XRP Short Squeeze: Unraveling the Liquidation Risks That Could Shake Crypto Markets

XRP Short Squeeze: Unraveling the Liquidation Risks That Could Shake Crypto Markets

When institutional buyers aggressively short XRP, a volatile cascade can unfold—one that triggers short squeezes and exposes a critical danger: liquidation risk. As traders pile into positions betting on a rapid XRP rally, high short interest amplifies market fragility, creating a domino effect when sentiment turns. This article dissects how XRP short squeezes unfold, why rapid liquidations threaten market stability, and what investors should watch closely.

The Mechanics of Short Squeeze in XRP Markets A short squeeze occurs when heavily shorted assets spike in price, forcing short sellers to cover their positions by buying shares at elevated levels—fueling further price acceleration. In the case of XRP, short positions often accumulate due to widespread bearish sentiment, anchored by concerns over regulatory uncertainty, exchange delistings, or shifting liquidity dynamics. When XRP’s price begins to rise—driven by news, institutional interest, or algorithmic trading bots—short sellers scramble to reduce risk.

Their buying pressure creates self-reinforcing momentum, tightening supply and pushing prices even higher. “This is where risk becomes systemic,” explains financial analyst Sarah Chen. “XRP’s relatively concentrated short interest, when combined with tight stop-loss orders and leveraged positions, creates a perfect storm.

