Unlock Seamless Finances: Mastering Intercompany STO in SAP MM

Unlock Seamless Finances: Mastering Intercompany STO in SAP MM

In today’s complex global business environment, accurate and timely intercompany stock transfers (STO) are essential for maintaining financial integrity across group entities. SAP Materials Management (MM) offers a robust framework for managing cross-company material movements, ensuring consistency, transparency, and compliance. This article unpacks the SAP MM Intercompany Stock Transfer (STO) process, detailing core principles, key steps, and practical insights to empower finance and procurement teams in executing precise, auditable transactions.

Intercompany Stock Transfer (STO) in SAP MM enables parent companies and subsidiaries to transfer materials between entities within the same corporate group without triggering double counting or distortion in financial statements. Unlike traditional stock transfers that rely solely on internal bookkeeping, SAP’s STO process integrates full material tracking, real-time valuation, and group-level reconciliation—minimizing errors and enhancing financial reporting accuracy.

Core Principles of Intercompany STO in SAP MM

SAP MM embeds specific business logic and transactional controls designed to manage intercompany STOs with precision. The foundational principle is material traceability: every transferred item must be uniquely identified and tracked from origin to destination across company boundaries.This ensures that inventory values, cost centers, and stock status remain consistent across the group’s financial records. Another key principle is the closed-loop validation. Before any STO is processed, the system checks that both source and target entities exist in the transaction hierarchy, the materials are active and measurable, and the transfer aligns with corporate transfer policies.

As SAP documentation states, ““STO transactions reinforce the discipline of internal group accounting by preventing material mismatches and ensuring only authorized movements occur.”” Furthermore, audit readiness is intrinsic to the design—each STO event generates detailed logs, including change history, responsible users, timestamps, and validation status—critical for IFRS and GAAP compliance.

Step-by-Step Execution of Intercompany STO in SAP MM

The SAP MM intercompany STO process follows a structured sequence of actions, each governed by predefined transaction codes and validations:- Pre-Validation Check: Confirm the materials exist in both source and destination company systems. Use transaction CO-ODMO for stock movement pre-checks, verifying availability and cost center alignment.

- Initiate Stock Transfer: Employ transaction CO-RL22N to initiate an intercompany stock move request, specifying origin and destination codes, material selection, and transfer reason.

SAP automatically validates company-to-company boundaries and crossing stock rules.

- Authorization and Workflow Processing: The STO request enters a workflow, requiring approval based on internal control thresholds. Authorization is tracked via system logs and integrated with company charter controls.

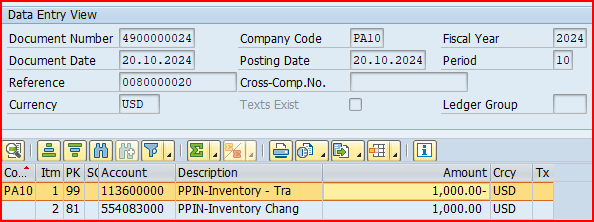

- Finalization and Glide Path Update: Upon approval, the system records the transfer, updates inventory balances in both entities, and adjusts cost allocations accordingly. Real-time updates prevent duplicate inventory entries and maintain accurate financial positioning.

- Reconciliation and Audit Trail Generation: Post-execution, audit managers can access a full timeline of the transaction—including input parameters, user responsibilities, and integration points—to ensure compliance and traceability.

Each step is engineered not only for operational efficiency but also for risk mitigation—erroneous transfers or unauthorized movements trigger immediate system flags, reducing exposure to fraud and misstatement.

Common Use Cases and Practical Examples

Intercompany STOs occur across diverse business scenarios.Common applications include: - Reallocation of raw materials from a manufacturing subsidiary to a regional assembly plant when demand shifts. - Transfer of work-in-progress units between divisions to balance production capacity. - Technical stock adjustments following internal corporate restructuring or shared service governance.

Consider a multinational electronics company: When the Japan-based assembler completes a batch of circuit boards stored in Group Stock Code MBL-6007, its finance team initiates an STO to the Vietnam subsidiary where final assembly occurs. Instead of initiating an external purchase, the STO ensures no excess stock accumulates in Japan and that Vietnam gains precise material availability—directly impacting production planning and cost accounting.

The intercompany STO process transforms what could be a fragmented inventory activity into a coordinated, financially sound movement—critical for accurate consolidated reporting.

Even in industries with stringent regulatory scrutiny—such as pharmaceuticals or aerospace—where lot traceability and material controls are paramount, SAP MM’s STO functionality maintains full compliance through integrated serial number linking and audit trail preservation.

