Unlock Financial Access: How the TD Bank Number Powers Every Transaction

Unlock Financial Access: How the TD Bank Number Powers Every Transaction

Whether you're making a daily deposit, processing payroll, or establishing a business account, the TD Bank number remains the essential key to seamless banking in Canada. From its standardized format to its nationwide reach, the TD Bank number is more than just a phone-like identifier—it’s a gateway to secure, efficient, and personalized financial services. In an era where digital access defines financial inclusion, understanding the structure, function, and advantages of the TD Bank number is critical for individuals and businesses alike.

Every TD Bank customer manifests a distinct number that functions as a unique transactional fingerprint.These numbers are not arbitrary—they follow a precise format designed for clarity and interoperability across ATMs, online platforms, and in-branch services. The typical TD Bank number, often starting with a five-digit prefix, encodes geographic and operational data, enabling instant routing of funds and verification. For everyday banking, this means faster logins, quicker transfers, and fewer authentication delays.

Breaking Down the Anatomy of a TD Bank Number

Decoding a TD Bank number reveals intentional design: the first digit, or the area code, identifies the proximity to one of TD’s major branch clusters—typically located in densely populated urban centers like Toronto, Calgary, or Vancouver.

This allows the bank’s systems to efficiently direct communications and reduce latency in processing transactions. The next digits follow a standardized Interac-compatible structure, enabling compatibility with Canada’s national debit and direct deposit network. The final portion, often eight to ten digits, serves as the individual account pin or line identifier within TD’s internal ledger system.

This structured format ensures that when you withdraw cash from a TDSATM, initiate a cross-canada transfer, or schedule standing deposits, every step is recognized instantly by TD’s infrastructure.

Unlike static bank codes used by other institutions, TD’s dynamic numbering adapts to evolving digital banking demands, supporting real-time verification and enhanced fraud detection.

Why the TD Bank Number Stands Out in Canadian Banking

Among thousands of financial institutions, TD Bank’s numbering system offers distinct advantages. The widespread usability across ATMs, POS terminals, and mobile banking apps eliminates friction in everyday transactions. For small and medium enterprises, integrating the TD Bank number simplifies payroll processing, vendor payments, and merchant account setup—critical for operational continuity.

TD’s emphasis on interoperability means its number works seamlessly with Interac e-Transfer, Payments Canada systems, and commercial clearing networks.

Moreover, TD institutions use enhanced security layers tied directly to account numbers. Biometric logins, two-factor authentication, and real-time transaction alerts are often anchored to the individual account component of the number. This integrated security model reduces identity theft risks and builds customer trust.

As highlighted by TD’s Chief Information Officer in a 2023 statement: “Our numbering strategy isn’t just about routing—it’s about empowerment. When customers know their number matters, they engage more confidently with their financial future.”

Practical Use Cases: From Personal Accounts to Enterprise Solutions

For personal finance users, the TD Bank number acts as a universal access key. Opening an account—whether online or in a branch—is streamlined by a single, reliable identifier.

Funds move instantly between linked accounts, and international transfers from TD’s worldwide network are efficiently routed using the number’s built-in destination metadata.

Businesses rely on the TD Bank number for scalability. Setting up automated monthly payments, issuing corporate cards, and managing high-volume merchant settlements all depend on a stable, recognizable number that banks and third-party paid processors instantly recognize. TD’s commercial banking division emphasizes that holding a dedicated Td Bank account number reduces operational bottlenecks and accelerates settlement times by up to 30% compared to generic banking identifiers.小节

