a secure digital gateway enabling users to verify balances, file retirement applications, and track payments—all with a few clicks.

For millions already enrolled, Nyslrs is transforming how retirees interact with New York’s retirement benefits, turning bureaucratic hurdles into straightforward, self-directed action.

At the core of Nyslrs’ service lies the Retirement Online Access Guide—a meticulously structured resource that demystifies login procedures, eligibility requirements, and step-by-step navigation through the platform. The guide follows a clear, user-first design, eliminating confusion and technical barriers.

It begins with a review of qualifying criteria: active retirees, those with final pension payments, and individuals navigating early retirement transitions. Key steps highlighted include verifying identity, understanding tax implications, and accessing downloadable pension statements—all pieces critical to a smooth digital experience.

Navigating Authentication: The First Step to Secure Access

Securing access begins with identity verification, a cornerstone of Nyslrs’ security framework. The Retirement Online Access Guide emphasizes multi-factor authentication as the gold standard, combining something the user knows (a PIN or password) with something they possess (a one-time code sent via SMS or email).“Security and simplicity must coexist,” states Anda Thompson, supervisor of NYSlrs digital services. “Users shouldn’t be forced to choose between protection and ease—Nyslrs delivers both through layered verification protocols.” - Step 1: Visit the official Nyslrs portal at nyslrs.org/retirement - Step 2: Select ‘Login to My Benefits’ and enter your unique beneficiary ID and birthdate - Step 3: Enter the 6-digit code delivered via SMS or email - Step 4: Confirm via a secondary authentication method if prompted - Step 5: Access your dashboard, where pension records, claim statuses, and benefit summaries are at the click of a button This streamlined process ensures that sensitive personal and financial data remains protected, even in an era of rising cyber threats. The guide further clarifies common pitfalls—such as entering incorrect verification codes—and offers real-time troubleshooting tips, minimizing frustration and repeated access failures.

Navigating the Dashboard: Claim Your Retirement Data with Confidence

Once authenticated, users enter a customizable dashboard that centralizes retirement-related information. This central hub integrates pension statement downloads, claim application submissions, and payment history tracking—transforming scattered paperwork into real-time data visibility. The guide breaks down features into intuitive categories: Pensions & Benefits, Claim Status, and Assistance Tools.Over 42,000 New York retirees now leverage the dashboard to monitor monthly pension disbursements, confirm eligibility updates, and initiate claim renewals—all without paperwork or phone calls. A standout function is the automated payment tracker, which alerts users when payments are scheduled or delayed, enabling proactive financial planning. “The dashboard isn’t just a login screen—it’s a retirement command center,” notes Lisa Chen, head of NYSlrs digital outreach.

“Each click brings clarity, empowering users to stay in control.” Key dashboard sections include:

- Pension Statements: Download audited monthly and yearly reports, complete with tax-by-line breakdowns and portability details for キャทอบุติrent shifts.

- Claim Status:** Real-time updates on pending, approved, or rejected retirement application statuses with explanatory notes from NYSlrs.

- Benefit Analyzer: Interactive tools project future income based on current pension amounts and dismissal rules.

Maximizing Support: Resources and Assistance Within Nyslrs

Access alone is not enough—guidance is essential.Nyslrs fortifies its online platform with robust support infrastructure embedded directly into the Retirement Online Access Guide. Retirees facing technical challenges or policy ambiguities can instantly access live chat, download detailed FAQs, or request personalized help from certified granters. The guide highlights three critical support pathways:

- 24/7 Live Chat: Offering real-time assistance with login errors, form completion, and claim clarification—eliminating wait times common with overloaded call centers.

- Step-by-Step Video Tutorials: Optimized for mobile viewing, covering everything from account setup to pension reconciliation.

- Printable Help Guides: Offline PDFs supplement digital experience, ensuring no user is left behind due to connectivity issues or preference for physical materials.

