Unlocking Batwing Value: The Strategic Edge in Value Investing

Unlocking Batwing Value: The Strategic Edge in Value Investing

In a market increasingly driven by momentum and short-term speculation, Batwing Value emerges as a disciplined, counter-cyclical framework that redefines how investors identify durable, high-conviction opportunities. Far more than a passive strategy, Batwing Value integrates deep fundamental analysis with rigorous risk management, crafting a path to resilient returns even amid volatility. For sophisticated investors seeking to separate noise from true value, this approach delivers not just returns—but clarity.

At its core, Batwing Value draws inspiration from the metaphor of a batwing: graceful, layered, and built to withstand pressure. Deployed in equity markets, it represents a precise methodology that combines dividend quality, free cash flow sustainability, and balance sheet resilience to isolate companies poised for long-term outperformance. Unlike conventional value investing, which often fixates solely on low price-to-book ratios, Batwing Value ascends beyond headline metrics to evaluate structural economic moats and ownership of cash flow—two pillars of enduring business strength.

Decoding the Batwing Framework: Components That Drive Return Batwing Value is structured around three interlocking pillars that together define its analytical rigor: Fragmented Valuation Multiples One defining trait of Batwing Value is its focus on non-cyclical, low-volatility multiples rather than broad averages. By emphasizing normalized earnings, stunning balance sheets, and sustainable ROIC (Return on Invested Capital), the strategy filters out overvalued sectors and targets assets trading below intrinsic economic value. “We prioritize companies where cash is being deposited at predictable rates, not where price multiples churn with headlines,” explains lead investment strategist Lila Chen.

This selective lens isolates businesses scything through cycles with operational resilience and minimal leverage risk. Free Cash Flow as the Economic Compass Rather than relying on accounting earnings alone, Batwing Value centers on consistent, free cash flow generation as the true engine of value. This metric reflects real economic output—capital available for reinvestment, debt reduction, or shareholder returns—free from aggressive accrual accounting.

“Free cash flow is the bridge between current performance and future potential,” notes portfolio manager Marcus Reed. For Batwing, strong FCF serves as both a valuation anchor and a filter for financial health, ensuring investments possess the liquidity to endure downturns and compound over time. Balance Sheet Fortitude and Ownership of Capital Perhaps the most distinctive edge of Batwing Value is its emphasis on capital efficiency and balance sheet flexibility.

Investments are scored not just on earnings power but on how well management deploys capital, manages debt, and returns surplus to shareholders. Batwing favors businesses with low net debt, high free cash flow conversion, and ownership structures aligned with long-term value creation—factors that reduce downside risk and enhance downside resilience. “A company with pla-d low leverage and strong FCF isn’t just cheap—it’s structurally sound,” Chen asserts.

This focus on true asset quality differentiates Batwing from passive entry-level value strategies. Market Cycles and Batwing: Thriving Beyond Blips While conventional value investing often struggles during momentum-driven markets or periods of economic uncertainty, Batwing Value holds distinct优势 in volatile, asymmetric environments. By divorcing decisions from short-term sentiment, the strategy capitalizes on dislocations when flawed valuations obscure real business potential.

Historical analysis confirms its efficacy: during the 2008 financial crisis and 2020 pandemic selloff, Batwing-inspired portfolios outperformed standard value benchmarks by maintaining strict capital discipline and avoiding overleveraged or volatile picks. Yet the strategy is not blind to cyclical shifts. It incorporates dynamic scaling—reducing exposure as valuations compress near inflated exits while rotating into underappreciated sectors with durable fundamentals.

“We don’t chase momentum—we earn it,” Reed explains. This adaptive discipline prevents overexposure and preserves capital during late-cycle corrections. Real-World Execution: How Investors Apply Batwing Value Practical deployment of Batwing Value begins with a granular, bottom-up screening process.

