Unlock Expert Cash Control: Key Features and Benefits of Fidelity Cash Management Accounts

Unlock Expert Cash Control: Key Features and Benefits of Fidelity Cash Management Accounts

For modern investors and business owners managing liquidity is no longer just about holding cash—it’s about aligning financial flexibility with strategic discipline. Fidelity Cash Management Accounts (CMAs) serve as powerful financial engines, designed to streamline cash organization, enhance returns, and optimize liquidity across both personal and institutional portfolios. With robust tools tailored for real-time oversight and proactive decision-making, these accounts have redefined how users manage short-term funds.

From automated transaction monitoring to advanced multi-tier interest strategies, the features embedded in Fidelity’s CMAs deliver tangible value in an era where financial precision only strengthens value retention.

At the heart of Fidelity’s CMAs lies a suite of innovative functionalities that transform raw cash holdings into intelligent, operational assets. These accounts are built not as passive savings vaults but as dynamic financial command centers.

The platform enables users to structure liquidity with precision, offering granular control through segmented sub-accounts—ideal for separating capital based on purpose, risk tolerance, or client mandates. “Customization is king,” notes a senior Fidelity product strategist. “Whether a business holds working capital earmarked for project funding or an investor segregates emergency reserves, Fidelity’s architecture supports both complexity and clarity.” This modular fund allocation minimizes misallocation risk and ensures each dollar serves its intended strategic role.

