Unlocking Property Control: How Texas Title Transfer Empowers Ownership Rights

Unlocking Property Control: How Texas Title Transfer Empowers Ownership Rights

When transferring real estate title in Texas, one of the most pivotal legal instruments at play is the Texas Title Transfer — a foundational process that formally conveys property ownership from seller to buyer. Far more than a bureaucratic formality, this transfer formalizes legal ownership, safeguards interests, and enables full control over land and improvements. In Texas, where property rights are deeply rooted in state law, understanding the mechanics and implications of title transfer is essential for anyone buying, selling, or developing real estate.

This article explores the nuances of Title Transfer in Texas, its legal framework, procedural steps, and its critical role in securing property ownership with clarity and permanence.

At its core, a Title Transfer in Texas formally records the changing of legal title in state land records, typically following a recorded deed or deed of trust. Unlike an oral agreement, this documented shift ensures transparency, enforcement rights, and public notice — fundamental safeguards in property transactions.

According to Texas Property Code § 13.001, a valid title transfer requires a written instrument, proper execution, notarization if mandated, and recording in the county where the property is situated. This structure creates an unbroken chain of clear ownership that protects both buyer and seller against future disputes.

Legal Foundations: What Makes Title Transfer Valid in Texas

Texas title transfer operates on a foundation of statutory authority and longstanding property law principles designed to protect ownership clarity. The state recognizes several forms of recorded instruments suitable for title transfer, including general deeds (warranty deeds being the most common), quitclaim deeds, and special promise deeds, each serving distinct purposes in conveyance.The Texas Deed Law, as codified in Title 25, Section 2.001–2.015, outlines strict requirements to ensure validity — particularly the presence of legal capacity, real subject matter, proper delivery, and recording to perfect interests.

Among the most significant legal concepts underpinning Texas title transfer is the concept of "marketable title." Every buyer has a legal right to confirm that the seller holds unencumbered ownership free of liens, easements, or third-party claims. This insurance against hidden defects is enforced through title search and title insurance, both of which are commonly used in Texas transactions. As noted by the Texas Society of Escrow and Title Professionals, “A properly executed title transfer not only records ownership but also absolves future transferees of risks stemming from prior ownership disputes.” This legal safeguard enhances confidence in property transactions, reinforcing the state’s commitment to secure, transparent land transfers.

