Unlocking Financial Precision: The Role and Significance of Routing Number 122000247

Unlocking Financial Precision: The Role and Significance of Routing Number 122000247

For millions of Americans managing bank transactions, routing numbers serve as the unseen backbone of financial movement—ensuring every dollar travels to the correct destination. Among these nine-digit identifiers, routing number 122000247 stands out as a critical code tied to Alliant Credit Union, facilitating secure, accurate fund transfers across the U.S. banking system.

This number is more than a string of digits; it’s a precise digital key that powers daily payments, direct deposits, and electronic transfers with speed and reliability. Understanding how routing number 122000247 operates reveals the intricate mechanics behind modern finance, highlighting its importance in maintaining trust and efficiency in banking operations.

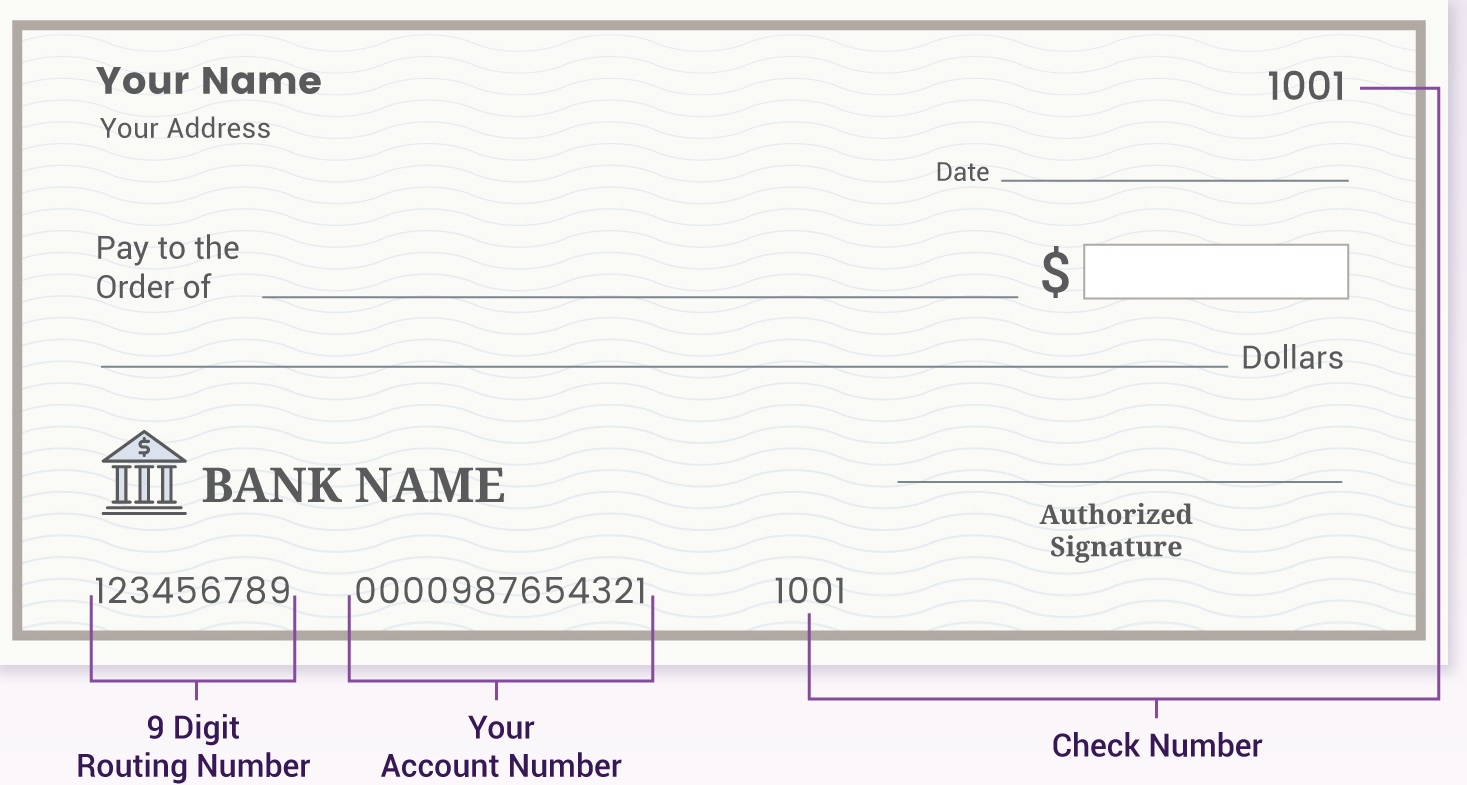

The Anatomy of ATM and ABA Routing Numbers

Routing numbers, particularly those issued by the American Bankers Association (ABA), follow a standardized nine-digit format. Each digit carries a distinct purpose: the first four digits uniquely identify Alliant Credit Union’s banking center, the next four specify its precise branch or processing location, and the final digit acts as a checksum to validate the code.Routing number 122000247, assigned to Alliant Credit Union’s centralized operational hub, enables the automated clearinghouse (ACH) networks to route electronic payments efficiently. Banks and credit unions use this number to identify matching institutions, prevent errors, and ensure transactions clear without delay. This structured system underpins everything from payroll deposits to vendor payments.

Alliant Credit Union: A Regional Workhorse with National Reach

Based in Colorado and serving a broad geographic footprint, Alliant Credit Union leverages routing number 122000247 to connect local members with national financial systems. As a credit union—structured as a not-for-profit cooperative—Alliant focuses on member-centric benefits, including lower fees, competitive interest rates, and personalized service. Routing number 122000247 allows customers to deposit paychecks, pay bills, and transfer funds to any federally insured bank seamlessly.During peak periods like tax season or direct deposit cycles in December, this number remains vital in preventing bottlenecks, ensuring timely and accurate distribution of funds when they matter most.

How Routing Number 122000247 Powers Electronic Transfers

Electronic Funds Transfer (EFT) systems depend heavily on accurate routing identifiers like 122000247 to authenticate and route transactions across banks. When a user authorizes a wire transfer, ACH processing uses this routing number to identify Alliant’s receiving institution, cross-verify account details, and route payment through national clearing networks.The number’s systematic design ensures each step—from authorization to final settlement—is traceable and secure. Without routing number 122000247, the synchronization between sender and receiver would falter, risking delays, misrouted payments, or incomplete transactions.