Accessing Your TD Bank Number: How to Find and Secure It

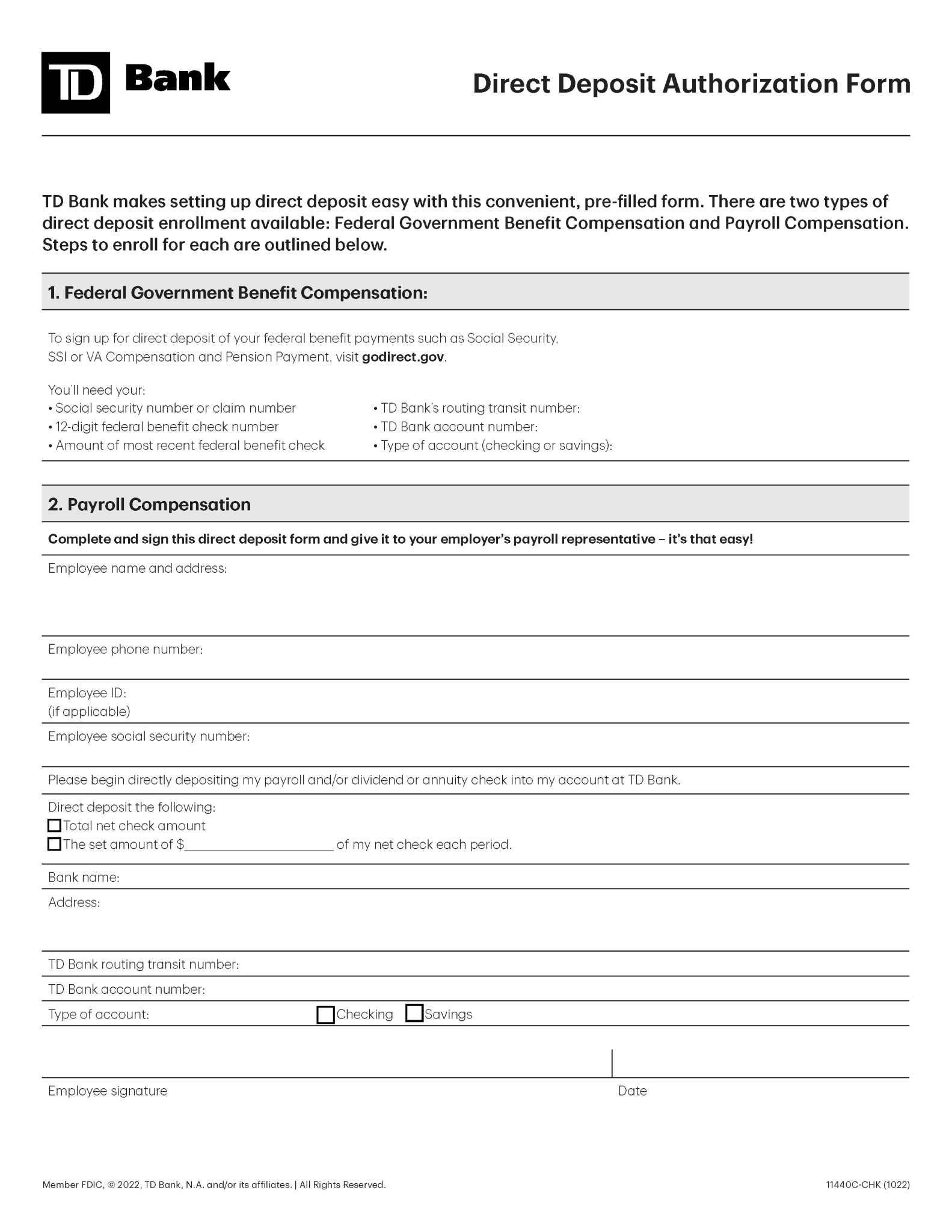

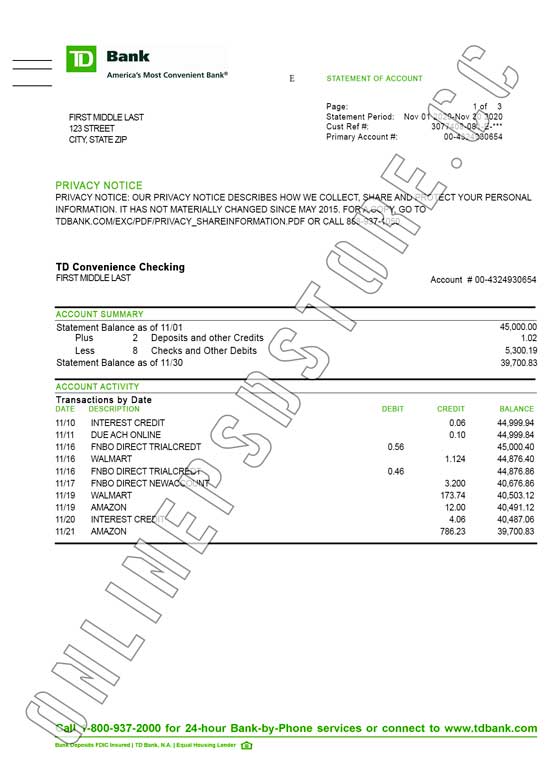

Discovering your TD Bank number is straightforward.

Upon opening an account—digitally or in person—you’ll receive a physical statement and login credentials, each containing your unique identifier. For mobile banking, the number appears in transaction histories, bill pay profiles, and account details screens. Security best practices include storing your number confidentially and avoiding sharing it beyond verified financial partners.

TD also offers dedicated support for retrieving or reactivating number-based account access, including remote recovery options and in-branch verification.

This ensures continuity even in scenarios involving lost cards or system outages, reinforcing the number’s role as a stable pillar of banking identity.

Looking Ahead: How TD’s Numbering Supports Digital Innovation

As Canada advances toward a cash-light and digital-first banking ecosystem, the TD Bank number is evolving. Innovations like real-time payment rails, enhanced open banking APIs, and smart contract integration depend on robust, machine-readable identifiers—all supported by TD’s structured numbering framework. The bank’s commitment to future-ready infrastructure positions the Td Bank number not just as a current tool, but as a cornerstone of tomorrow’s financial services.

Whether used for microtransactions, payroll disbursements, or cross-border trade, the TD Bank number remains indispensable—a symbol of reliability, innovation, and accessibility in modern banking.

As the financial landscape transforms, understanding and leveraging this core identifier empowers users to navigate their banking journey with clarity and confidence.

The TD Bank number is more than a contact code—it’s the foundational element enabling secure, fast, and seamless financial interactions across Canada. In a world where convenience drives engagement, TD’s numbering strategy ensures that every transaction, big or small, flows with precision, security, and speed.

Related Post

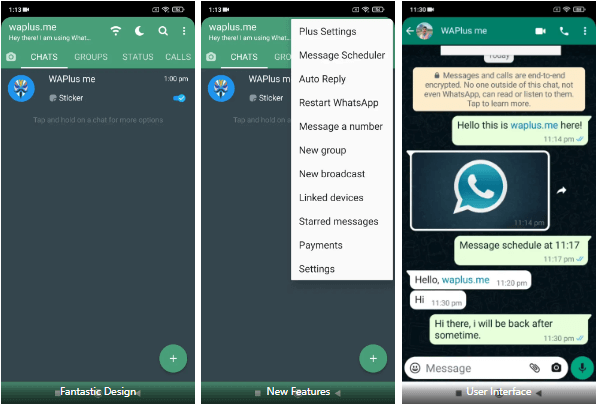

WhatsApp Plus Whatsapp: Unlocking Enhanced Control Without Breaking the Rules

George Grenier’s Deadline: When Villainy Meets Method

The Next Big Shift After Erome Quality 13: Redefining Standards in Digital Experience

Is Gretchen Ross Married? Unveiling the Personal Life Behind the Public Figure