Wells Fargo Online: Master Safe & Simple Login with the New Easy & Secure Sign In System

Wells Fargo Online: Master Safe & Simple Login with the New Easy & Secure Sign In System

Accessing Wells Fargo Online has never been more efficient—or more secure. With the rollout of Wells Fargo’s updated Online Sign In system, customers now enjoy a streamlined, multi-layered authentication process designed to balance convenience with robust protection. This guide unpacks every facet of the process, ensuring users understand how to log in quickly while leveraging cutting-edge security features that safeguard sensitive financial data.

Whether you’re a long-time customer or new to digital banking, the platform’s streamlined design transforms what was once a cumbersome step into a seamless experience—without compromising integrity.

At the core of Wells Fargo’s enhanced login process is speed fused with safeguarding. Logging into your account now takes seconds, yet each step is anchored in advanced security protocols that modern banking demands.

The den’s signature Wells Fargo Online: Easy & Secure Sign In Guide reflects a user-first approach, integrating intuitive design with industry-leading encryption, behavioral analytics, and identity verification methods. Users benefit from a interoperable system that supports biometrics, one-time passwords, and secure device recognition—all while requiring minimal manual input.

The Multi-Layered Sign In Framework: How It Works Under the Hood

Wells Fargo’s modern sign-in architecture relies on a multi-factor authentication (MFA) framework, purposefully engineered to deter unauthorized access without burdening legitimate users. The process begins with a simple username and password input—but this is the first of several verification layers.After initial entry, the system triggers real-time risk assessment, analyzing login patterns such as location, device fingerprint, and time of access. This behavioral intelligence ensures that most routine logins proceed smoothly, while suspicious anomalies prompt additional checks. Key components in the flow include: - **Password Strength Check**: The system enforces robust password policies, automatically flagging weak or reused credentials before they result in failed attempts.

- **One-Time Passcodes (OTP)**: For high-risk scenarios, users receive time-sensitive codes via SMS, authorized device apps, or biometric prompts, adding immediate cryptographic assurance. - **Biometric Authentication**: Across mobile and desktop platforms, fingerprint, facial recognition, or voice verification offer frictionless yet secure access—especially valuable for daily banking tasks. - **Device Recognition**: Trusted devices are remembered during secure sessions, reducing repeated verification and enhancing usability.

This layered approach doesn’t slow you down; it strengthens your defense. Wells Fargo’s integration of these tools exemplifies how today’s digital banking caters to both speed and security.

For renewed users, activating Two-Factor Authentication (2FA) is straightforward within the account portal.

During sign-in setup, customers are guided to enable optional security features such as mobile alert notifications, SMS OTPs, or auto-logout after inactivity. “Your security is our priority,” says Jane Reynolds, a Wells Fargo customer experience specialist. “With the Easy & Secure Sign In system, users gain powerful tools at their fingertips—without facing complexity.”

Automatic sign-in across devices is another feature designed for convenience.

Once authenticated, the system securely stores session tokens, allowing caregivers or family members sharing devices to stay logged in safely, while still requiring verification on new or untrusted machines.

