Us Bank Wire Routing Number Your Quick Guide: Essential Steps, Security, and Usage

Us Bank Wire Routing Number Your Quick Guide: Essential Steps, Security, and Usage

Understanding the Us Bank wire routing number is the key to swift, error-free financial transactions across the United States. Whether sending funds via wire transfer, making direct deposits, or processing business payments, knowing how to identify, obtain, and use the correct routing number ensures speed, accuracy, and security. For millions relying on timely transfers—individuals and businesses alike—mastering the intricacies of Us Bank routing numbers is not just helpful—it’s essential.

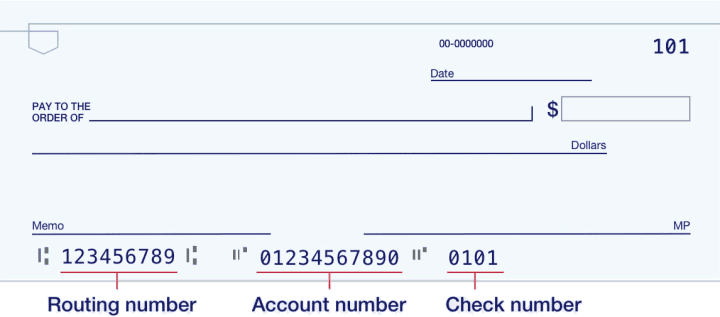

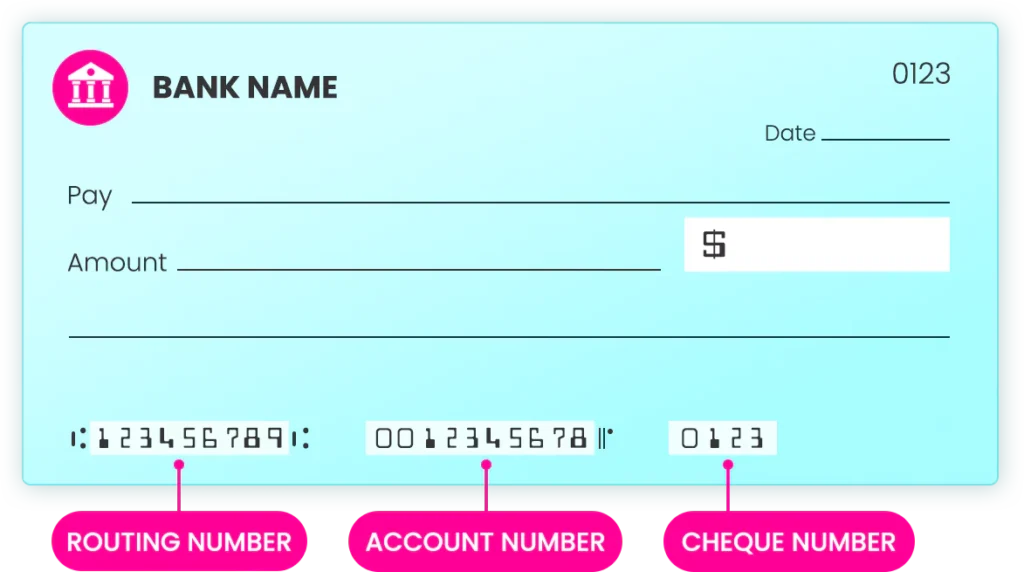

At its core, a routing number is a nine- or 10-digit code uniquely assigned to each financial institution within the U.S. Financial wire system, standardized by the American Bankers Association (ABA). For Us Bank, the routing number functions as a gateway that directs funds to the correct destination, enabling seamless movement of money between accounts, branches, and external institutions.

The modern wire transfer ecosystem depends on precise routing data—any error can delay transactions, trigger holds, or lead to fund misrouting, potentially disrupting personal budgets or business operations.

Breaking Down the Us Bank Routing Number: Format, Structure, and Recognition

The standard Us Bank wire routing number follows the ABA’s established format: nine digits, beginning with “021” for domestic checks (though modern EFTPOS and wire systems primarily use the more universal 9-digit structure), followed by nine additional digits that uniquely identify the institution. For example, a routine wire transfer to a Us Bank account might use routing number 021000046, though exact digits vary by processing location and account type.Identifying the right routing number is straightforward once familiar with patterns. Most Us Bank routing numbers begin with “021,” especially for checks, but wire transfers use solely the full 9-digit code without dashes or extensions.

