Unlock Financial Confidence: The Essential Role of a Us Bank Number in Secure Transactions

Unlock Financial Confidence: The Essential Role of a Us Bank Number in Secure Transactions

Everywhere you turn—whether online purchasing, paying bills, or setting up direct deposits—your Us Bank Number stands at the heart of modern financial operations. It is more than just a sequence of digits; it is a critical identifier that ensures funds move safely and accurately between accounts, institutions, and platforms. In an era defined by rapid digital transactions and cybersecurity concerns, understanding the Us Bank Number’s function, structure, and safeguards is essential for both individuals and businesses.

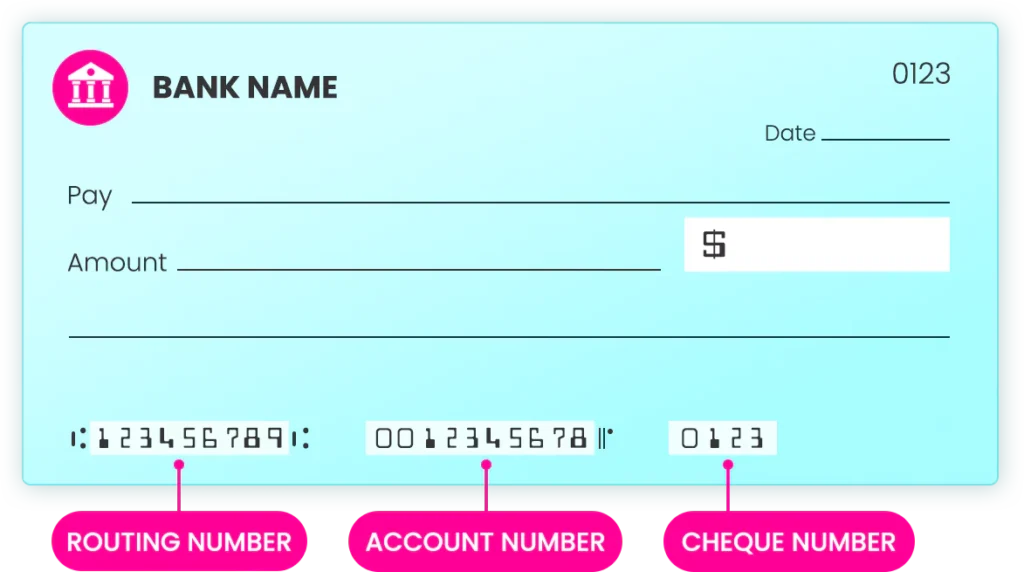

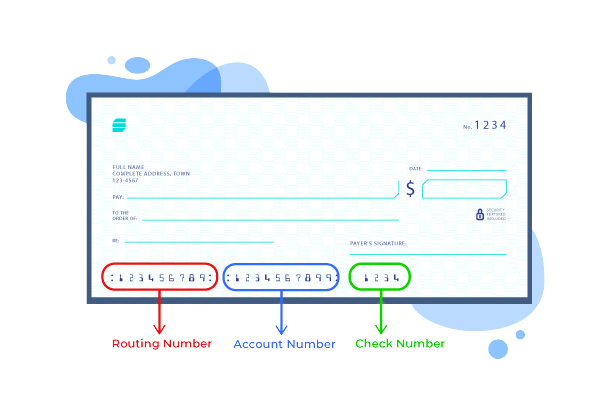

Understanding the Us Bank Number: Structure and Purpose At its core, the Us Bank Number—often aligned with queries like “Us Bank Number” or “Us Bank Account Number”—identifies a financial institution within the U.S. banking system. While not identical to a full account number, it contains key components such as the Federal Reserve bank ID, state-chart identifier, and institutional code, all working together to route funds precisely.

These numbers follow standardized formats developed by the American Bankers Association, ensuring compatibility across ATMs, electronic payment systems, and banking software. “Think of the Us Bank Number as the postal code of money flows—without it, transactions lack direction and trust,” explains financial services analyst Maria Torres. “Its role is foundational in matching remittances with the correct institution, reducing errors, and preventing fraud.” The typical structure includes: - First segment: Regional Federal Reserve district code - Next two digits: State-chartered bank - Followed by unique institution identifier - Ends with checksum digits for validation This layered coding enables banks and processors to cross-verify details instantly, a necessity in an environment where timing and accuracy are paramount.

Whether you’re setting up auto-debit payments or verifying direct deposits, the Us Bank Number acts as a digital fingerprint, protecting against misrouted funds and ensuring transactions reach authorized recipients.

Why Your Us Bank Number Matters More Than You Think

Beyond basic routing, the Us Bank Number underpins several critical functions in today’s financial ecosystem. It ensures compliance with federal regulations, supports ACH credit and debit operations, and plays a vital role in identity verification processes.Financial institutions depend on these numbers not only for operational efficiency but also to maintain audit trails and fraud detection protocols. For individual users, using a correct Us Bank Number prevents delays, rejected payments, and account discrepancies. Small businesses, meanwhile, rely on accurate bank identifiers to streamline payroll, vendor payments, and client reimbursements—avoiding costly payment failures that impact cash flow and customer trust.

