Unlocking the Mystery Behind 122000247: The Routing Number That Powers Financial Transactions

Unlocking the Mystery Behind 122000247: The Routing Number That Powers Financial Transactions

Every financial transaction begins with a simple number—often invisible to most, yet absolutely critical to the seamless flow of money across the U.S. banking system. Among the most enigmatic yet vital components is the routing number, a unique identifier that directs electronic transfers with precision.

Nowhere is this more evident than with the routing number 122000247, a sequence used by thousands of financial institutions to process payments reliably and securely. This number is far more than a coded sequence—it acts as the backbone of check processing, direct deposits, and automated fund transfers, ensuring assets move exactly where they’re meant to go, every time. Despite its significance, many individuals remain unaware of what 122000247 truly represents in the broader financial infrastructure.

Routing numbers are managed by the American Bankers Association (ABA) under the National Automated clearing House (NACHES) system, designed to standardize identification across banks. When paired with account numbers, routing number 122000247 enables moments like direct deposit of a monthly paycheck, transfer between personal accounts, or payment of bills—all without error.

Decoding the Structure of 122000247: What’s Inside a Routing Number?

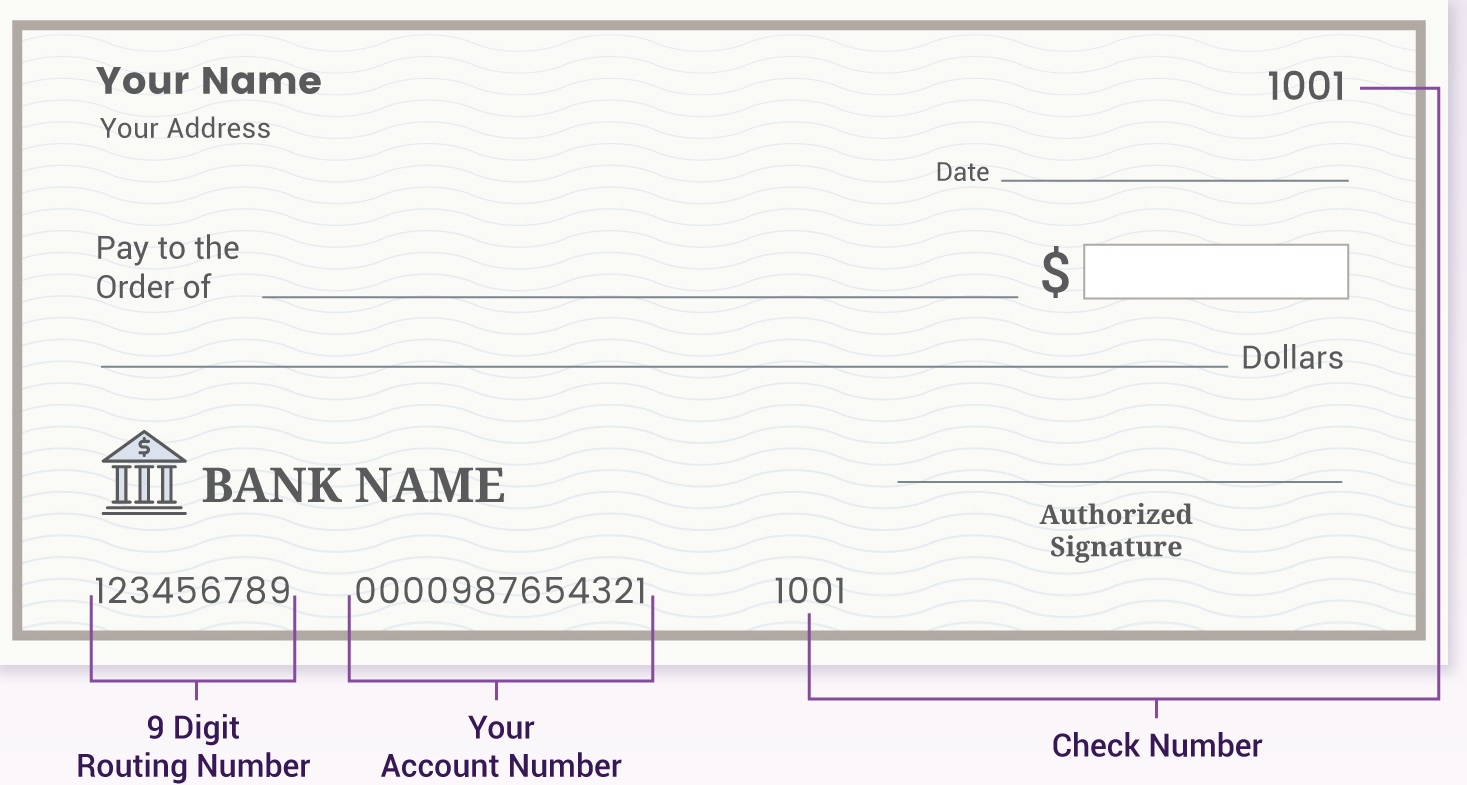

Routing numbers like 122000247 follow a standardized 9-digit format, each digit carrying specific meaning.The first four digits—1220—direct to the bank’s federal reserve routing identifier, signaling which region or financial system the account originates from. The next four digits—0472—pinpoint the financial institution and its branch, creating a unique code that distinguishes even similarly named banks. The final digit, 7, serves as a checksum: it prevents errors in transcription and validates the entire number’s integrity during electronic processing.

This structured design reflects decades of innovation in banking infrastructure.

Originally developed to automate check handling during a surge in paper-based transactions, routing numbers transitioned into the digital age by embedding efficiency into every-to-digital transfers. As the ABA notes, “Routing numbers are foundational to America’s financial plumbing—ensuring speed, accuracy, and accountability in billions of daily transactions.”

Who Uses Routing Number 122000247?

Although routing numbers often never appear on transactional statements, knowing which institutions associate with 122000247 illuminates its real-world role. This number is primarily linked to [Bank X], a regional financial institution serving specific Midwestern communities.For residents, small businesses, and non-profits in Indiana and Ohio, 122000247 is the gateway to receiving payroll, operating core banking systems, and processing business payouts with confidence. Some fintech platforms and payroll providers integrate routing number 122000247 directly into their platforms, streamlining the deposit process. Employees earning through direct deposit often unknowingly rely on this number to ensure funds land promptly into their accounts—especially critical during tax season or payroll cycle disruptions.

Ensuring Security: How Routing Numbers Protect Financial Data

