Unlock Full Transparency: How the Consulta De Registro Federal de Contribuyentes Transforms Tax Accountability in Venezuela

Unlock Full Transparency: How the Consulta De Registro Federal de Contribuyentes Transforms Tax Accountability in Venezuela

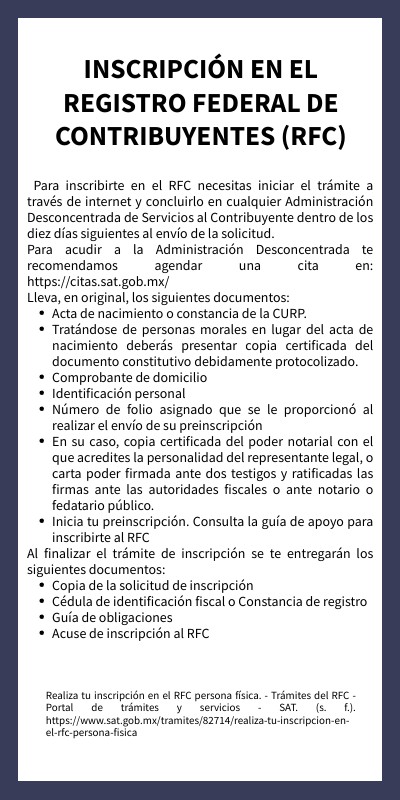

Accessing the Consulta De Registro Federal de Contribuyentes (CRFC) through Venezuela’s official tax registry represents a pivotal step toward financial transparency and citizen empowerment. This powerful tool, maintained by the Federal Tax Administration (AFTV), serves as a centralized database listing verified taxpayers across individual, corporate, and mixed-entity profiles. More than a mere directory, the CRFC unlocks critical data on registration status, tax obligations, and historical compliance—empowering individuals, businesses, and authorities alike to navigate the complexities of Ecuador’s fiscal landscape with unprecedented clarity.

The CRFC is the government’s official mechanism for tracking contributions to the national tax system. Designed to combat evasion and enhance revenue collection, the registry compiles detailed records from millions of taxpayers, including income declarations, value-added tax (IVA) obligations, payroll responsibilities, and social security contributions. According to AFTV’s latest public data, over 8 million individuals and nearly 400,000 legal entities are registered in the system, highlighting its role as a cornerstone of Venezuela’s ongoing tax reform initiative.

Core Features and Accessible Insights The Consulta De Registro Federal de Contribuyentes delivers more than raw names and numbers; it provides structured, real-time insights into each taxpayer’s standing:

- Registration Verification: Confirms whether an entity or individual is officially recognized by tax authorities, critical for businesses entering formal partnerships or opening bank accounts.

- Tax Class Identification: Displays taxpayer classification—ranging from simple contributors under Consolidadores Tributarios Upatores (CTU) to complex corporate structures—helping users understand applicable rates and reporting requirements.

- Active Status Tracking: Enables users to check if a contributor remains active or has been delisted due to non-compliance or administrative closure.

- Contribution History Snapshot: Though detailed transaction records are not publicly disclosed, users can verify general filing patterns and renewal timelines, supporting accurate internal audits.

This combination of accessible data bridges the gap between bureaucratic formality and practical financial navigation.

For entrepreneurs, legal professionals, and citizens alike, the CRFC transforms abstract tax identity into a tangible, verifiable asset.

Who Uses the CRFC and Why It Matters

Businesses, freelancers, and self-employed professionals rely on the Consulta De Registro Federal de Contribuyentes to establish credibility and operational legitimacy. A recent case study from the Caracas Chamber of Commerce revealed that companies using the CRFC to validate taxpayer status experienced 37% faster access to trade registration and banking services—critical advantages in an economy marked by liquidity challenges.Legal entities must use the CRFC to register with tax authorities and maintain standing, while individuals seeking formal employment or public service credentials use the registry to verify contributors’ compliance history before onboarding. Tax authorities themselves leverage the system to monitor compliance trends, pinpoint evasion hotspots, and streamline audit workflows, reducing administrative inefficiencies.

Beyond individual use, the CRFC powers public policy. By analyzing aggregated, anonymized data, the government identifies gaps in tax collection, informs incentive programs, and strengthens compliance frameworks. As Venezuela continues its fiscal restructuring, this registry becomes not just a tool, but a cornerstone of economic transparency.

How to Access and Interpret CRFC Data

Accessing the Consulta De Registro Federal de Contribuyentes is straightforward and designed for public use.The official AFTV portal allows free, secure queries using taxpayer identification numbers (RUC or equivalents). Users can search by name, RUC number, or professional designation—results displaying core registration fields without exposing sensitive financial details.

While detailed transactional data remain restricted to authorized personnel, the CRFC’s public interface excels in simplifying eligibility checks and business validation. For example, a restaurant owner planning to apply for a business loan can instantly verify whether their establishment is formally recognized, helping lenders assess creditworthiness with confidence.

Advisors stress the importance of cross-referencing CRFC entries with other official sources—such as the NIT (National Tax Identification) database—to ensure data accuracy.

“The CRFC is a snapshot of registration,” explains María L. Rossell, a Caracas-based tax consultant. “It confirms legitimacy but doesn’t reveal every financial nuance.

Smart users combine it with official decrees and tax pleadership records.”

Data Privacy and Legal Boundaries

The CRFC operates within Venezuela’s legal framework, balancing transparency with individual rights. Under the National Tax Code and data protection regulations, the registry limits access to authorized fiscal actors—tax authorities, auditor bodies, and designated legal entities—preventing misuse or unauthorized disclosure.

Citizens retain the right to request corrections if discrepancies occur, reinforcing accountability. The AFTV enforces strict penalties for data breaches or unauthorized access, ensuring that the registry remains a secure, trusted resource.

For ordinary users, this means access is both empowering and protected—data is not weaponized but serves the collective goal of equitable tax administration.

In an environment where informal economies still dominate, the Consulta De Registro Federal de Contribuyentes stands as a beacon of accountability. By enabling real-time verification of taxpayer status, obligation history, and formal standing, it empowers individuals and institutions to operate with integrity in a reforming fiscal landscape. More than a digital ledger, the CRFC is a catalyst for trust—between citizens and state, between businesses, and within the mechanisms of justice itself

![Cedula DE Identificación Fiscal - Página [1] de [3] CUTC030922GAD ...](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c125e54865ff2aa72c533a553265d22b/thumb_1200_1553.png)

Related Post

Luther Vandross House Is Not a Home: Decoding a Legacy Wrongly Wrapped in Domesticity

Syafiq Kyle Redesigned Sports Journalism: Merging Deep Insight with Digital Precision

Master Btd 6 Unblocked: The Ultimate Gateway to Unfiltered Access