Westlake Payoff Phone Number: Your Key to Fast, Transparent Debt Resolution

Westlake Payoff Phone Number: Your Key to Fast, Transparent Debt Resolution

When life throws unexpected financial blows—whether medical bills, legal fees, or loans gone unpaid—navigating payment solutions becomes a high-stakes challenge. Among the tools available, the Westlake Payoff Phone Number stands out as a trusted, accessible resource for individuals seeking efficient, no-nonsense debt resolution. This dedicated number connects callers directly to personalized payoff strategies, offering clarity and accountability in an otherwise overwhelming process.

In an era where predatory lending and unclear billing dominate headlines, understanding how this phone number functions—and why it matters—can empower consumers to take control of their financial futures.

At its core, the Westlake Payoff Phone Number acts as a streamlined gateway between individuals in financial distress and professional, vetted guidance on consolidating obligations into a single monthly payment. Unlike generic debt counseling services or high-pressure collection agencies, this number ensures immediate access to a structured payoff plan designed to reduce total debt burden while maintaining credit integrity.

Callers report minimal hold times—often under two minutes—and a structured conversation that outlines repayment options rooted in transparency and fairness. As one user noted, “I called the Westlake number exactly when I felt buried under bills—within minutes, I had a clear path forward, no sales pitches, just real numbers.”

How the Westlake Payoff System Operates: A Step-by-Step Breakdown

The process via the Westlake Payoff Phone Number is intentionally direct, avoiding the complexity that often plagues debt management. Here’s how it typically unfolds:- Immediate Access: Dialing the number connects callers to a trained financial specialist dedicated to payoff planning within minutes.

There’s no automated menu or irrelevant promotions—just a single-purpose line focused on solving payment crises.

- Personalized Assessment: After initial contact, the representative gathers key financial data—mentions include total debt, monthly income, existing payments, and debt types (i.e., medical, credit cards, loans). This intake enables a tailored strategy aligned with the caller’s unique situation.

- Clear Debt Consolidation Details: The payoff proposal outlines exactly how much will be paid monthly, how long the plan lasts, and what percentage of outstanding balances will be eliminated. Importantly, Westlake emphasizes zero credit damage for approved plans, a critical point amid growing concerns over credit score impacts.

- Full Transparency: Callers receive a written summary of the agreement before activation, including interest rates, fees, and obligations—eliminating surprises and fostering trust from the outset.

- Ongoing Support: The service concludes with follow-up check-ins and direct access to support, ensuring callers stay on track and adapt plans if life changes affect payment capacity.

What distinguishes this process is its adherence to ethical standards, avoiding high-pressure tactics common in the payoff industry.

Callers consistently value honesty—whether repayment terms are adjusted due to hardship or alternatives are explored when longer-term solutions prove necessary.

Why the Westlake Payoff Number Stands Out in a Crowded Market

While numerous debt resolution services exist, the Westlake Payoff Phone Number has carved a niche through speed, simplicity, and integrity. Unlike companies that prioritize profit over customer well-being, Westlake’s model centers on long-term financial health rather than short-term gains.Several defining features set it apart:

No Hidden Fees or Stringent Terms Callers are consistently surprised to learn their total payoff costs are upfront and fixed. Westlake avoids ballooning interest, origination fees, or clauses that trap users in cycles of debt. The focus remains purely on reducing principal and streamlining payments within a sustainable timeframe—typically 12 to 36 months.

Specialized Expertise, Not SalesScripts Operators undergo rigorous training in debt science and financial counseling, not just sales techniques.

This expertise ensures conversations move beyond generic scripts, instead offering nuanced strategies

Related Post

Discovering The Fascinating Journey of Dominique Wiche: From Grassroots Passion to Professional Excellence

/vidio-web-prod-video/uploads/video/image/7248282/seg-4-pemenang-hati-satpamwati-ftv-sctv-4a910e.jpg)

<strong>Unwinding with Purpose: The Afternoon Movie’s Enduring Appeal in the SCTV FTV Today Lineup</strong>

Top Religions in Malaysia: A Diverse Tapestry of Faith and Cultural Identity

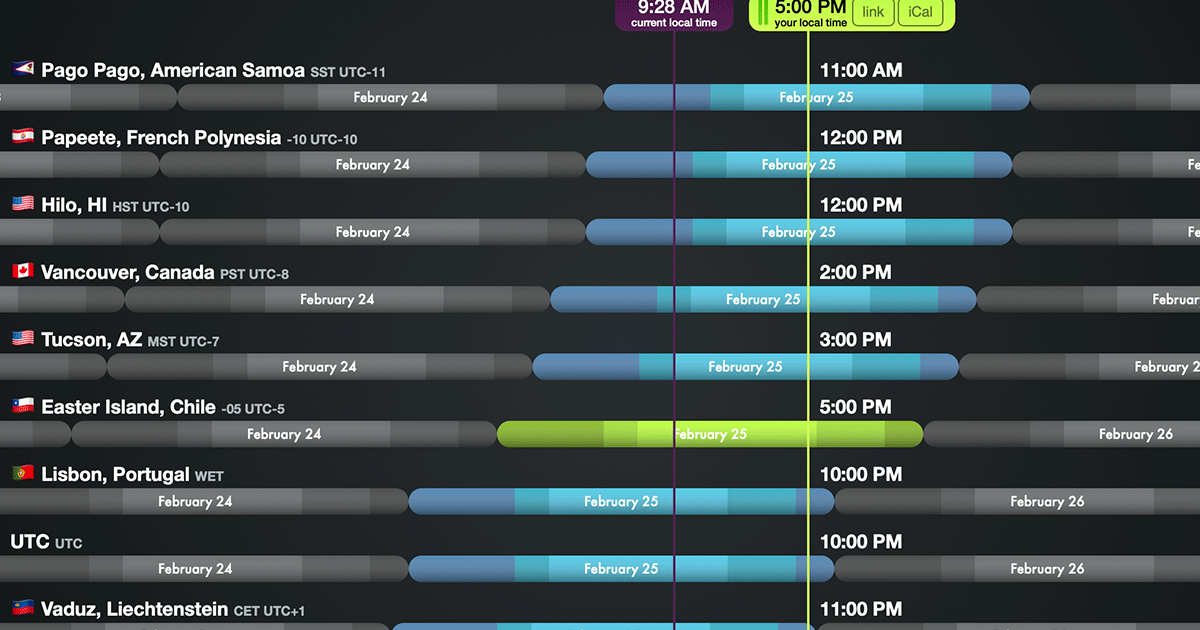

Unlock the Global Clock: How PST Time Zone Shapes Schedules, Cultures, and Commerce