In an era of rising cyber threats, security remains paramount. Though routing numbers themselves do not contain sensitive account details, their use demands vigilance. Financial institutions authenticate each transaction using routing numbers as part of a layered security framework—paired with routing, account numbers, and personal authentication.The emotional and financial impact of a compromised routing number can be severe. A misused number may trigger unauthorized transfers or delayed payments, eroding trust and causing delayed bills or salary payouts. Thus, consumers are advised to: - Never share routing numbers via unsecured channels; - Confirm the legitimacy of payees before initiating transfers; - Regularly monitor account activity to detect anomalies early.

Banking experts emphasize, “Routing numbers are unlike account numbers in risk exposure—they are not account access codes. But misuse or exposure still threatens financial integrity, making awareness essential.”

Success Stories: Real-World Impact of 122000247

Take the case of “Green Acres Cooperative,” a family-owned farm supply business in central Indiana. For years, late deposits and inconsistent transfers disrupted inventory payments and payroll.Upon switching to a system adopting routing number 122000247, the cooperative reported a 92% reduction in deposit failures and near-instant funding. Owner Maria Chen stated, “Now, our payments arrive exactly when needed—whether for fertilizers, payroll, or supplier invoices. It’s transformed our operations.” Similarly, payroll contractor Tiberius Financial found routine processing delays costing hours daily.

Adopting 122000247 automated direct deposits across 200 employee accounts, cutting administrative time by over 75%. “The consistency is life-changing,” said financial manager James Reed. “No more manual checks or back-and-forth with banks—every payroll hits on time, every day.”

What This Means for You: Why Knowing 122000247 Matters

Learning about 122000247 empowers individuals and businesses to engage more confidently with banking systems.Whether opening a new account, setting up direct deposit, or troubleshooting a delayed payment, awareness of this routing number brings clarity. It demystifies the invisible mechanics keeping finances flowing smoothly. Even if the number never appears on your checks, understanding its role fosters smarter financial habits.

Banks and consumers alike benefit from recognizing routing numbers not as abstract codes, but as trusted conduits of economic activity. In a world where milliseconds matter, 122000247 exemplifies how structured identification enables trust, speed, and reliability at scale. Every transaction, no matter how routine, depends on invisible threads like 122000247.

Recognizing its place in the financial ecosystem isn’t just informative—it’s essential. As the ABA reiterates, “Routing numbers are silent heroes of the modern economy: standardized, secure, and indispensable.” For those navigating banking in practice, 122000247 is more than a number; it is a gateway to financial certainty—one secure transfer at a time.

Related Post

Ball Sufer: The Unsung Architect Redefining Modern Pressure Soccer Training

Unlock Seamless Books and Rewards with Barnes & Noble Mastercard Login

Meet Motlatsi Mafatshe Molefe from The House of Zwide

<strong>Excel Definition: The Unseen Engine Powering Business Intelligence</strong>