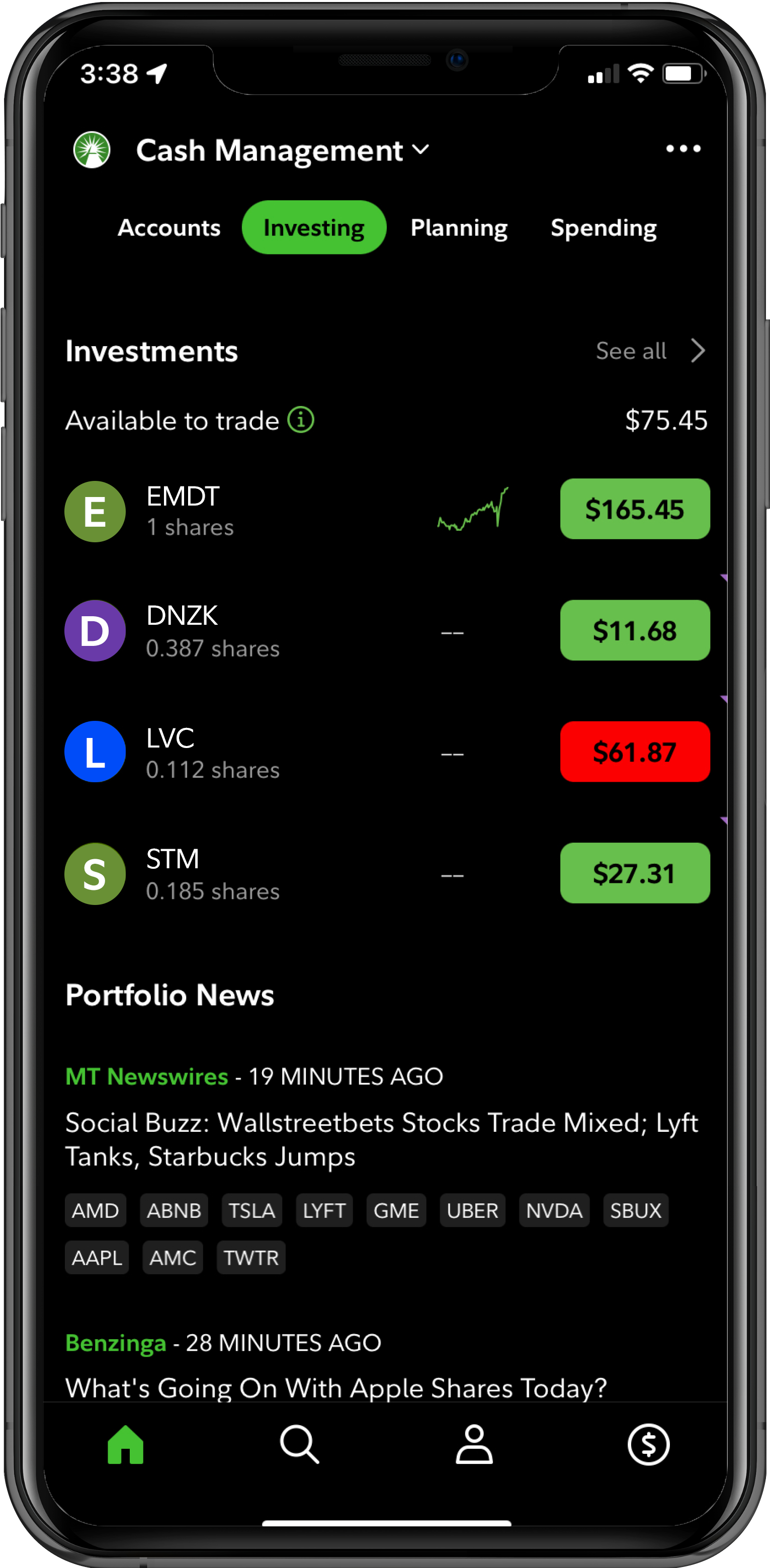

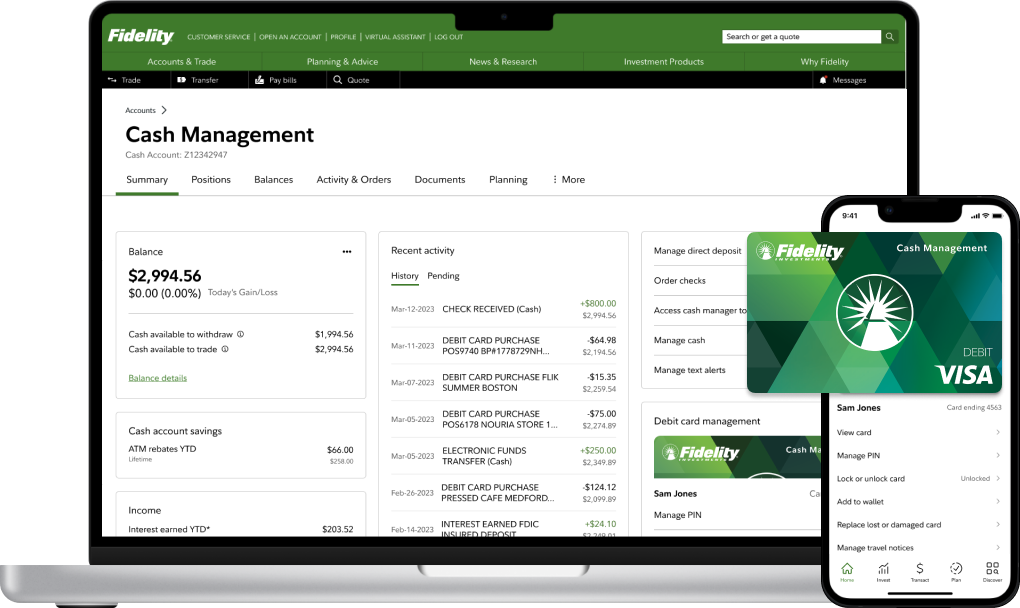

One of the most compelling advantages of Fidelity’s CMAs is their real-time visibility and reporting ecosystem. Unlike traditional accounts where cash status lags behind daily transactions, Fidelity platforms deliver instant updates powered by direct interbank feeds. Dashboards update in real time, displaying current balances, pending settlements, and transaction histories with remarkable accuracy.

“Every penny’s journey is transparent—no more manual reconciliations or outdated spreadsheets,” says a small business manager who uses the service. “Being able to see cash inflows and outflows as they happen has been a game-changer.” This instant access extends beyond local transactions; international transfers, wire activity, and regulatory compliance tracking are integrated into a single, cohesive view, reducing operational friction and supporting faster, data-driven cash deployment.

Another standout feature is the tiered interest structure engineered to maximize returns on idle cash.

Fidelity offers competitively structured interest rates that vary not by customer profile alone, but by segment categorization—such as short-term liquidity, business reserves, or investment holdings. By automatically routing funds to the most advantageous earning profiles within the account, users earn more from cash without altering their overall strategy. “It’s automatic, but it’s smart—your cash earns where it belongs,” explains a wealth advisory expert analyzing institutional adoption.

