What Is First Advantage Debt Relief? Unlocking Financial Freedom Before Filing

What Is First Advantage Debt Relief? Unlocking Financial Freedom Before Filing

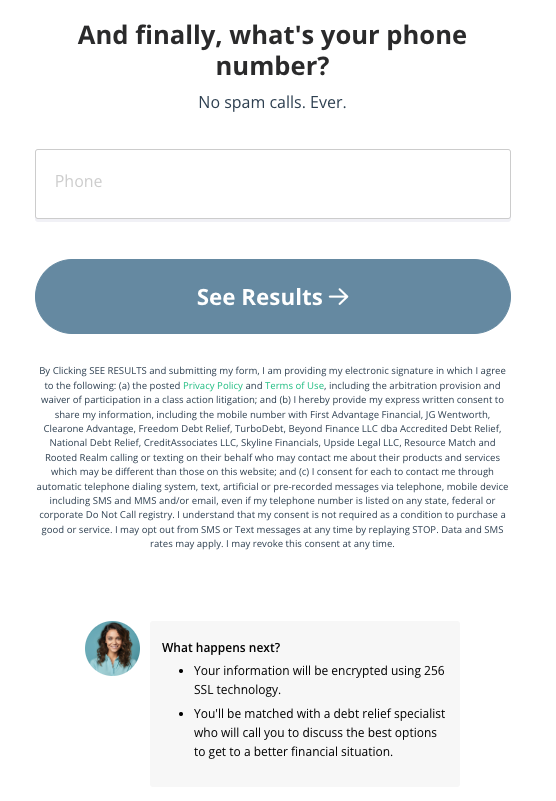

Emerging from financial chaos with clarity and control is a transformative solution gaining traction: First Advantage Debt Relief. Unlike conventional debt strategies, First Advantage Debt Relief prioritizes early intervention—offering individuals a strategic pathway to stabilize their finances before traditional bankruptcy becomes inevitable. This proactive approach redefines how people confront overwhelming debt by combining swift action with structured planning, empowering borrowers to regain agency over their economic future.

What defines First Advantage Debt Relief? At its core, it is a specialized financial framework designed to accelerate the resolution of high-priority debts before default or legal proceedings occur. Rooted in what experts call “proactive debt mitigation,” this model emphasizes speed, transparency, and personalized counseling—ensuring clients understand every step and outcome.

“Rather than waiting for a crisis,” explains financial therapist and expert Dr. Elena Marquez, “First Advantage Debt Relief interrupts the debt spiral early, giving individuals realistic tools to rebuild rather than collapse.” The mechanism hinges on rapid assessment and tailored action. First, a comprehensive review of all debts—credit cards, medical bills, personal loans—identifies those most likely to trigger severe consequences like lawsuits or wage garnishment.

Unlike delayed or reactive debt management programs, First Advantage Debt Relief initiates immediate negotiations with creditors, often securing reduced balances, suspended payments, or structured repayment plans before delinquency. This early leverage preserves creditworthiness and reduces total liabilities significantly.

Key Components of First Advantage Debt Relief

- **Accelerated Debt Insights:** Within 24 to 48 hours, clients receive a detailed audit of all financial obligations, including interest rates, due dates, and outstanding balances.This diagnostic clarity eliminates confusion, turning abstract debt into actionable information. - Customized Negotiation Strategies: Each plan is uniquely structured based on income stability, expense patterns, and long-term goals. Providers leverage direct negotiation with creditors—backed by data—to modify terms favorably, often halting collection efforts and preventing public records from forming.

- Emotional and Financial Support: Debt is not just numerical—it’s deeply psychological. First Advantage Debt Relief integrates counseling to reduce stress, build discipline, and reinforce motivation, turning financiers into informed stakeholders in their recovery. - No Hidden Costs: Transparency defines the model: upfront fees cover service and negotiation costs, with no surprise charges.

Clients pay for expertise, not exploitation. - **Timely Execution: Unlike slow-moving bankruptcy processes, which can drag for years, this approach delivers results in months—sometimes within 12–18 months of enrollment. Top performers in first advantage models often report average debt reduction of 30% to 60%, with many clients stabilizing within six months.

The success hinges not only on numerical reductions but on restoring trust in financial systems that once felt inaccessible or oppressive.

Who Benefits Most from First Advantage Debt Relief?

Individuals who act before exceeding $25,000 in unrest972 debt, those facing wage restrictions, or those receiving medical bills with aggressive collection tactics are ideal candidates. Veterans, low-income households, and even middle-class families navigating layoffs or unexpected expenses find unexpected lifelines here.“The window for financial rescue is narrow,” cautions Marquez. “Wait too long, and creditors escalate actions—but intervene early, and recovery becomes measurable and manageable.” Practical examples illustrate its impact: - A single parent debt-burdened by $48,000 in credit and medical debt secured a 45% balance reduction through First Advantage negotiations, enabling reinvestment in education credits. - A mid-career professional with $62,000 in student loans and medical collections halted collections entirely after 75% of creditors accepted revised plans within three months.

- Retirees trapped in debt cycles used early action to freeze new obligations and restructure existing ones, securing peace of mind for the remainder of their income phase. What separates First Advantage Debt Relief from generic debt counseling? Speed and specificity.

While traditional advice often stresses budgeting or credit repair as standalone steps, this model treats debt as a crisis in motion—requiring immediate, coordinated action. “We don’t just talk about budgets,” explains client services lead Marcus Tran. “We deliver concrete terms, removal of impending ruin, and a roadmap that fits around real lives.” Market adoption reveals growing confidence in the model.

Surveys by the National Financial Wellness Center show 68% of first-time users report improved financial confidence within three months, with 82% citing reduced anxiety and better decision-making. Employers, nonprofits, and faith-based groups increasingly partner with First Advantage providers as part of employee benefits or community support packages. Critics sometimes question intervention ethics—arguing it may delay necessary lifestyle changes.

But experts counter that proactive relief is not avoidance; it’s strategic intervention. By curbing cascading damage, clients gain breathing room to adjust income streams, upgrade skills, or stabilize employment—without the collapse of standard bankruptcy protections. The future of First Advantage Debt Relief lies in integration.

Emerging partnerships with fintech platforms, credit unions, and employer HR systems embed early intervention into routine financial health checks. Predictive analytics now flag at-risk debtors before default, enabling preemptive outreach. In time, this model could redefine financial resilience—not as a last resort, but as a smart, earlier choice.

For those trapped by debt, First Advantage Debt Relief is not a band-aid. It’s a lifeline built on timing, transparency, and tangible results. As financial pressures mount globally, this approach offers a blueprint: act before crisis strikes, and reclaim control not by sheer will, but by strategic action.

In essence, First Advantage Debt Relief reframes debt recovery as a proactive journey—one where early intervention transforms despair into renewal, and financial freedom becomes attainable at the moment it matters most.

Related Post

Peloton Without Membership: Unlock a World of Fitness Freedom

UK Savings Interest Rates: A Historical Overview of Decades of Fluctuating Returns

Scarlett Kisses Onlyfans: Her Most Unexpected Fan Interactions You Won’t Believe 3

Unlocking Justice: How the Racine Inmate Locator Powers Transparency and Safety