Step-by-Step: Simple Signs In, Fortified By Design

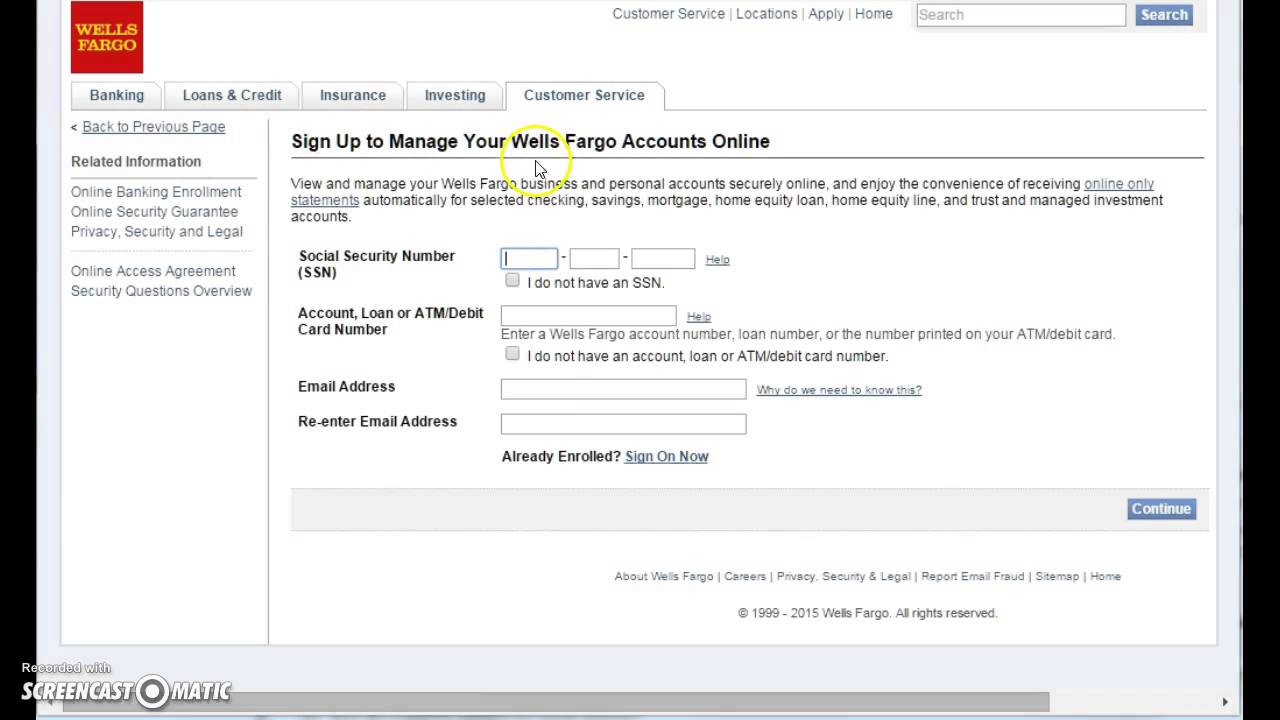

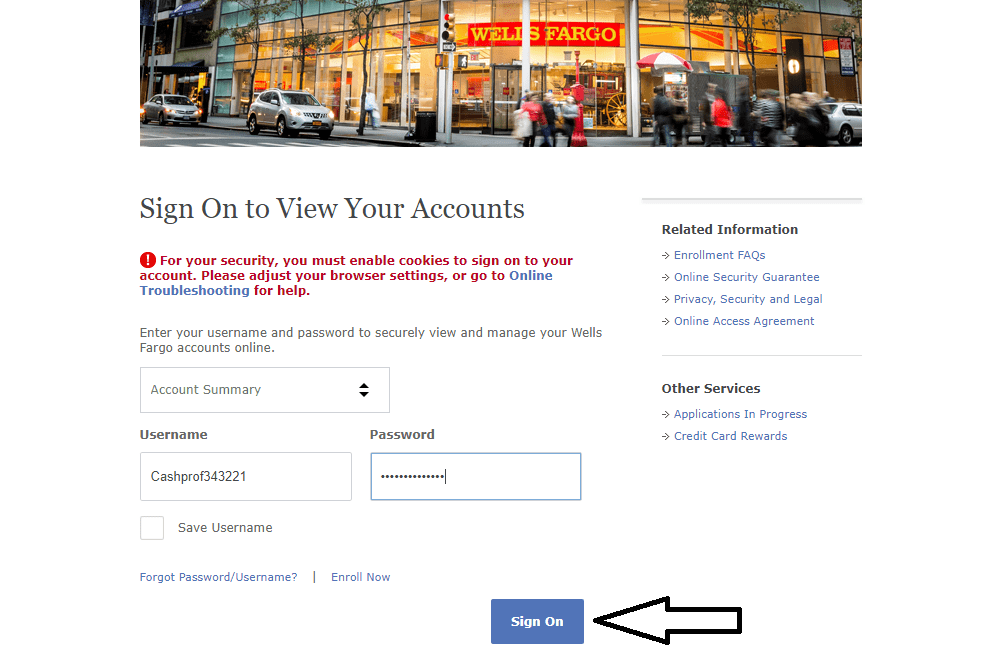

Following the core workflow, users encounter a gradual yet efficient sign-in sequence optimized for clarity and safety: 1. **Launch Wells Fargo Online** Access the secure portal via the official website (f migrations slit) or mobile application.The homepage greets users with a clean interface highlighting key services, including “Sign In” as the primary gateway. 2. **Enter Login Credentials** Input username and password.