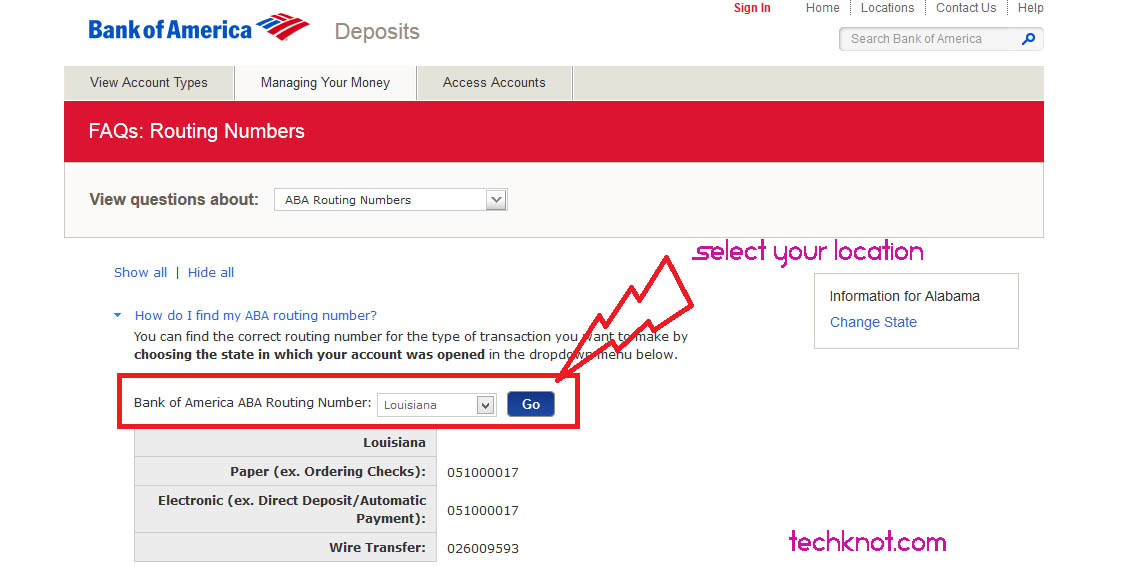

Banks may assign slightly modified versions for different services—such as domestic, international, or corporate accounts—though the core routing identifies the institution’s federal location. Always verify the routing number against official Us Bank documentation or Bank Biometric authentication tools before finalizing a transfer.

How to Find Your Us Bank Routing Number: Step-by-Step

Finding the correct Us Bank routing number is efficient when done through verified, secure channels. Here are the most reliable methods: - _Online Banking Dashboard:_ Log into your Us Bank mobile or desktop banking app.Navigate to Account Settings or Profile, where routing numbers are usually listed under account details. Access is restricted to authorized users only, ensuring privacy. - _Mobile Check Deposit Feature:_ When depositing a check via the Us Bank mobile app, scan the check to reveal the routing and account numbers instantly—no manual keying required.

- _Bank Statements:_ Routing numbers appear alongside account numbers on monthly paper or electronic statements, formatted clearly for easy reference. - _In-Branch or Customer Service:_ Speak with a Us Bank representative who can provide routing details securely over a video call or in person, especially for businesses managing multiple accounts. - _Achieve.gov For Businesses:_ Businesses open through the Federal Reserve’s online platform can retrieve routing numbers for direct bank integrations and automated clearing house (ACH) processes.

For added safety, never share routing numbers via unencrypted email or text. Always validate the recipient’s details directly with Us Bank’s verified contact channels to avoid fraud.

Using the Us Bank Routing Number in Wire Transfers: Process and Best Practices

Using the correct Us Bank routing number begins with clarity: always input the full 9-digit number without abbreviations. When transferring funds, match this code at every stage—from online forms to wire transfer instructions.Banks rely on this code not just for routing, but for compliance checks, fraud prevention, and settlement assurance. Wire transfer workflows typically require the following: - Recipient’s full name as it appears on official documents - Complete routing number (e.g., 021000046) - Routing-type identifier if prompted (e.g., “WT” for wire transfer) - Destination bank’s address (if required) - Reference or purpose code (optional, but helpful for tracking) For businesses, integrating routing numbers into automated payment systems—like payroll or vendor payroll platforms—reduces manual errors and accelerates processing cycles. Us Bank supports secure API access for enterprises, allowing real-time routing confirmation and transaction validation directly within financial software.

