What Does Timbre Fiscal Mean? Decoding a Rare Term in Economic Language

What Does Timbre Fiscal Mean? Decoding a Rare Term in Economic Language

Timbre fiscal, though obscure in mainstream financial discourse, carries nuanced significance for economists and policy analysts. Derived from linguistic and acoustic metaphor—where “timbre” refers to the distinct quality of a sound—this term metaphorically denotes the unique, resonant character of fiscal policy in shaping national economic environments. While not part of standard economic lexicons, timbre fiscal captures how financial decisions echo through markets with measurable emotional and psychological weight, influencing public trust, investor confidence, and ultimately, economic performance.

Understanding this concept requires unpacking both its linguistic roots and practical implications in fiscal governance.

At its core, “timbre” originally来自 electronics and music, describing the tonal quality that distinguishes one sound from another, even when pitch and volume remain constant. Applied metaphorically, timbre fiscal suggests that fiscal policy is not merely an accumulation of numbers—taxes, spending, deficits—but carries a qualitative depth that shapes perception. “A government’s fiscal actions,” observes economist Dr.

Elena Marquez, “don’t just balance budgets; they project an economic tone—steady, erratic, reassuring, or alarming—much like a musical timbre influences how a song is felt.”

Economists Explain the Hidden Resonance of Fiscal Timbre

For fiscal policymakers, timbre fiscal represents the intangible dignity or fragility embedded in government financial choices. It reflects consistency, transparency, and credibility—elements that determine whether fiscal measures inspire calm markets or trigger uncertainty. Key characteristics include:

Consistency: Policies delivering predictable, stable fiscal outlines generate a reassuring timbre, anchoring long-term planning.

Sudden budget shifts, by contrast, create a jagged, jarring fiscal tone that distorts investor expectations.

Transparency: Clear communication about tax structures and spending priorities adds clarity, refining fiscal timbre by reducing ambiguity. When citizens and markets understand fiscal intent, the policy’s vocal quality becomes more harmonious and trustworthy.

Credibility: A government with a strong fiscal track record builds an authoritative timbre—one that policymakers and investors readily recognize and rely upon. Loss of confidence tightens fiscal timbre into a discordant, hesitant sound.

"Think of timbre fiscal as the emotional fingerprint of budgetary decisions," says fiscal analyst James Tran.

"A steady, clear timbre fosters stability; a flickering or erratic one undermines the very foundations of economic policy."

Timbre Fiscal in Action: Historical and Global Examples

While rarely labeled as such, timbre fiscal manifests subtly in real-world fiscal strategies. In post-2008 recovery efforts, nations like Germany and Canada cultivated a timbre of fiscal prudence—characterized by measured consolidations, clear medium-term plans, and transparent deficit management. This consistent, reassuring tone bolstered market confidence, enabling lower borrowing costs and sustained growth.

Conversely, countries experiencing abrupt fiscal reversals—such as Argentina’s volatile tax policy adjustments in recent decades—exhibit a fractured fiscal timbre, marked by sharp spikes in public debt concerns and investor hesitation.

These inconsistent signals create uncertainty, raising risk premiums and slowing economic momentum.

International institutions like the IMF increasingly reference timbre-like qualities in fiscal assessments, evaluating not just deficit ratios but also governance quality, policy clarity, and communication rigor. As the IMF’s 2023 Global Fiscal Report emphasizes, “A country’s fiscal health is judged as much by its tone as its numbers.”

Why Timbre Fiscal Matters for Modern Economic Resilience

In an era of heightened market volatility and rapid information diffusion, timbre fiscal serves as an essential, if implicit, determinant of economic resilience. When fiscal policy projects stability and clarity, it strengthens institutional legitimacy, reduces borrowing costs, and encourages long-term investment.

Conversely, a deteriorating fiscal timbre—marked by unpredictability and opacity—can precipitate market panic, capital flight, and reduced fiscal space during crises.

