Understanding Perfectly Inelastic Goods: The Unmoving Core of Economic Demand

Understanding Perfectly Inelastic Goods: The Unmoving Core of Economic Demand

In markets where necessity reigns supreme, some goods defy the natural elasticity of consumer choice—prices may rise and fall, but demand remains steadfastly unchanged. These goods, known as perfectly inelastic, represent a critical concept in economic theory and daily real-world decision-making. When demand for a product is perfectly inelastic, quantity demanded does not respond at all to price changes, revealing a rigid, unyielding segment of human consumption.

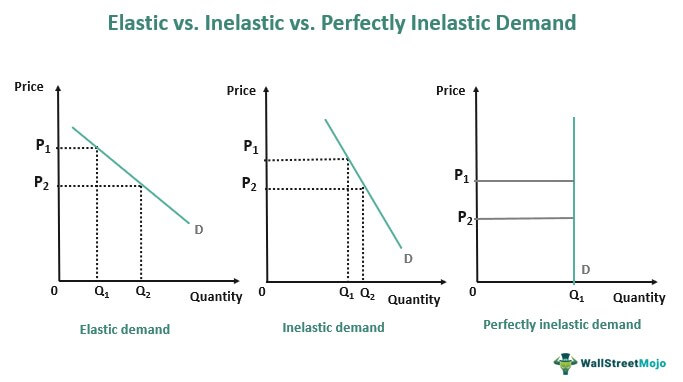

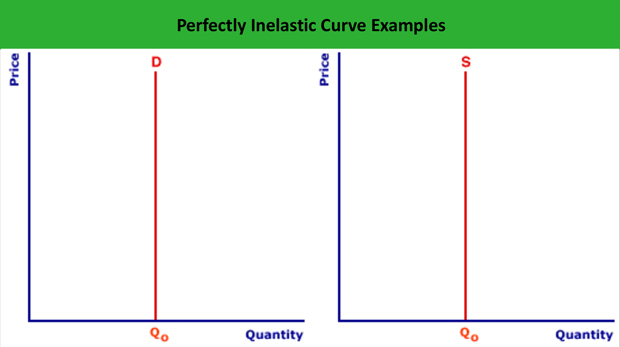

This stability makes perfectly inelastic goods a fascinating lens through which to examine value, consumption patterns, and pricing power. The hallmark of perfectly inelastic demand is a **vertical demand curve** across price and quantity, indicating zero responsiveness to price fluctuations. In practical terms, consumers will purchase the same amount regardless of cost—because the good is essential, replacement options are nonexistent, or both.

This phenomenon challenges conventional economic assumptions about consumer behavior, where more of a good is typically sought as price falls. With perfectly inelastic goods, value and need remain fixed, anchoring markets in predictable patterns.

Among the most recognized tagged examples, **insulin for people with diabetes** stands as a defining case.

Unlike discretionary medical supplies, insulin is a life-sustaining treatment—no substitution exists, and strict adherence is non-negotiable. Despite dramatic insurance cost shifts and drug price hikes over decades, primary insulin users maintain nearly constant consumption. Economists define this as a classic example of perfectly inelastic demand: since access to insulin isn’t optional, price adjustments fail to alter quantity demanded by even a fraction.

Beyond healthcare, everyday necessities underscore the concept’s real-world relevance. Consider basic drinking water in crisis zones. When clean water is scarce and available only through emergency distribution, the urgency compresses demand into a fixed point—overpriced bottled water may tempt suppliers, but desperate families buy regardless.

This illustrates how emergencies amplify inelasticity: scarcity transforms a commodity into a survival imperative, collapsing price sensitivity.

Another vivid example lies in fire detectors and smoke alarms—regulated safety devices essential for life protection. Regulatory bodies mandate installation in homes and workplaces, and their purpose is non-substitutable.

No amount of price escalation changes how many units a household purchases or skips. In this domain, demand becomes perfectly anchored, reflecting both legal necessity and ethical obligation.

The Science Behind Inelastic Demand

Perfectly inelastic demand emerges from fundamental constraints: medical, structural, or existential.For insulin, the human body’s biochemical dependence eliminates substitute possibilities. For mandated fire safety devices, legal frameworks enforce universal adoption. These goods fall outside typical demand elasticity models, where a 1% price change triggers a measurable shift in quantity demanded.

Instead, demand collapses to zero sensitivity, mathematically represented as a slope of zero on a graph. Economists often reference the **price elasticity of demand (PED)** coefficient, where PED = (% change in quantity) / (% change in price). For perfectly inelastic goods, PED = 0—an extreme value with profound implications.

Unlike elastic goods, where revenue maximization entails price reductions, providers of inelastic goods can raise prices without losing customers. This pricing power shapes market dynamics but also raises ethical and regulatory concerns, particularly when survival or safety is at stake.

Understanding perfectly inelasticity extends beyond academic curiosity—it informs policy, insurance design, and corporate strategy.

Emergency response systems prioritize guaranteed access to inelastic goods, knowing price spikes do not curtail demand. Healthcare pricing models reflect this rigidity, balancing affordability with treatment necessity. Similarly, manufacturers of mandated safety devices factor in consumer inflexibility, setting prices that align with legal defaults, not pure market currents.

Broader Economic and Social Implications

The existence of perfectly inelastic demand presents both efficiency and equity challenges. From a business standpoint, monopolistic or oligopolistic control over inelastic goods yields insulated revenue streams—insulin’s pricing history exemplifies this power. Yet, such insulation risks exploitation when oversight is absent.The societal cost of unregulated price gouging on essentials underscores the need for robust public policy and price controls. Regulators rely on identifying inelastic goods to protect vulnerable populations. Essentials like water during droughts or prenatal nutrition supplements are shielded from speculative pricing through subsidies and caps.

“When demand is inelastic, pricing power becomes a double-edged sword,” notes one health economist. “Profitability rises, but so does the responsibility to ensure accessibility.” Moreover, perfectly inelastic goods highlight the limits of traditional market logic. In economics, demand elasticity shapes supply incentives and consumer behavior—but inelasticity reveals markets where supply constraints do not drive behavior, but rather human survival and safety dictate demand.

This distinction sharpens policy tools, emphasizing equity over pure market efficiency.

As global challenges like climate-driven shortages and pandemics reshape consumption, recognizing perfectly inelastic goods becomes ever more critical. Whether in medicine, safety, or basic sustenance, these goods anchor economic resilience, demanding balanced regulation to prevent abuse while ensuring availability.

Their unyielding nature binds purchasing power to necessity, redefining value at the core of human need. In essence, perfectly inelastic goods occupy a singular space in markets—unchanging, unyielding, and indispensable. Their study not only deepens economic theory but also guides real-world decisions that safeguard health, safety, and fairness across societies.

:max_bytes(150000):strip_icc()/inelastic.asp-30bf26b0b05a46db847298872d9acc76.png)

Related Post

Unveiling Kelsi Monroe: Discoveries And Insights

Spotify Premium Web Player Login and Getting Started: Your Gateway to Uninterrupted Audio Excellence

Lexus: Where Engineering Excellence Meets Luxury Drive

Hamilton County Mugshots Unveiled: A Gripping Glimpse Into Local Justice Through Unforgettable Stories