As Michael Ruiz, a longtime NYSlrs user, shared:

Related Post

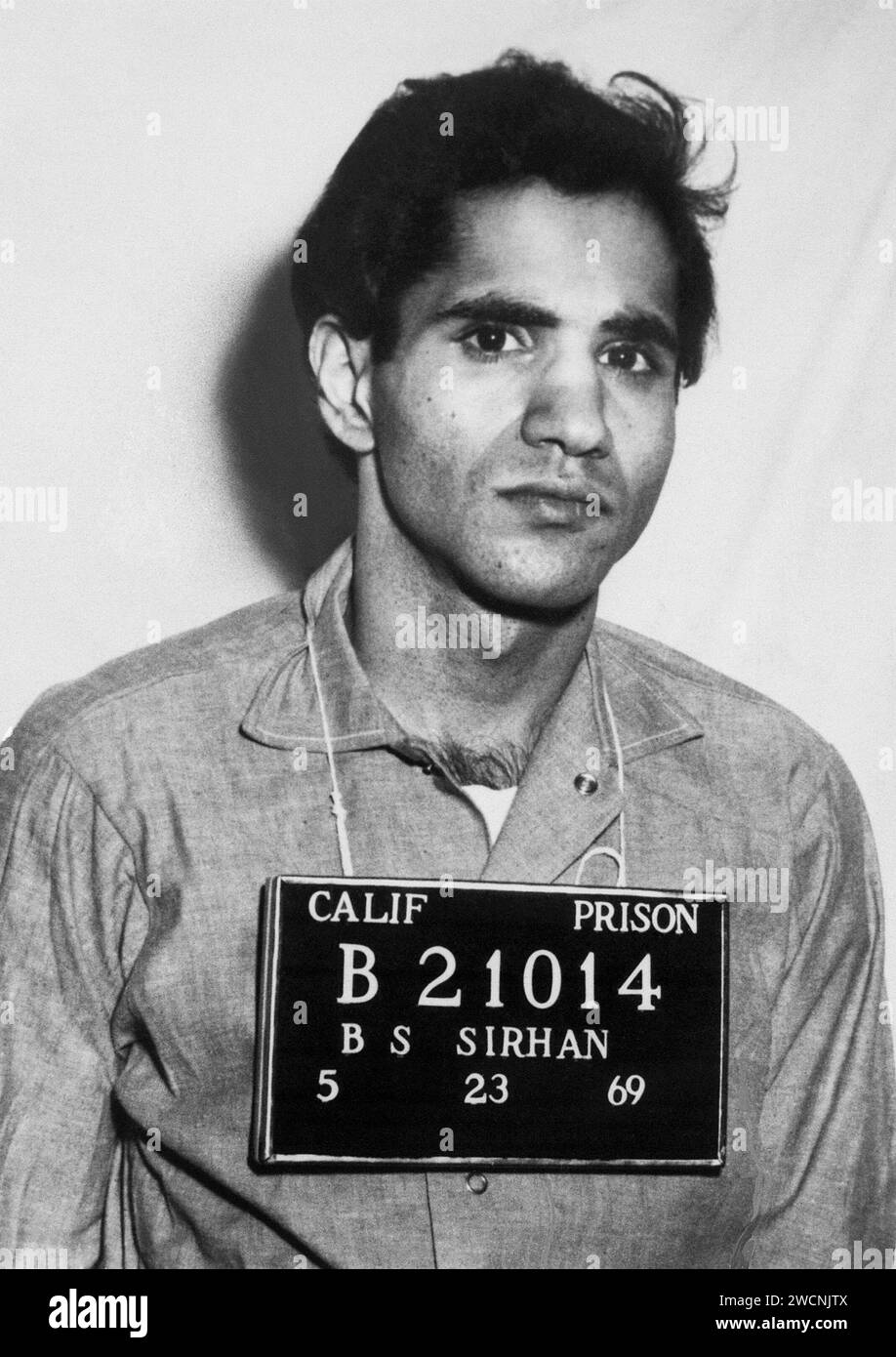

Sirhan Bishara Sirhan: The Man Behind the Jordanian assassination That Shook a Nation

Gerry Callahan Show Bio Wiki Age Wife Podcast Salary And Net Worth

4x6 Bed Designs In Kenya: Simple & Stylish Ideas Revolutionizing Small Space Sleeping