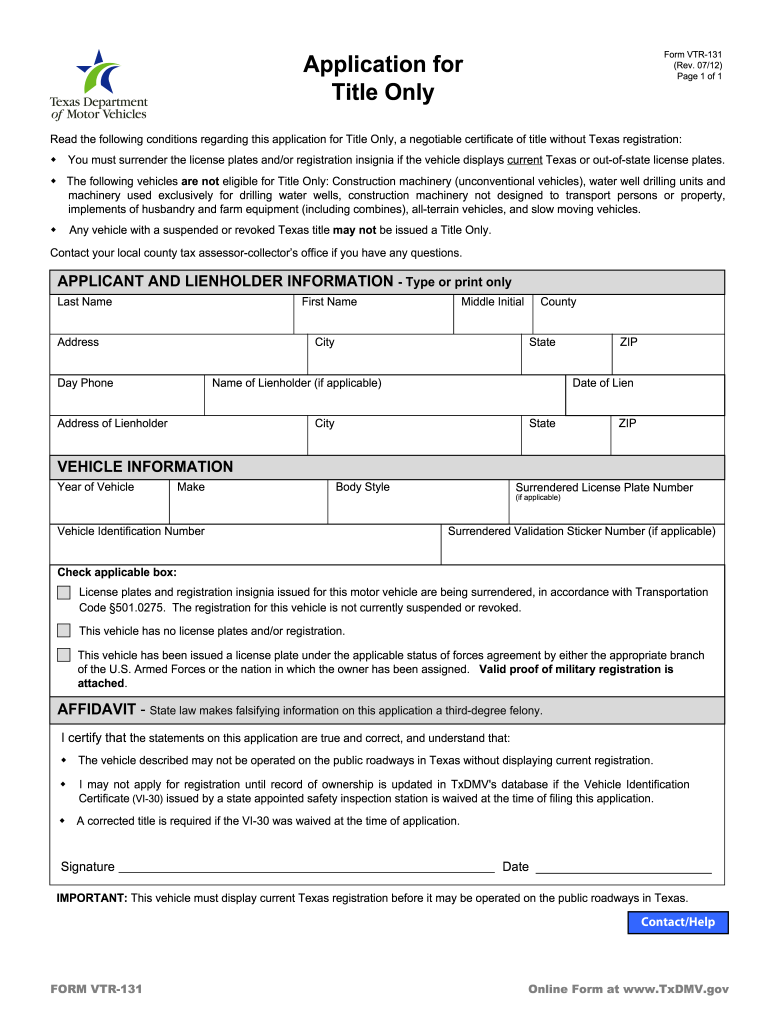

Step-by-Step: Navigating the Title Transfer Process in Texas

The process of executing a title transfer involves several critical steps, each designed to verify and formalize property ownership.Starting with the drafting or acquiring the deed — whether through purchase, inheritance, or donation — the document must clearly identify the grantor, grantee, and a detailed legal description of the property, including parcel number, county, and boundaries. Accuracy here prevents future ambiguities and title disputes.

- Execution: The deed must be signed by the grantor, preferably under oath or before notary public, especially in complex transfers or when third-party interests are involved.

- Analytical Review: A title search compiles public records to uncover liens, easements, tax delinquencies, or zoning restrictions that might affect ownership transfer.

- Title Search & Inspection: Professional title examiners confirm clear title by identifying and qualifying any vulnerabilities that could jeopardize ownership continuity.

- Recording: The deed is filed with the county registry of deeds, typically within 20–40 days of transfer, to tiết the public record. Recording establishes priority and protects the buyer’s rights under the principle of recorded priority.

- Payment of Recording Fee: County governments charge nominal fees for processing filings, further securing the transfer legally and temporally.

- Transfer of Funds & Closing: Final settlement of purchase price and post-closing obligations complete the legal transfer, with the new owner walking away with clear title.

Recordation is not merely a formality — it is the legal cornerstone preserving ownership integrity.

Without timely filing, even a validly executed deed risks challenges or und Zwei enrollment in subsequent transactions. Texas counties maintain digital systems (such as the County-wide Property Records Information System, C-PRIS) enabling efficient access and verification, reducing delays and enhancing trust in the process.

Types of Deeds Used in Texas Title Transfer

Texas landowners choose among several standard instruments to effect title transfer, each suited to different ownership scenarios and levels of protection. The warranty deed offers the highest guarantee, warranty sellers assume existing liens and defend buyer interest against third-party claims for a set period.This suited to most sales where buyer confidence is paramount.

In contrast, the quitclaim deed transfers only relative interest without any immunity from past disputes — common in transfers between family members where no warranties are assumed. For specialized scenarios, the special promise deed settles disputes by transferring ownership only where a previous owner’s rights are confirmed, often used in partition sales to divide jointly owned property. These varied options reflect Texas’ flexibility in addressing unique transfer needs, balancing traditional conveyancing with modern legal safeguards.

Recording Requirements and Public Notice

Once recorded, the transferred title becomes part of the public record, providing “constructive notice” to future purchasers, creditors, and government entities.This system prevents fraud, protects innocent buyers, and upholds the integrity of land markets. In Texas, the County Recording Act mandates that deed acceptance at the county office triggers immediate public notice, including metadata such as title date, grantor, and grantee details.

The public registry serves multiple purposes: it acts as an audit trail for legal claims, lowers transaction costs by reducing due diligence burdens, and supports efficient property tax assessments. Moreover, properly recorded transfers empower future developers, lenders, and insurers with reliable data, underpinning Texas’ robust real estate ecosystem.

Challenges and Best Practices in Title Transfers

While Texas title transfers are generally straightforward, complexities can arise — from unrecorded easements and boundary disputes to undnoticed tax liens or prior owners’ unresolved claims.These issues underscore the necessity of proactive measures such as full title searches and title insurance policies, which protect against financial losses from unknown title defects.

Experts recommend several best practices: • Always engage a licensed Texas attorney or title company to draft, review, and file deed

Related Post