Real-World Applications and Member Examples

Consider Maria, a small business owner in Denver who relies on timely customer payments.When her clients deposit checks via direct deposit, routing number 122000247 ensures those funds flow instantly into Alliant’s accounts, funding payroll and operations without waiting days for physical checks. Similarly, remote workers receiving payroll through payroll processors use this routing code to receive consistent, accurate payments, even during high-volume processing periods. For families, direct deposits for Social Security or benefits hinge on this number’s reliability, turning what might be a delayed, stressful process into a seamless, dependable routine.

Security and Verification in the Digital Banking Era

True to Alliant Credit Union’s commitment to member safety, routing number 122000247 operates within a secure, regulated framework. Financial institutions and third-party service providers across the U.S. validate this code during transaction authorizations to prevent fraud and ensure compliance with federal banking standards.All transactions tied to 122000247 undergo real-time fraud monitoring, encrypting data to protect members from unauthorized access. This layer of security empowers users to transfer money confidently, knowing their funds are shielded by rigorous verification protocols.

Future Outlook: Routing Number 122000247 in Evolving Finance

As digital banking accelerates, routing number 122000247 remains a cornerstone of transaction infrastructure.Innovations like real-time payments and blockchain-based settlements may reshape how funds move, yet the fundamental need for precise routing codes endures. Alliant Credit Union continues to modernize its systems, ensuring routing number 122000247 adapts to emerging technologies while preserving accuracy and reliability. For millions, this number represents more than a transactional guide—it embodies financial connectivity in a fast-paced world.

Understanding routing number 122000247 reveals the quiet complexity behind everyday banking, illustrating how standardized identifiers sustain America’s financial ecosystem. As technology evolves, this code endures not as an outdated relic, but as a vital mechanism ensuring every dollar arrives where it belongs—securely, efficiently, and on time.

Related Post

Brian Bosworth & His Wife: Unveiling the Private Life Behind the Hollywood Glamour

How Old Is Lexi? Unveiling the Age Behind the Public Persona

MLBB: Level Up Your Coin Game! Quick Tips & Tricks

Univision Careers: Unlock Remote Work Opportunities Today