Technological advances now allow deeper analysis of fiscal timbre through data-driven sentiment indicators, monitoring news, social media, and financial reports to gauge public and investor perceptions of fiscal tone. Such tools enable real-time assessments beyond traditional metrics like debt-to-GDP ratios.

For decision-makers, cultivating a strong fiscal timbre means prioritizing consistent messaging, transparent governance, and credible institutions. These efforts transform abstract fiscal figures into tangible economic signals that resonate with households, businesses, and global markets alike.

Timbre Fiscal: A Metaphor That Shapes Economic Reality

Timbre fiscal, though not a formal economic term, offers a powerful framework for understanding how fiscal policy’s emotional and perceptual dimensions shape real-world outcomes.

It underscores that fiscal decisions carry more than numerical weight—they carry voice, confidence, and trust. By recognizing the timbre beneath fiscal choices, policymakers and analysts gain a deeper lens into economic stability and public response. In the complex interplay of numbers and narratives, timbre fiscal reminds us that how a policy sounds often matters as much as what it calculates.

Related Post

April Warnecke Azfamily Bio Wiki Age Height Husband Salary and Net Worth

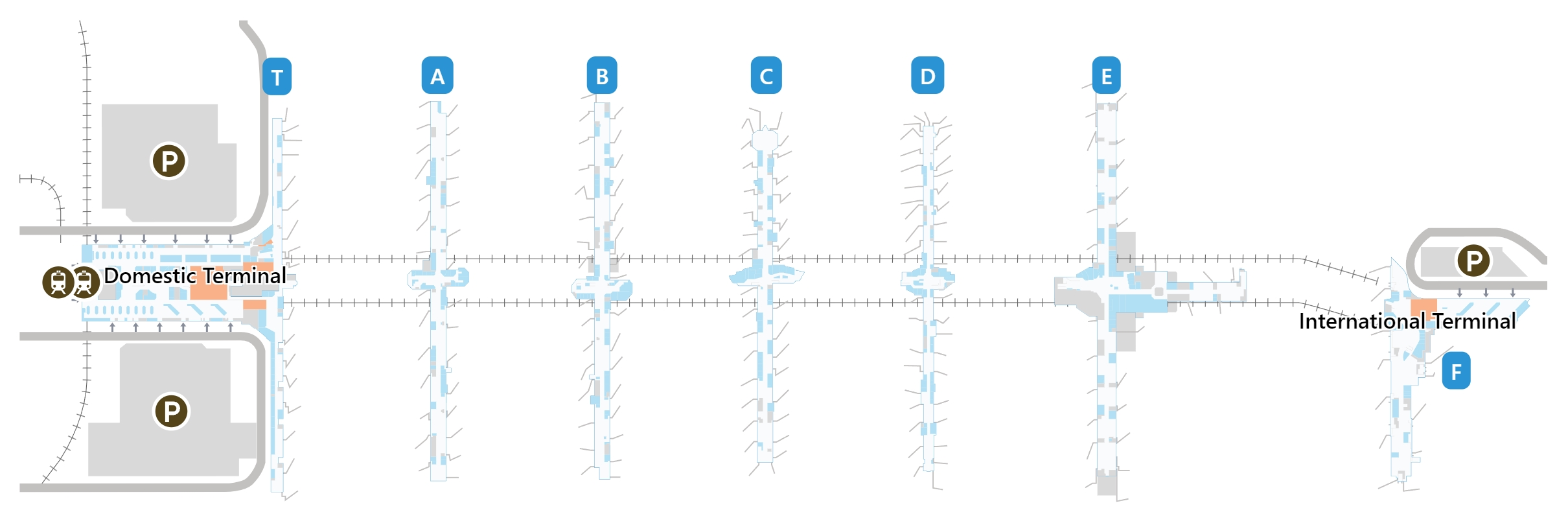

Atlanta Airport Terminal S Your Ultimate Guide: Navigating the South’s Most Efficient Aviation Hub

Mary Bruce Husband: Architectural Visionary Who Redefined Canadian Urban Space

Top Brazilian Male Fashion Influencers Defining Latin America’s Style Frontier