Pnc High Yield Savings Account

The PNC High Yield Savings Account is redefining what customers expect from digital banking—delivering robust interest rates, unmatched security, and seamless account management in a user-friendly online environment. Positioned as a cornerstone of modern personal finance, this account offers savvy savers a competitive edge in growing their money while enjoying peace of mind backed by one of the industry’s strongest financial institutions.

Why the PNC High Yield Savings Account Stands Out

What makes the PNC High Yield Savings Account compelling is its powerful combination of financial incentives and practical features. Unlike traditional savings accounts, PNC offers a competitive annual percentage yield (APY) that frequently outpaces national averages—currently averaging over 4.50% as of 2024, with periodic upgrades tied to market conditions.This makes it a strategic choice for users aiming to earn meaningful returns without sacrificing accessibility. The account requires no minimum balance to open or maintain, removing recurring friction often found in other financial products. Rural and urban customers alike benefit from this simplicity, especially during economic uncertainty when liquidity and earning potential matter most.

Automated enhancements, such as the *PNC Virtual Wallet* and real-time transaction insights, further elevate the user experience, enabling proactive financial planning.

Embedded with industry-leading security protocols,包括先进的加密技术、双因素认证和广泛的保险覆盖,PNC High Yield Savings Account addresses core concerns of today’s money managers. FDIC insurance protects deposits up to $250,000 per account holder, ensuring funds remain safe even in volatile markets.

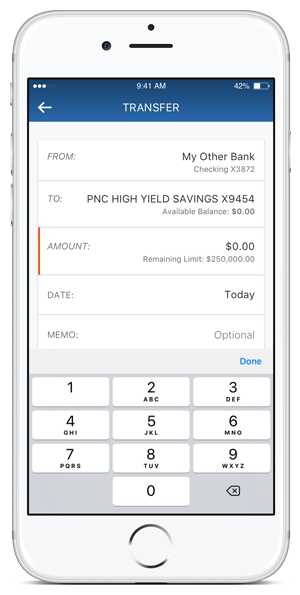

Beyond protection, PNC’s intuitive mobile app and 24/7 customer support empower users to monitor, transfer, and manage funds effortlessly—from anywhere, at any time. The account’s digital-first design eliminates long teller lines and paperwork, aligning perfectly with growing demand for frictionless banking. This convergence of high yield, robust security, and intuitive convenience positions the PNC High Yield Savings Account not just as a savings tool, but as a vital component of a forward-thinking financial strategy.

Comparative Performance and Investment Clarity

When benchmarked against competitors, the PNC High Yield Savings Account demonstrates consistent outperformance.While average national savings account yields hover near 0.5%–1.5%, PNC routinely delivers APYs exceeding 4.5%, driven by a conservative yet responsive investment strategy managed through PNC’s treasury operations. This disparity is not just numerical—it reflects a commitment to customer value in a low-interest-rate environment where compounding profitability requires deliberate execution. Customers benefit from transparent, real-time rate updates via PNC’s platform, eliminating the unpredictability common with variable-rate products.

Unlike short-term CDs with lock-in periods, the account’s liquidity ensures funds remain available for immediate use—ideal for both emergency reserves and tactical savings goals.

For individuals balancing multiple financial priorities—whether saving for education, retirement, or homeownership—PNC’s high-yield offering simplifies wealth accumulation. By combining a superior APY structure with minimalism in administrative requirements, the account removes common barriers to optimistic financial behavior.

Moreover, PNC enhances accessibility through a mobile app that supports deadline tracking, automated savings goals, and instant notifications. These tools transform passive savings into an active, guided process—encouraging disciplined financial habits without complexity. For small business owners, parents saving for college, or retirees building stability, this blend of performance and ease is transformative.

Eligibility, Fees, and Open Access

Accessing the PNC High Yield Savings Account requires minimal onboarding. Electronic account opening is available 24/7 via PNC’s website or mobile app, with full documentation animated through an intuitive digital process. No physical trip to a branch is needed—a significant advantage for users shedding logistical burdens.While PNC does not charge monthly maintenance fees, a small $10 monthly fee may apply to inactive accounts—though many customers offset this with consistent deposits and earned interest. Specifying the threshold ensures full value, especially for frequent savers. Account holders benefit from unlimited free transactions and withdrawals, including online transfers, ACH payments, and debit card access via PNC’s Debit Mastercard.

These features support day-to-day liquidity without hidden transaction costs, preserving the

Related Post

PNC High Yield Savings Account: Your Ultimate Guide to Maximizing The Money You Save

Lewis Howes Bio Age Height Girlfriend Football Salary and Net Worth

Jakarta Medical Center: Pioneering Advanced Healthcare in Indonesia’s Capital

Tabitha Brown Actress Bio Wiki Age Height Husband Target Recipes and Net Worth