When Demand Never Bends: The Power of Perfectly Inelastic Demand

When Demand Never Bends: The Power of Perfectly Inelastic Demand

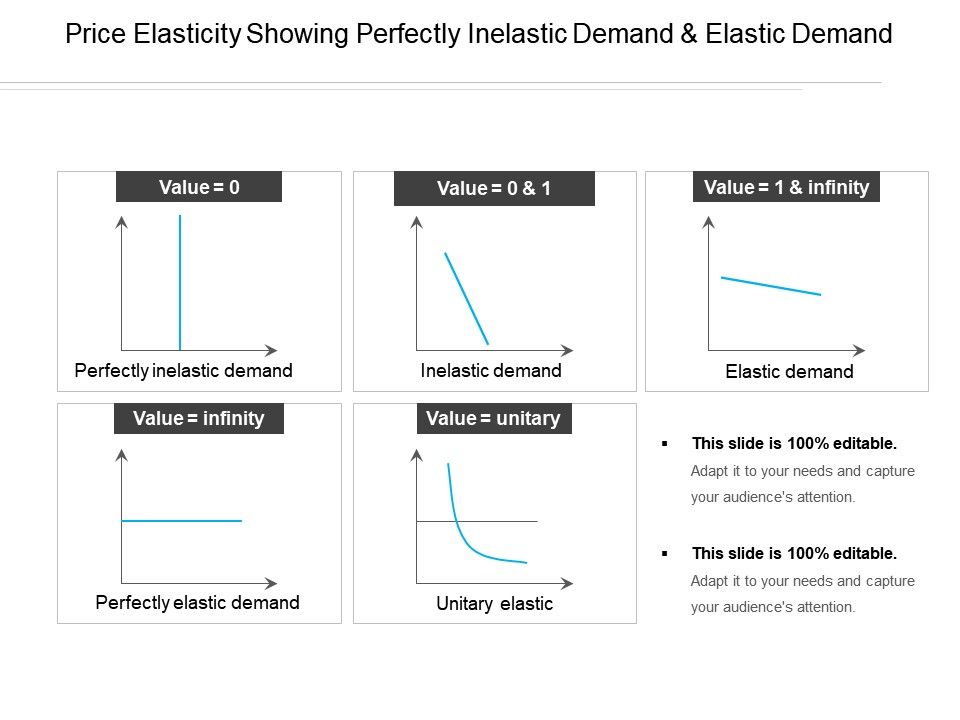

In markets where consumers refuse to shift their purchases regardless of price changes, the economic concept of perfectly inelastic demand reveals a rare and powerful reality—demand that remains rigidly fixed, unaffected by cost. This phenomenon occurs not in theory alone, but in critical sectors where necessity overrides price sensitivity, reshaping how businesses, policymakers, and economists understand market behavior. Perfectly inelastic demand describes a scenario where the quantity demanded of a good or service remains constant regardless of price fluctuations, reflected by a vertical demand curve.

Understanding this principle unlocks insights into essential healthcare, utilities, and certain addictive or socially ingrained behaviors—revealing why consumers treat some needs with unwavering commitment.

At the heart of perfectly inelastic demand lies the principle that essential goods or compulsive behaviors demand unwavering persistence in purchase, immune to price signals. Unlike typical demand, which responds to cost through quantity adjustments, inelastic demand means consumers absorb price increases without reducing consumption.

For example, individuals with chronic health conditions requiring daily medication face virtually no elasticity—skipping doses or forgoing purchases carries severe consequences, making price changes irrelevant to their choice. Economist Milton Friedman once noted, “Demand is not a mathematical curve that bends with prices—it is a fundamental human fact shaped by necessity.” This rigid behavior underscores a critical distinction: necessity creates inelasticity, and price becomes a secondary concern.

Quantifying perfect inelasticity demands strict observation of quantity demanded versus price changes over time.

A demand curve for insulin or emergency prescription drugs typically plateaus, indicating no discernible drop in quantity demanded across price ranges. This vertical slope—steepest possible—represents mathematically a demand elasticity of zero. Economists define perfect inelasticity as a price elasticity of demand (PED) equal to zero, calculated as the percentage change in quantity demanded divided by the percentage change in price.

When that ratio stands at zero, elasticity collapses, confirming consumers treat the product as indispensable. Real-world data from pharmaceutical pricing studies repeatedly confirm this pattern, validating the theoretical benchmark.

The real-world implications of perfectly inelastic demand profoundly shape industry strategies and policy design.

Utility companies, for instance, know electricity and water demand remains steady despite rate hikes—ensuring stable revenue but limiting pricing power. Similarly, tobacco and alcohol markets exhibit strong inelastic demand; despite steep taxes and public health campaigns, consumption drops only marginally, reinforcing the role of addiction and habit. Social policy often grapples with this when addressing access to medicines or emergency services.

As Susanمج736 الإلكتروني دعatility—not a flaw, but a powerful indicator of human behavior in the face of necessity.

Breakthroughs in understanding perfectly inelastic demand have reshaped economic forecasting and consumer strategy. Businesses leverage this insight to price essential goods with confidence, knowing volume remains predictable.

In healthcare, formulary managers rely on inelastic demand patterns to prioritize equitable access to high-need medications rather than responding solely to market pressures. Public health officials recognize that behavioral campaigns must shift focus from incentives to cultural and structural support, since price sensitivity rarely drives change in these domains. The efficiency gains and equity outcomes hinge on accepting that some needs defy economic flexibility.

Notable examples further illustrate the depth and reach of this concept. Destination cities facing exorbitant travel costs—such as Hong Kong’s sky-high transportation fares—still see inelastic demand for public transit among daily commuters. Students dependent on specialized equipment exhibit zero price responsiveness when essential for education.

Even in digital spheres, crisis response apps or emergency communications services maintain steady usage regardless of subscription charges, reflecting deep societal reliance. In each case, the absence of viable substitutes or route-by-need demands solidifies inelasticity.

Yet, perfect inelasticity is a theoretical and practical tightrope—rarely absolute and context-dependent.

Consumer preferences evolve, substitutes emerge (such as generic drugs replacing branded versions), and economic shocks can erode steadfastness. Policymakers must acknowledge that while a product may appear inelastic today, dynamic markets and shifting social attitudes constantly test its boundaries. Rigid data analysis and ethical responsibility are essential to avoid exploiting consumers whose choices are driven by necessity, not luxury.

Ultimately, perfectly inelastic demand represents a cornerstone of economic realism: some needs transcend price sensitivity, anchoring markets in a fundamental truth—human behavior is shaped as much by necessity as by choice. Recognizing this imperative empowers smarter decision-making across sectors, ensuring policies prioritize access over revenue and strategies honor the unyielding demand for what truly matters. In this rigid economic boundary lies not a limitation, but a vital compass for navigating the essentials of life.