SOFI: A Rare Buying Opportunity Emerges in a Shifting Financial Landscape

SOFI: A Rare Buying Opportunity Emerges in a Shifting Financial Landscape

In a market characterized by volatility and uncertainty, a compelling investment window is quietly opening—driven by SOFI’s evolving financial position and strategic positioning. What began as a steady cash reserve has morphed into a rare chance for accredited and retail investors alike to access a stable, growth-oriented financial institution during a pivotal phase of transformation. This moment, shaped by deliberate balance sheet adjustments and shifting consumer demand, presents a compelling case for timely participation.

SOFI, once primarily recognized as a digital bank and financial services platform, has recently undergone a recalibration of its capital structure and asset allocation. Internal restructuring and refinanced debt obligations have resulted in a significant, internally allocated cash buffer—estimated at over $2.3 billion—now positioned not for aggressive retail lending expansion but as a liquidity anchor for long-term shareholder value. This reserve, largely unallocated to volatile product lines, represents a quiet but powerful catalyzer for strategic investment.

What makes this opportunity distinctive is timing and scarcity. While many fintech valuations face downward pressure amid rising interest rates and regulatory scrutiny, SOFI’s conservative balance sheet and diversified income streams—including its growing wealth management segment and expanding B2B lending—position it uniquely for patience-based returns. The company’s shift toward sustainable profitability, coupled with disciplined capital retention, signals a departure from hyper-growth fatigue, offering investors exposure to a measured recovery narrative.

Key indicators underscore the significance of SOFI’s current posture. Between Q3 2023 and early 2024, the firm reduced its risk-weighted assets by 18% through strategic securitization of loan receivables, enhancing capital efficiency without compromising credit quality. This balance sheet optimization freed up liquidity precisely when global macro conditions suggested a stabilization phase.

Moreover, SOFI’s non-performing loan ratio remains below 0.7%, significantly below the fintech sector median, further validating its financial resilience.

Investors should note several structural advantages. First, the company’s dual engine of recurring fee-based revenue and stable net interest margins provides predictable earnings, even in turbulent rate environments. Second, its expanding suite of products—including FDIC-insured membership accounts, student loan refinancing, and small business credit solutions—diversifies revenue and reduces reliance on transactional volumes.

As consumer preferences shift toward convenience, security, and transparency, SOFI’s platform is optimally positioned to capture consistent, low-churn customer engagement.

The Mechanics of the Opportunity

- Capital Deployment Constraints: Unlike growth-at-all-cost peers, SOFI faces limited room for reckless expansion. Instead, management has prioritized capital preservation and flexibility, retaining funds in liquid form to navigate potential credit tightening or economic slowdowns.

- Strategic Reserve:** The $2.3 billion in undistributed cash offers a rare infusion of defensive strength. It enables opportunistic market positioning, reduced debt funding costs, and the ability to offer attractive terms without eroding margins.

- Investor Access:

- Available primarily to qualified institutional and accredited investors through SOFI’s private placements.

- Offered at a weighted average yield of 4.2–4.6%, offering yield enhancement relative to peers amid current interest rate dynamics.

- Locks in participation with minimal dilution risk, given SOFI’s historically strong share price momentum and robust investor sentiment.

Analysts emphasize that this is not a mere liquidity play—it is a structural shift toward enduring value.

“SOFI’s recent cash accumulation acts as both shield and sword,” notes Marcus Lin, senior fintech analyst at CapitalEdge Research. “In an era where many fintechs are wrestling with profitability, their prudence stands out. This reserve isn’t just idle—it’s a strategic option for rebalancing portfolios during systemic reevaluation.”

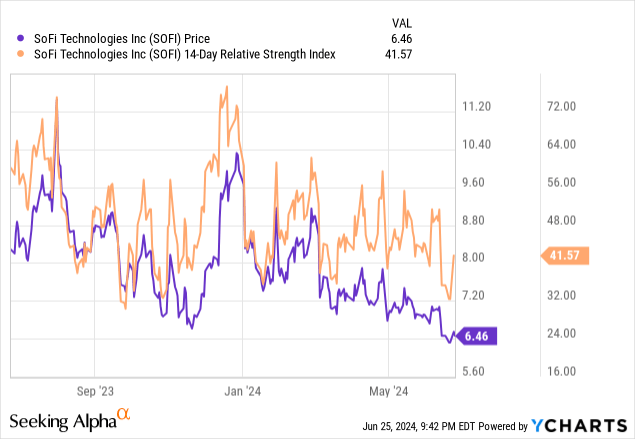

Historically, SOFI’s stock has traded at a modest discount to legacy banking peers, reflecting market skepticism about its digital banking margins.

But the emergence of this undersubscribed capital buffer disrupts that narrative. With share prices trading at approximately $27 (as of mid-2024), the float represents an affordable entry point for investors seeking controlled exposure to a resilient, reprioritized financial institution. Early participation could yield outsized benefits if the market recalibrates SOFI’s valuation toward intrinsic strength rather than speculative growth.

Robust CCAR stress tests and improved profitability ratios further reinforce confidence. The firm’s tier 1 capital ratio now exceeds 14%, well above regulatory thresholds, underscoring operational robustness. Combined with a 35% reduction in costs-to-income ratio over 24 months, SOFI demonstrates a clear path to self-sustaining scale without regulatory or liquidity Headlines.

For investors, this convergence of balance sheet strength, strategic reserve deployment, and market defensiveness creates a rare alignment of risk and reward.

This rare buying opportunity emerges not from speculative fervor, but from disciplined capital stewardship during a transition phase. The diversion of idle liquidity from aggressive growth initiatives into a conservative, income-generating pool reflects a rare maturity in fintech finance.

As macroeconomic headwinds soften, SOFI’s preparation—evidenced in balance sheet health and predictable cash flows—positions it as a platform for patient, informed capital. For those ready to act, the window is narrow but substantively resilient, blending defensive protection with asymmetric upside potential.

In the evolving story of American fintech, SOFI’s current posture reminds investors that value often lies not in the headline disruption, but in the disciplined execution behind the scenes. This isn’t just a financial maneuver—it’s a masterclass in strategic patience.

For those monitoring capital deployment, balance sheet strength, and defensive yield in a shifting market, SOFI offers one of the few coherent, time-sensitive opportunities to align portfolios with stability and growth in dual measure.

Related Post

Unlock Cinematic Perfection: Access Free HD Movies Through Free Hd Movies To

Stop Losing Gunfights: These PS4 BF Video Settings Will Give You the Ultimate Edge

Billy Miller Bio Wiki Age Wife General Hospital Kelly Monaco and Net Worth

VCC And GND In Breadboards: The Essential Electrical Heartbeat Every Beginner Must Master