Transaction speed depends heavily on accuracy: a single digit mismatch could route funds to an unintended account, delay processing by days, or trigger a fraud alert. As one incumbent bank specialist noted, “The routing number is not just a number—it’s the identity of where your money goes. Protect it, verify it, and never underestimate its power.”

Security and Fraud Prevention: Safeguarding Your Us Bank Routing Number

With rising cyber threats, protecting your Us Bank routing number is non-negotiable.Unlike account passwords, routing numbers shouldn’t be used to share sensitive financial data, but they are critical for transaction legitimacy. Us Bank advises users to: - Store routing numbers securely, avoiding public or unencrypted storage - Use secure, password-protected banking apps for accessing routing data - Never include routing numbers in email signatures, social media, or unverified websites - Monitor account activity regularly for unauthorized transfers - Enable two-factor authentication (2FA) on all banking platforms Recent reports indicate a spike in phishing attempts targeting routing number data, particularly under the guise of “bank compliance updates” or “payment verification.” Us Bank’s fraud detection systems automatically flag unusual patterns—such as transfers originating from unfamiliar locations or at odd hours—halting potential misuse before damage occurs.

Remember: the routing number alone does not grant access to funds.

It simply identifies the destination bank, making it a primary vector for fraud if mismanaged. As such, vigilance and education remain the strongest defenses.

Frequently Asked Questions About Us Bank Wire Routing Numbers

What happens if I use the wrong Us Bank routing number?

Using an incorrect routing number can delay or block wire transfers. Funds may be returned or routed to a different institution entirely, causing financial disruptions and potential reporting requirements for businesses.Always double-check digits and confirm with the receiving bank before finalizing.

Can routing numbers change for the same Us Bank account?

Routing numbers are generally static for a given institution and location. Only major operational shifts—such as merging branches or system overhauls—may result in updates, typically communicated via official statements or direct notification from Us Bank.Is the 9-digit routing number sufficient for international wire transfers?

While domestic US wire transfers use 9-digit routing numbers, international wire systems often require additional identifiers like the BIC (SWIFT code), destination bank name, and foreign branch codes. Us Bank provides integrated support for global transfers, including automatic BIC matching where applicable.Do all Us Bank branches use the same routing number?

No.While the central US Bank feeds major clearinghouses using a standardized core routing number, local branches may use variants tied to their regional Federal Reserve assignments or service models, though the routing prefix (e.g., “021”) remains consistent.

How can I correct an incorrectly entered routing number?

Contact Us Bank’s support team immediately. File a wire correction request online or via the app, providing proof of identity and transaction details.Us Bank processes corrections within 1–3 business days, updating records across connected systems.

Maximizing Efficiency: Why Knowing Your Us Bank Routing Number Matters

Mastering the use of the Us Bank wire routing number transforms everyday financial tasks from sources of frustration into models of reliability. Whether paying a vendor, receiving a payroll deposit, or transferring funds across borders, precision with the routing number ensures transactions settle on time, securely, and without friction.As financial systems grow more automated and interconnected, this foundational knowledge builds trust between institution and user, empowering smoother operations across personal and professional spheres. For millions dependent on seamless funds movement, the routing number is more than a code—it’s a cornerstone of modern finance. Understanding, protecting, and utilizing it correctly is not just a skill; it’s a responsibility every account holder should embrace.

In an era where speed and security define financial success, Us Bank routing numbers remain silent yet indispensable instruments. With proper handling, they unlock the full potential of digital banking—connecting people, businesses, and institutions with confidence and clarity.

Related Post

Chelsea Clinton’s Children: Navigating Public Life with Purpose and Privacy in a High-Profile World

Who Got Busted in Taylor County, Texas? Uncovering the Behind-the-Scenes of a Local Law Enforcement Clash

Unveiling the Story of Rita Cosby's Mate

Orange Cassidy Injured During AEW Face Of The Revolution Ladder Match

.png/revision/latest?cb=20220724182241)