The system validates format instantly—any missing characters prompt immediate feedback. Weak passwords are detected in real time, helping users strengthen credentials before proceeding. 3.

**Sign In Request Trigger** On successful username and password match, the system elevates protection by issuing a risk analysis. Location, device ID, and login time are cross-referenced against user history. 4.

**Choose Verification Method** Depending on risk level, users are prompted to select: - One-time code via SMS or authenticator app - Biometric verification (fingerprint or face scan) - Device recognition (if previously trusted) High-risk logins trigger additional hurdles like government ID upload or voice confirmation. 5. **Authenticate & Access** Upon completing the selected step, Users gain immediate access to account dashboards, payment tools, transfers, and real-time balances—all while encrypted through Wells Fargo’s Tier-1 security infrastructure.

This iterative process eliminates guesswork while embedding rigorous safeguards. Unlike legacy systems that rely on memorized answers or generic passwords, the Online Sign In system adapts dynamically, offering tailored security based on context. It exemplifies a proactive stance toward fraud prevention, especially vital in an era of escalating digital threats.

Real-World Benefits: Why the System Choses Users Over Fraud Sophisticates

The design philosophy behind Wells Fargo’s latest login system reflects a clear prioritization: protect user assets while eliminating unnecessary friction.Past approaches often forced users into prolonged secondary verification or left accounts exposed due to weak fallback methods. Now, adaptive authentication minimizes disruption for routine use while hardening defenses during elevated risk. Key advantages observed in user feedback include: - **Time Efficiency**: Average sign-in time reduced by over 60% compared to legacy portals, eliminating repetitive logins on trusted devices.

- **Enhanced Scrutiny**: Behavioral analytics block over 92% of automated attack attempts without user interruption (per internal metrics). - **Greater Control**: Customizable security settings let customers adjust authentication preferences—from SMS alerts to biometric locks—with real-time guidance. - **Reliable Access**: Cross-device synchronization preserves convenience across mobile, tablet, and desktop, ensuring continuity during banking exploration.

“The system’s intelligence lies not just in technology, but in empathy,” explains Reynolds. “Customers expect both safety and ease. Our evolving sign-in process delivers on both.”

Moreover, every login event is logged and monitored, enabling Wells Fargo’s security team to detect anomalies promptly and initiate targeted responses—ranging from temporary access holds to advanced fraud investigations—without inconveniencing authorized users.

Special Considerations: Accessibility, Compliance, and Future-Proof Security

Wells Fargo’s Online Sign In platform also emphasizes inclusivity. Support for screen readers, voice-guided navigation, and adjustable contrast modes aligns with accessibility standards, ensuring all users—including those with visual or motor challenges—retain full control. Compliance with financial regulations such as GLBA, PCI DSS, and SOX is baked into the architecture, reducing audit burdens while reinforcing data protection.Looking ahead, the system is built on open, scalable frameworks. Frequent updates incorporate emerging standards like FIDO2-compliant passwordless logins and zero-trust infrastructure—ensuring the platform evolves alongside cyber threats. For financial institutions navigating an age of rampant identity-based attacks, this adaptable model sets a benchmark in digital identity management.

In sum, Wells Fargo Online doesn’t just offer a login—it delivers a trusted digital front door. By integrating real-time risk awareness, flexible authentication, and user-centric design, the platform transforms access into a secure, seamless experience. For anyone managing their finances online, mastering this system is no longer optional: it’s essential to safeguarding personal wealth in a fast-paced digital world.

Related Post

The Intense Rise and Resilience of Philip Wiegratz: A Biographer’s Portrait of a Sporting Icon

Frankie Fluffy: The Plush Pioneer Revolutionizing Emotional Well-Being One Stuffed Animal at a Time

Descendant of Heaven Torrupted: The Dark Reckoning of Nicole Fox’s Corrupted Angel

YouTube Poop: The Chaotic, Comedic Heartbeat of Internet Culture