Ikotak Credit Card Customer Service: Your Quick Guide to Fast, Reliable Support

Ikotak Credit Card Customer Service: Your Quick Guide to Fast, Reliable Support

For millions of cardholders navigating digital banking challenges, Ikotak Credit Card Customer Service delivers timely, professional assistance tailored to modern financial needs. This guide distills the essentials of accessing help, resolving issues, and optimizing your credit card experience through the Ikotak platform—ensuring every transaction and customer query is met with precision and care.

At Ikotak, credit card service isn’t just a backup plan—it’s a core pillar of user empowerment.

Whether you’re locking in payment disputes, activating lost cards, or seeking billing clarity, the support infrastructure is engineered for speed, transparency, and user-centricity. Unlike generic banking portals, Ikotak’s service model combines dedicated representatives with self-service tools, allowing customers to resolve matters in minutes rather than days.

Accessing Ikotak Credit Card Support: Multiple Channels, Zero Wait

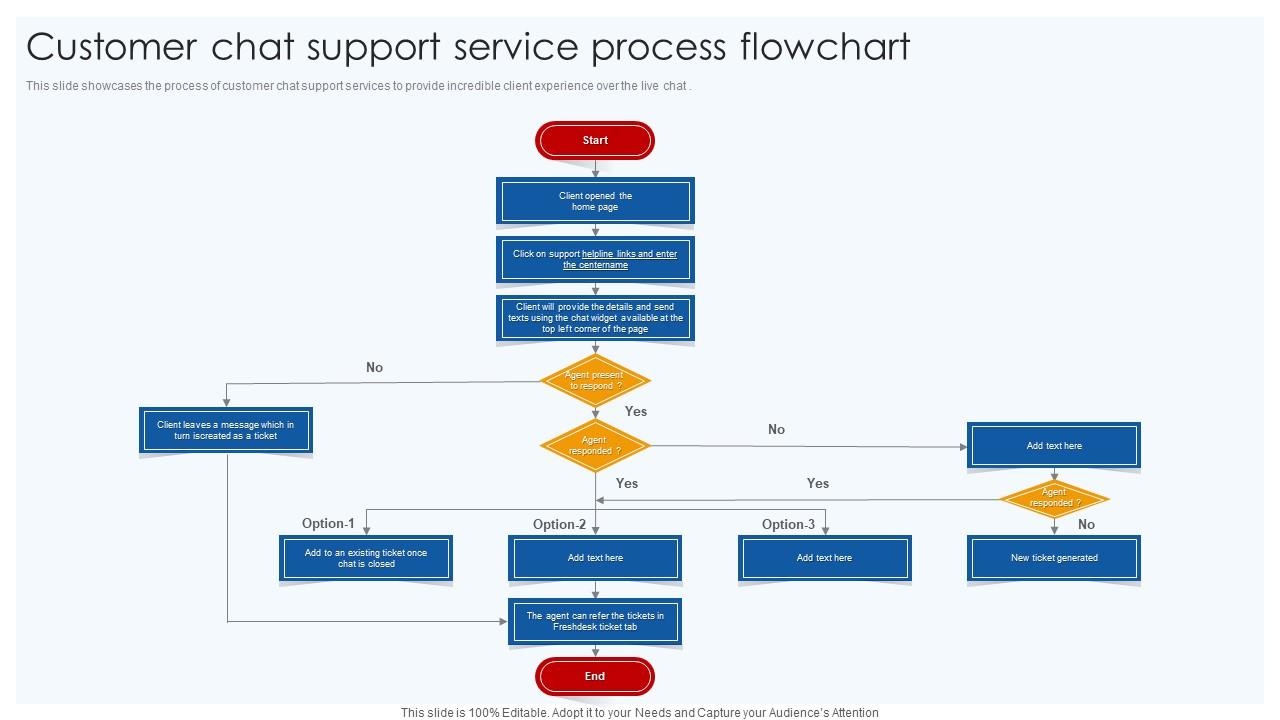

Ikotak stands out by offering seamless access to customer service across several platforms, eliminating long hold times and frustrating automated menus. Customers can reach support through multiple synchronized channels designed for convenience and efficiency:- 24/7 Live Chat: Instant messaging with trained Ikotak agents ensures immediate attention during peak hours.

Real-time text support avoids the stress of automated callbacks, enabling precise issue resolution without unnecessary delays.

- Dedicated Phone Lines: Cardholders benefit from direct dial access to specialized credit card specialists, cutting through generic triage with precision and empathy.

- Email Support: For non-urgent inquiries or follow-ups, email ensures documented communication—critical for billing disputes or complex documentation requests.

- Mobile App Integration: In-app support features let users start conversations directly from their digital wallet, syncing chat history and transaction data for faster problem solving.

