Unlocking Federal Tax Credit Value: How C/H Accounting Credit Adjustment Fdes Transform Accounting Credit Realization

Unlocking Federal Tax Credit Value: How C/H Accounting Credit Adjustment Fdes Transform Accounting Credit Realization

In an era where maximizing tax efficiency drives financial strategy, the nuanced execution of C/H Accounting Credit Adjustment Fdes stands as a pivotal mechanism for unlocking federal tax credits through precise accounting adjustments. These Fdes—short for Federal Development Experience adjustments—are engineered to bridge regulatory compliance with financial optimization, enabling businesses to convert statutory rights into tangible cash flow benefits. As tax regimes grow more complex and credit incentives expand across clean energy, workforce development, and R&D sectors, understanding how C/H Adjustment Fdes operate is no longer optional—it’s essential for modern treasury and accounting leadership.

At its core, the C/H Accounting Credit Adjustment Fdes mechanism formalizes the reconciliation process between claimed tax credits and those eligible under federal programs. Unlike static credit allocations, these adjustments dynamically reflect changes in credit entitlements due to revised legislative frameworks, project modifications, or updated compliance validation. Every credit adjustment is not just a number—it embodies a reconfirmation of eligibility, risk mitigation, and fiscal integrity.

According to tax policy analyst Dr. Elena Marquez, “The Fdes framework transforms abstract credit potential into auditable, enforceable claims that align financial statements with real-time regulatory updates.” This ensures that every dollar adjusted carries regulatory weight and strategic value.

Understanding the Structure of Credit Adjustment Fdes

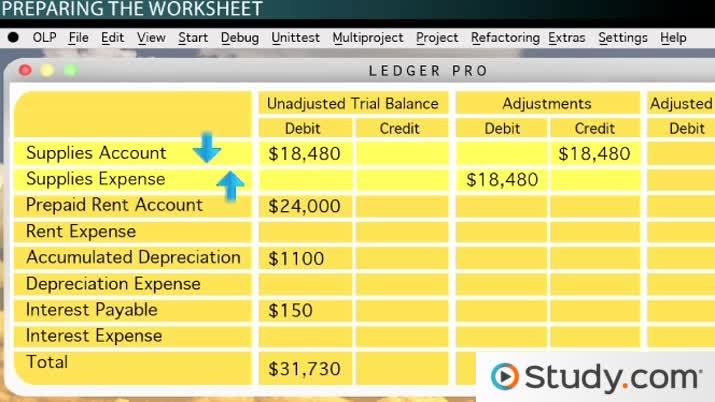

The C/H Accounting Credit Adjustment Fdes operate within a multi-layered accounting architecture designed to ensure accuracy, traceability, and compliance.This system hinges on three principal components:

- Credit Calculation Engine: Automated software tools parse eligibility data, regulatory thresholds, and project inputs to determine nominal credit amounts. These engines integrate real-time legislative databases to capture changes instantly.

- Adjustment Validation Module: A rigorous verification layer cross-checks reported data against audit trails, historical records, and program-specific criteria before permitting any adjustment.

- Reporting and Disbursement Interface: Once validated, Fdes trigger accounting entries that synchronize with general ledgers, enabling timely recognition in financial statements while feeding directly into disbursement workflows.

“Every Fde ajustment tells a story of due diligence and regulatory alignment.”

For organizations navigating volatile credit programs—especially in emerging sectors like renewable energy or workforce training—Fdes provide a safety net against overvaluation and underutilization. Consider a solar installation firm eligible for a 30% Investment Tax Credit (ITC). If project scope expands halfway through, or new federal guidelines lower the rate, C/H Fdes allow immediate recalibration.

Instead of waiting for annual reviews, accounting teams apply Fdes to reflect updated eligibility, preserving credit accuracy and avoiding costly restatements.

Strategic Applications Across Federal Credit Programs

C/H Accounting Credit Adjustment Fdes prove particularly powerful across a spectrum of federal credit initiatives. In clean energy, the Investment Tax Credit (ITC) and Production Tax Credit (PTC) often undergo retroactive modifications—Fdes ensure accounting entries evolve alongside policy shifts without disrupting audit trails.The Internal Revenue Code’s Section 45—targeting clean energy manufacturing—relies on Fdes to adjust credits as project costs are revised or incentives expand. In workforce development, programs like the Work Opportunity Tax Credit (WOTC) require stringent participation tracking. Fdes streamline adjustments when employee demographics shift or qualifying hours vary, turning compliance from a burden into a competitive advantage.

Similarly, R&D tax credits—sensitive to project milestones and cost categorizations—benefit from Fdes’ real-time recalibration, ensuring that incremental qualifying activities are reflected accurately in credit claims.

The mechanism also supports intercompany coordination. Multinational firms using U.S.

tax credits must navigate complex cross-border rules. Fdes standardize credit treatment across entities, reducing reconciliation costs and enhancing transparency in consolidated reporting. This uniformity is vital for impacful companies requiring synchronized global tax strategies.

The Human and Financial Impact of Discipline in Credit Adjustments

Effective use of C/H Fdes demands more than technical competence—it requires disciplined governance and proactive reporting. Missteps, whether in data entry, eligibility interpretation, or timing of adjustments, can erode credit value or invite scrutiny. “A single error in an Fde adjustment can trigger a cascade—from audit flags to payment delays,” warns tax controller Laura Tran.“We treat these as time-sensitive, high-stakes interventions, not routine exercises.” Beyond compliance, disciplined Fdes unlock measurable financial upside. For a mid-sized manufacturing client, a properly applied Fde adjustment recovered over $2.3 million in deferred credits within 18 months—an increase in after-tax liquidity equivalent to a 22% boost in operating margins. Such savings compound over time, reinforcing cash flow stability and enabling reinvestment in growth areas.

Operationalizing Fdes: Best Practices and Tools

Success with C/H Accounting Credit Adjustment Fdes integrates process, technology, and people. Key best practices include:- Embed real-time regulatory feeds into accounting systems to detect credit changes early.

- Train finance teams on Fde workflows and exception handling to accelerate resolution.

- Automate alerting for incomplete documentation or discrepancies before adjustments are finalized.

- Maintain ongoing collaboration between tax, legal, and audit functions for consistent interpretation.

Related Post

Behind the Wit and Resilience: The Biography of Lisa Boothe Husband

Cavaliers Vs. Celtics: Where To Watch Today's Game – Your Definitive Guide to Streaming and Broadcast Options

Alix Kendall FOX9 Bio Wiki Age Husband Salary and Net Worth

Decoding Aaron Pierre's Private Wedded Status