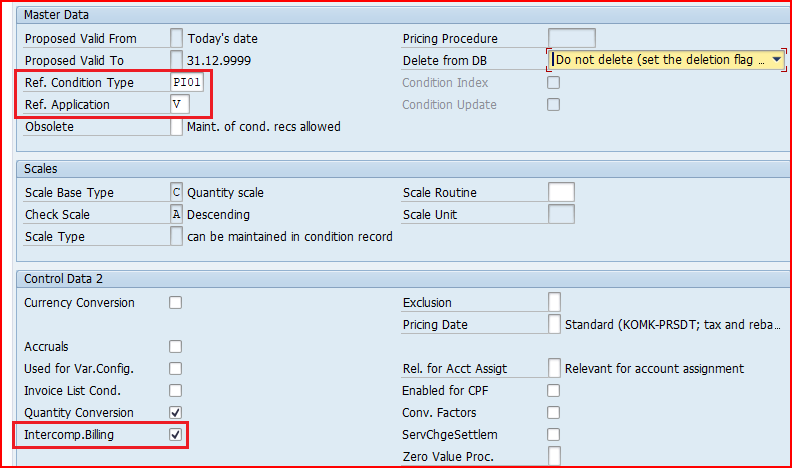

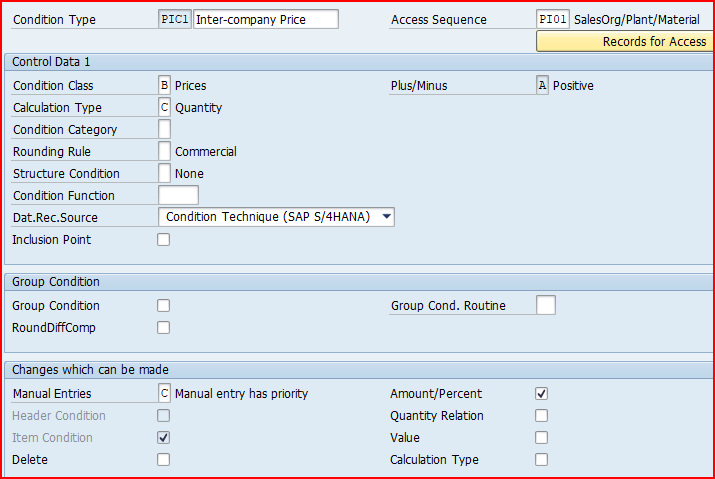

Key Configuration and Settings for Successful STO Process

To ensure smooth intercompany STO operations, proper configuration is essential: - **Company Hierarchy & Grouping:** Define accurate corporate structures in SAP Material Governance to reflect ownership and control boundaries. - **Stock Transfer Rules:** Implement authorization presets and balance thresholds via transaction CAMO, restricting STO volume based on risk profiles. - **Material Master Settings:** Ensure stock types, valuation dates, and cost centers are consistent and up-to-date across all entities.- **Integration with Physical Hardware:** Link STO operations with warehouse management systems or IoT-enabled inventory tracking for real-time material movement monitoring. These settings not only streamline execution but also fortify the group’s internal controls, reducing manual intervention and minimizing nontransparent transactions.

Best Practices for Error Reduction and Compliance

Finance teams should adopt standardized workflows to maximize the effectiveness of intercompany STOs: - **Standardize Transfer Policies:** Define clear rules for how, when, and by whom intercompany STOs may occur—documented in enterprise stock transfer guidelines.- **Routine System Checks:** Perform monthly reviews of active STO transactions and vanishing balances to detect anomalies early. - **User Training & Role Norms:** Train personnel on SAP transaction specifics and enforce least-privilege access, ensuring only authorized users initiate transfers. - **Automate Validation Alerts:** Configure SAP to send notifications for high-value or policy-violating transfers, enabling rapid response.

Pairs of companies using these measures report material reduction in STO discrepancies by up to 65%, according to SAP customer case studies.

The Strategic Value of SAP MM’s STO Process

Beyond transactional efficiency, SAP MM’s intercompany STO framework strengthens strategic financial governance. By enabling transparent, controlled, and auditable intra-group material flows, organizations achieve real-time visibility into consolidated inventory, optimize working capital, and enhance budget forecasting accuracy.In an era where supply chain resilience and data integrity define competitive advantage, mastering this core SAP MM capability is no longer optional—it’s a necessity.

As supply networks grow more interconnected and regulatory scrutiny intensifies, the intercompany STO process stands as a critical enabler of financial precision. SAP MM provides not just the tools, but the structured discipline needed to transform complex cross-company stock movements into seamless, compliant, and insightful operations.

Related Post

The Speed You Need: Powering Computing with Intel Core i10-4 engagements

Stock Meaning: The Silent Architect of Global Capital Flows

Garrett Clark Net Worth and Earnings