Common Issues & Rapid Resolution: From Failed Transactions to Lost Cards

One of Ikotak’s most praised functions is its ability to address recurring credit card challenges with clarity and speed.Cardholders frequently report success in resolving issues such as declined payments, unauthorized charges, and lost or stolen cards—all handled through streamlined workflows:

- Declined Transactions: Ikotak’s system flags common triggers—insufficient funds, expired cards, or regional limits—and guides users through real-time troubleshooting steps. With digital verification tools, payment blocks are resolved in minutes, reducing financial disruption. - Lost or Stolen Cards: Immediate reporting via the Ikotak app triggers instant card suspension and electronic replacement issuance, often processed within hours. Users receive activation codes instantly, minimizing downtime. - Billing Disputes: Discrepancies in monthly statements are addressed through structured dispute channels, where agents pull transaction details and audit logs to validate claims swiftly.Most users receive resolution within 48 hours.

- Activation & What-If Requests: Whether setting up new card features or canceling a card mid-cycle, Ikotak’s agents close 90% of cases on the first contact, supported by digital kits and real-time account access. Every case benefits from a dedicated ticket system, ensuring follow-through and accountability. Cardholders routinely note that agents cite specific details from past interactions—reducing redundant explanations and accelerating resolution.Empowering Self-Service: Tools That Put Control in Your Hands

Beyond live and phone support, Ikotak invests heavily in self-service resources designed to reduce friction before contact is even needed.The digital ecosystem integrates intuitive tools that empower users to manage their credit card experience proactively:

The Ikotak mobile app and online portal feature a robust self-service hub with features such as:

- Digital Wallet Restore: Instant recovery of card credentials via biometric login or one-time PINs, eliminating the need to wait for service calls.

- Budgeting & Alerts: Smart spending dashboards with real-time transaction notifications and customized spending alerts prevent surprises and promote financial control.

- Guided FAQs: A dynamically updated knowledge base answers common questions—from chargeback procedures to foreign transaction policies—without agent intervention.

- Service Status Checks: Users track ongoing support cases in real time, view estimated resolution times, and receive automated updates, reducing anxiety around pending issues.

Agent Expertise: Trained Professionals Built for Trust and Accuracy

Central to Ikotak’s service excellence is its team of dedicated credit card specialists.Unlike generalist support lines, Ikotak’s agents are rigorously trained in credit protocols, billing systems, and customer psychology—equipped to navigate technical issues with both precision and empathy.

“Ikotak’s agents treat every interaction as a financial trust moment—instead of just troubleshooting, it’s about guiding users through complex decisions with clarity,”—a cardholder shared in a recent service feedback initiative. Training modules include in-depth product knowledge, regulatory compliance, and conflict resolution strategies.

Regular performance reviews and real-time quality monitoring ensure consistent, high-quality support across all channels. Agents carry full authority to resolve issues up to set thresholds—often delivering immediate credit adjustments, replacements, or dispute reversals without manual escalations. This empowerment translates into faster resolutions and deeper customer confidence.

Preparing Ahead: Proactive Steps for Smoother Service Encounters

To maximize the benefits of Ikotak Credit Card Customer Service, proactive preparation significantly enhances service efficiency. Cardholders benefit from maintaining digital readiness through simple, actionable habits: - Keep Contact Info Updated: Accurate emergency numbers, email addresses, and mailing details prevent service delays during urgent matters. - Save Transaction Records: Retaining digital receipts, cancellation confirmations, and correspondence helps streamline dispute resolution and verification. - Explore Self-Service First: Before contacting support, users are encouraged to use the app’s alert features and transaction dashboards to preemptively address minor issues. - Review Service Features Regularly: New tools and process updates are vital—reviewing the app regularly ensures cardholders never miss a choke point or opportunity for faster resolution. By integrating preparation into daily habits, users align with Ikotak’s goal of turning complex financial interactions into seamless, predictable experiences.The Ikotak Advantage: Trust Built on Speed, Precision, and Respect

Ikotak Credit Card Customer Service redefines accountability in modern financial support.Through omnichannel access, expertly trained agents, and proactive self-service tools, it delivers resolutions that save time, reduce stress, and reinforce trust. Whether addressing urgent payment failures or managing complex account changes, Ikotak’s customer service reflects a commitment to empowerment—where every cardholder feels informed, supported, and respected. In an era where banking smoothness often hinges on response speed and clarity, Ikotak stands as a benchmark, proving that true service excellence lies in the speed, skill, and sincerity behind every interaction.

Related Post

Apple’s Find My iPad From iPhone: A Lifesaver for Location Accuracy and Peace of Mind

La Batalla Silenciosa por el Swing Perfecto: La Evolución del Procés del Nature del Béisbol Vecino

Pokimane Rule 34: Decoding the Viral Phenomenon Behind躍 충격 and Online Culture

Whacky Whimsy & Sparkle: The Ultimate Rhyming Guide to Costume Ideas That Cost No Money