Consider these realities: - **Payment Accuracy:** Even a one-digit error in the Us Bank Number can redirect $100+ transfers to the wrong account—causing financial strain and recovery headaches. - **Security Validation:** Banks use these numbers in multi-factor authentication to confirm transaction legitimacy, reducing breach risks. - **System Integration:** Payment processors, fintech apps, and government disbursements all depend on standardized bank identifiers to interface securely and efficiently.

Many users unknowingly interact with their Us Bank Number daily—when signing up for digital wallets, enrolling in automatic bill pay, or receiving federal benefits. Each interaction depends on its precision and predictability.

Protecting Your Us Bank Number: Best Practices for Secure Transactions

With increasing cyber threats and sophisticated financial fraud, safeguarding your Us Bank Number has become non-negotiable.Unlike static account numbers, bank identifiers are frequently involved in automated payment workflows, making them high-value targets. Exposing this data improperly—through phishing scams, insecure portals, or unvetted third parties—can expose users to identity theft and unauthorized transfers. Experts stress a multi-layered defense approach: - **Never Share Publicly:** Keep your Us Bank Number confidential and avoid disclosing it via unencrypted messages or unverified websites.

- **Verify Institutional Authenticity:** Before providing bank details—especially via email or pop-ups—confirm requests originate directly from official sources, such as bank websites or verified banking apps. - **Monitor Bank Statements Regularly:** Routine reviews help detect anomalies early, protecting against unauthorized use. - **Use Secure Platforms:** Leverage bank-apps, encrypted portals, and trusted financial service providers to minimize exposure to digital risks.

“Consumers often underestimate how vulnerable their bank identifiers can be once exposed,” warns cybersecurity expert Dr. Elena Park. “The Us Bank Number is not trivial—it’s a gatekeeper to your financial identity.

Proactive protection saves real money, time, and emotional stress.” Notably, banks enforce strict internal controls around Us Bank Number usage, including tokenization and end-to-end encryption, further hardening defenses. Still, user vigilance remains the first line of defense.

Real-World Use Cases: How the Us Bank Number Powers Everyday Finance

Understanding the Us Bank Number in theory is powerful—but its true impact is visible in daily financial activities.Consider these practical applications: - **Direct Deposit:** Employees setting up payroll benefits specify their Us Bank Number to receive salary transfers efficiently, often within 1–2 business days. - **Bill Payments:** Setting authentic payment profiles for recurring bills involves entering the correct bank number to prevent missed or misdirected deposits. - **Government Disbursements:** Federal and state recovery funds, stimulus checks, and unemployment payments rely on accurate Us Bank Numbers to reach rightful recipients promptly.

- **Business Transactions:** Commercial clients use specified Us Bank Numbers in vendor platforms, banking interfaces, and payment gateways to automate invoicing and collections. Small business owners, in particular, rely on accurate banking identifiers to manage accounting software, bank reconciliations, and third-party integrations. A single error here can disrupt entire cash flow systems, highlighting the need for meticulous data entry.

Even in digital lending and credit processes, verification of a user’s Us Bank Number enables lenders to assess financial history and risk profiles, ensuring fairer and more secure credit access.

The Future of Us Bank Numbers in an Evolving Financial Landscape

As financial technology advances, the role of the Us Bank Number continues to evolve—adapting to innovations like real-time payments, open banking, and blockchain-based solutions. While emerging systems promise faster, more transparent transactions, the foundational value of standardized banking identifiers remains unchanged.Regulatory shifts, such as enhanced anti-money laundering (AML) compliance and digital identity verification frameworks, increasingly mandate robust bank number validation. These requirements reinforce the Us Bank Number’s role as a trusted, interoperable data element across global and national payment networks. At the same time, growing consumer awareness around digital security is shifting expectations.

Users increasingly demand clearer explanations of how their bank numbers are used, stored, and protected. Banks and fintech firms respond with enhanced transparency, user education, and fortified security protocols, making trust a central pillar of modern banking relationships. “Us Bank Numbers are no longer just internal codes—they’re part of a broader digital identity ecosystem,” notes financial infrastructure analyst James Reed.

“Their reliability enables innovation, but only when safeguarded by intelligent design and responsible use.” In the years ahead, the clarity, accuracy, and security of Us Bank Numbers will remain pivotal to both individual financial health and systemic stability in the payments revolution. The Us Bank Number, though often overlooked, is a cornerstone of modern finance—a silent guardian ensuring money moves as intended, securely and efficiently, across every digital interaction.

Related Post

Coldplay’s Global Resurgence Explored: Insights from CEO Romano and Fox News Spotlight

Scarab: The Ancient Beetle Reshaping Technology, Archaeology, and Human Ingenuity

Highball Alcohol Percentage Your Guide to the Japanese Drink That Defines Simplicity and Precision