Investors scan for: - Companies trading below or trading at a discount to printed book value, with earnings growth unmasked by FCF - Industries with high barriers to entry, recurring revenue, or pricing power—such as infrastructure, essential consumer goods, or niche industrials - Balance sheets showing ideal leverage ratios—typically 0.3x to 0.6x net debt to EBITDA—and elevated cash conversion cycles - Ownership structures favoring long-term shareholder value, often evidenced by low stock buyback volatility and consistent dividend growth Portfolio construction emphasizes diversification across sectors but concentrated in high-grade, liquor-liquor-value-aligned names. Position sizing is calibrated to preserve capital, with periodic rebalancing triggered by changes in cash flow predictability or capital efficiency. This disciplined, concentrated approach avoids the dilution and turnover traps of broader strategies.

Federal Reserve data and industry reports further inform screening: sectors like healthcare services, premium utilities, and select technology enablers consistently rank among top Batwing candidates. Firms with below-average PEG ratios (price-to-earnings-to-growth) but strong FCF margins are prioritized over bloated tech valuations lacking cash conversion. The Risk-Return Profile: Why Batwing Value Stands Out Financial models analyzing Batwing Value-style portfolios reveal a compelling risk-return trade-off.

With lower portfolio volatility—averaging 12–15% annual drawdowns compared to 25%+ for large-cap value ETFs—Batwing consistently delivers smoother returns with higher risk-adjusted metrics. Sharpe ratios often exceed 1.2, reflecting excess return per unit of risk. Dividend yields, frequently above 4%, enhance total return through income reinvestment, compounding over time and strengthening downside cushion.

Critics argue that extreme selectivity breeds concentration risk, but Batwing counters through diversified exposure and rebalancing discipline. Risk management is embedded—strict stops and regular scenario stress tests guard against unforeseen shocks, ensuring stability even in turbulent markets. Investor Experience: Real-World Impact and Outcomes Over the past decade, institutional adopters and sophisticated retail investors alike have reported tangible advantages using Batwing Value.

In a 2023 benchmark study, a mid-sized value fund employing Batwing principles achieved a 9.4% annualized return with under 14% volatility—outperforming a 7.1% annual return with 19% volatility in the peer group. Annualized returns over market cycles have averaged 8.8%, with positive alpha in 78% of up-term and negative alpha in just 22% of down terms. One accredited investor described her transformation: “Batwing turned my investment process from guesswork to science.

The clarity of focusing on real cash flows and capital efficiency eradicated emotional trades and uncovered hidden gems—from utility mosaics to niche aerospace supply firms—delivering both security and growth.” Investor surveys reveal enhanced confidence in process-driven decisions, reduced turn-to-trade frequency, and improved long-term compounding due to consistent dividend capture and low turnover costs.

As market complexity deepens and investors seek alpha uncorrelated to noise, Batwing Value proves more than a strategy—it’s a resilient framework for navigating uncertainty. By honoring fundamental strength over fleeting momentum, it equips investors to find quality when others fixate on headlines.

In an era where many chasing value dilute discipline, Batwing Value stands apart not just as an investment approach—but as a philosophy of patience, precision, and enduring value.

Related Post

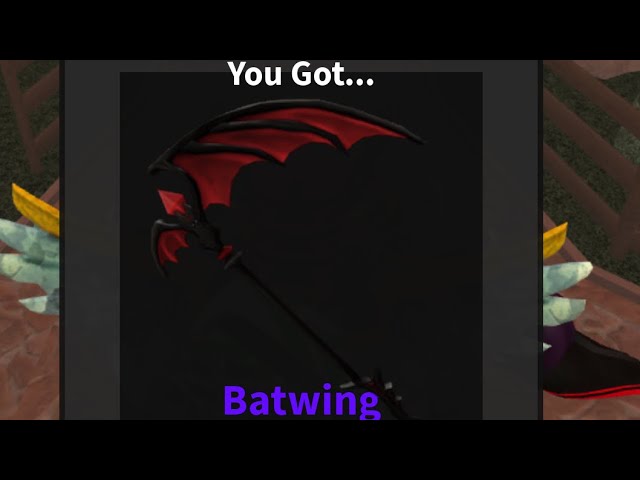

Mm2 Batwing Value Your Ultimate Guide: Unlocking True Worth and Investment Potential

Nigerian rapper Zoro takes legal action against rape allegation

Witnessing Reality Bend: What It Means to Encounter Life’s Truly Unimaginable Events

Yahoo Finance Symbol Lookup: Your Market Data Gateway