“The float generates passive income that compounds steadily across portfolios, often outperforming conventional book accounts.” This approach rewards users with higher effective yields while preserving liquidity—an essential balance for entities managing volatile cash flows.

Multi-entity management further elevates Fidelity’s CMAs, enabling centralized oversight across disparate accounts without sacrificing functional autonomy. In complex organizations—such as family offices, private equity firms, or multi-brand businesses—this capability prevents fragmented reporting and redundant oversight.

Users can create hierarchical structures with shared access, delegated permissions, and consolidated dashboards that reflect ownership stakes, performance metrics, and risk exposure across all tagged funds. “Managing multiple entities manually would be error-prone and time-consuming,” observes a fintech lead. “Fidelity’s architecture brings clarity: you monitor the whole ecosystem, not isolated silos.” This unified interface supports accurate forecasting, risk assessment, and regulatory compliance, even amid diverse operational mandates.

Compliance and security are woven into the CMAs’ core design, ensuring that sophisticated cash management remains fully aligned with financial regulations. Fidelity integrates robust authentication protocols, encrypted data transmission, and automated audit trails—meeting or exceeding industry standards like FINRA, SEC, and GDPR requirements. Real-time alerts flag unusual activity, unauthorized transactions, or nearing-limit settlements, empowering proactive defense against fraud or operational lapses.

“In an environment of heightened scrutiny, Fidelity’s CMAs don’t just safeguard capital—they validate it,” says a compliance officer using the platform. “The auditability is comprehensive, and security is non-negotiable.” These safeguards instill confidence across personal, corporate, and institutional use cases where trust and regulatory alignment are paramount.

Automated cash optimization tools represent another frontier in Fidelity’s CMA ecosystem.

These features intelligently route surplus funds into short-duration instruments—such as Treasury bills, money market funds, or cash management instruments—maximizing returns while minimizing interest rate risk. Machine learning enhances timing accuracy, adapting to market conditions and settlement cycles to capture incremental yield without overexposure. “It’s like having a financial allocator on autopilot,” says a portfolio manager relying on Fidelity’s systems.

“The platform senses liquidity peaks and slots capital into the safest, most timely opportunities—without requiring constant manual input.” This automation not only boosts earnings but also reduces emotional decision-making, reinforcing disciplined cash stewardship.

The range of reporting and export capabilities complements the functional depth, enabling users to generate tailored financial summaries, compliance packages, or performance analytics in industry-standard formats. Excel, PDF, and CSV exports support seamless integration with existing accounting and ERP systems, simplifying reconciliation and audit preparation.

Interactive charts visualize liquidity ratios, cash conversion cycles, and interest accrual patterns—transforming raw data into actionable insights. “Clarity in reporting translates directly to smarter decisions,” emphasizes a corporate finance director. “Whether reporting to auditors or guiding C-suite strategy, Fidelity delivers data that informs and convinces.”

Underpinning all these features is the philosophy of accessibility—instead of a fragmented, opaque cash management tool, Fidelity offers a unified, scalable platform built for evolving financial needs.

Whether deployed by micro-investors conserving personal liquidity or enterprise finance teams managing multi-billion-dollar operating reserves, the account’s design prioritizes seamless integration into diverse workflows. As one institutional user aptly put it, “Fidelity’s CMAs aren’t just accounts—they’re cash strategists.” By blending automation, transparency, and flexibility, the platform empowers users to treat cash not as a burden, but as a leveraged asset in the broader financial ecosystem.

In an age where liquidity management determines competitive advantage, Fidelity Cash Management Accounts deliver more than control—they drive efficiency, returns, and strategic clarity.

Their feature-rich architecture transforms static capital into a responsive, earn-earning engine, perfectly aligned with modern financial demands. For anyone seeking to turn cash holding into cash value, Fidelity’s CMAs set a new benchmark in what a cash management account can achieve.

Related Post

Why Multi Cloud Strategy is Reshaping the Future of Enterprise Technology

Jasmine Wright CNN Bio Age Height Family Husband Education Salary and Net Worth

Is Carl Rosk Still Alive? Uncovering the Truth Behind His Current Status