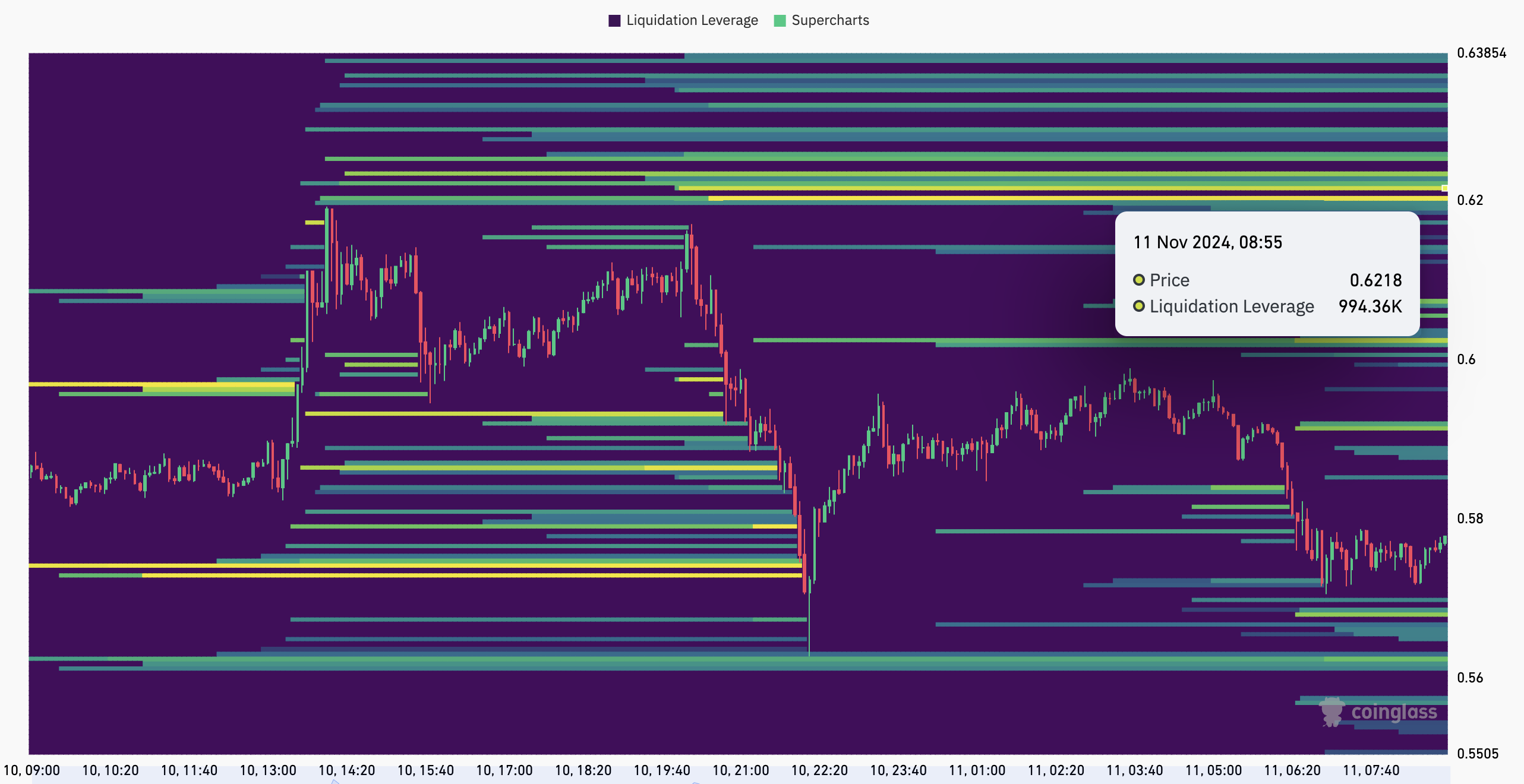

A single upward spike can trigger mass liquidations across margin accounts, accelerating volatility.” How Liquidation Risks Intensify During Short Squeezes Liquidation risk arises when the rapid price appreciation forces traders to cover shorts at unfavorable levels—often triggering margin calls. Most XRP traders using derivatives, margin accounts, or leveraged tokens operate under tight risk parameters. Once prices jump, these positions unwind automatically or manually, accelerating sell-off.

Features amplifying liquidation risks: - High short interest relative to trading volume - Leveraged positions held by retail or institutional traders - Concentrated buy orders from market makers or sidelined sellers - Market saturation near key resistance levels “The danger isn’t just about price hits,” warns Chen. “It’s about how fast those prices move—sudden moves overwhelm liquidity, making it impossible to exit without disappeishing volume.” In XRP’s history, such dynamics have repeatedly produced extreme volatility, exposing weak spots in leveraged trading environments. Real-World Patterns: Past XRP Short Squeezes and Their Aftermath XRP has experienced multiple short squeeze episodes, notably around price breakouts in late 2020 and 2023.

During these moments, short interest spiked sharply following macro announcements, drawing bot-driven buying waves that triggered cascading liquidations. Each surge revealed stark vulnerabilities: engineers tracking real-time order books observed how concentrated shorting amplified price swings, while exchanges reported sharp upticks in trading volume and margin calls. One 2023 surge saw XRP climb from under $0.50 to nearly $1.20 within days—an acceleration that forced dozens of leveraged positions to close at losses.

Traders who entered via automated strategies found themselves hit by slippage and late execution, turning sustainable gains into abrupt losses. “These spikes aren’t natural market corrections,” says blockchain researcher Marcus Bell. “They’re liquidity events—risk concentrated, crystallized, and released at dawn.” Broader Implications for Traders and Market Integrity The liquidation risks tied to XRP short squeezes carry far-reaching consequences.

For retail and institutional traders alike, reliance on short positions in highly leveraged environments without robust risk controls invites catastrophic losses. More than individual trades, repeated squeeze events challenge market stability by distorting price discovery, eroding confidence, and prompting regulatory scrutiny. “Traders must anticipate more than just price movement—they must map liquidity depth, margin usage, and order flow,” Chen advises.

“Understanding liquidation risk isn’t optional; it’s essential to surviving volatile surges.” Market-wide, repeated squeeze-driven volatility risks deter risk-averse investors, potentially limiting XRP’s long-term adoption in regulated finance. What Traders Need to Know to Protect Themselves To navigate XRP’s volatility during potential squeeze events, investors should adopt disciplined strategies: - Monitor short interest ratios: High short percentages often precede short squeezes. Tools like WhaleWatch or MarketChameleon track institutional positioning.

- Avoid over-leveraging: Stop-loss levels should account for expected volatility, not just technical support. - Use limit orders instead of market buys during breakouts to control execution and avoid slippage. - Diversify risk exposure: No single asset’s momentum should dictate allocations.

- Prepare for rapid liquidations by maintaining sufficient buffer in margin accounts. “If you’re long XRP ahead of volatility, expect sudden entries from alternators and leverage unwinding,” Bell cautions. “Risk isn’t just near resistance—it’s embedded in the system’s architecture.” Looking Forward: How Regulators and Market Participants Respond Regulators are increasingly scrutinizing short positions and squeeze dynamics following market disruptions.

Proposals for enhanced transparency—such as real-time reporting of short interest and margin exposure—aim to bolster market resilience. Meanwhile, exchanges like BitMart and Coinbase are refining circuit breakers and liquidation triggers to curb extreme swings. These developments reflect a growing recognition: XRP’s journey through short squeezes underscores not just trader risk, but the fragile balance between momentum, liquidity, and control.

As institutional adoption grows, managing liquidation risk isn’t just prudent—it’s imperative to sustainable market evolution. The interplay between short squeezes and liquidation risk in XRP trading reveals a market at a crossroads—bright with promise but shadowed by structural vulnerabilities. For participants, awareness and disciplined risk management remain the safest bets in this high-octane arena.