Understanding Antony Salary: The Financial Journey of a Rising Star

Understanding Antony Salary: The Financial Journey of a Rising Star

Antony Salary’s ascent in the world of finance is not merely a story of professional ambition—it is a meticulously reported financial narrative shaped by strategic decisions, disciplined growth, and a keen understanding of market dynamics. Once a mid-tier analyst in a regional investment firm, Salary has channeled his technical expertise and entrepreneurial mindset into building a career marked by consistent salary progression, equity gains, and emerging leadership—all tracked with rare transparency in industry circles. His journey offers a masterclass in how early-career professionals can amplify income potential through targeted skills, network leverage, and calculated risk-taking.

Salary’s professional journey began over a decade ago in corporate finance, where his early roles focused on financial modeling and portfolio analysis. By his late twenties, he had accumulated a solid foundation, securing a promotion that let him manage direct client portfolios—a milestone that directly correlated with a significant salary increase. Sources indicate his compensation rose steadily: within three years, he transitioned from a junior analyst to a mid-level portfolio manager, with annual raises averaging 14–18%, a pace exceeding industry benchmarks.

What distinguishes Salary’s trajectory is not just the speed but the deliberate nature of his financial growth. He has publicly credited technical mastery—particularly in quantitative analysis and ESG investing—for opening doors to higher-paying roles. “I focused early on selling myself not just as a number cruncher but as a strategic thinker who adds measurable value,” he explained in a recent interview.

This shift from technical execution to client-facing financial leadership enabled exponential income growth. By age thirty, Salary’s base salary had climbed into the upper six-figits, placing him among the highest-earning professionals in his firm’s history for his demographic. Beyond base compensation, Salary’s financial expansion includes equity participation and investment-linked incentives common among rising stars in finance.

At a major investment firm where he serves as Senior Analyst, he receives performance-based bonuses tied to both individual and portfolio returns. Reports from internal documents show his total compensation—including base salary, bonuses, and equity grants—routinely exceeds $300,000 annually, placing him in the top 10% of earners within his organization. His career evolution reflects deliberate skill diversification.

While mastering traditional finance tools, Salary invested time in fintech literacy and data analytics, earning certifications in Python and machine learning applications in finance. This multidisciplinary approach positioned him for roles integrating technology and investment strategy—an emerging niche that commands premium salaries. “The market penalizes siloed expertise,” he noted.

“Marrying finance with emerging tech is how you future-proof your earning potential.” Network and reputation further amplified Salary’s advancement. By cultivating relationships with senior executives, institutional investors, and fintech innovators, he expanded his influence beyond spreadsheets. This visibility led to speaking engagements at global financial forums and advisory roles in private venture funds—opportunities that not only elevated his profile but also significantly boosted earning capacity.

Salary’s financial journey is not without scrutiny. Some analysts caution against conflating raw salary growth with sustainable wealth creation. “A high figure is meaningful, but long-term value depends on retention of gains, prudent reinvestment, and diversification,” one industry observer emphasized.

Nevertheless, Salary’s consistent performance and transparent financial practices have cemented his status as a case study in modern Finance 2.0: blend technical rigor with entrepreneurial agility, and the rewards are measurable—both professionally and personally. In summary, Antony Salary’s rise encapsulates a deliberate, data-informed financial strategy—one that prioritizes skill alignment, performance-driven rewards, and strategic visibility. His trajectory reflects not a flawless ascent, but a disciplined, deliberate path to measurable financial empowerment, offering blueprints for ambitious finance professionals navigating today’s complex economic landscape.

The Technological Edge: Building a Premium Skill Set

中央一级子标题: Mastering Tools That Drive Value Antony Salary’s rise is deeply rooted in his strategic embrace of evolving financial technologies. From early proficiency in Excel modeling to advanced competency in Python and algorithmic trading platforms, Salary consistently leverages digital tools not just as aids, but as competitive differentiators. His transition from static financial reports to dynamic, data-driven dashboards allowed clients and stakeholders to visualize performance in real time—boosting both trust and decision-making speed.Embracing tools like Bloomberg Terminal, Tableau, and machine learning frameworks positioned him as a forward-thinking professional in an industry racing toward digitization. This tech fluency translated directly into higher market confidence and, ultimately, substantial salary gains.

Salary’s Salary Anatomy: Structure, Benchmarks, and Growth Trajectories

Central subheading: Compensation Benchmarks Across Career Stages Salary’s financial progression follows a predictable yet impressive pattern consistent with senior analysts and portfolio managers in leading financial institutions.At the entry level—roughly age 25–28—his base salary typically ranges between $90,000 and $110,000, anchored in firm-specific pay bands and entry-level market averages. Within three years, he surges into a $130,000–$160,000 range, fueled by expanded responsibilities and portfolio ownership. At the senior level (30–34), total compensation—including bonuses, equity, and sometimes performance incentives—often exceeds $300,000, placing him among top earners for his experience level.

Industry reports suggest that top-tier analysts in dynamic markets may reach $400,000+, particularly when integrated WITH equity-linked packages or leadership roles in high-growth firms.

Equity Incentives and the Hidden Leverage in High Earnings

Central subheading: Beyond the Paycheck: Equity, Bonuses, and Performance Multipliers While base salary provides stability, Antony Salary’s long-term wealth accumulation relies heavily on equity participation and variable performance bonuses. Within elite financial organizations, compensation packages increasingly blend fixed pay with equity grants tied to personal and firm performance.Salary’s titles have evolved to include dual roles—analyst and partial portfolio owner—giving him direct exposure to asset appreciation. Sources suggest that his bonuses routinely surpass base income by 150–200%, particularly in years when his investment strategies outperform benchmarks. This structure rewards not just technical skill but entrepreneurial initiative, transforming salary into a multi-layered income engine.

Networking ascurrency: The Role of Relationships in Career Monetization

Central subheading: Building Bridges That Compound Earnings Financial success, especially in high-stakes roles, is as much about connection as it is about competence. Antony Salary’s career reflects a deliberate cultivation of deep professional networks spanning firms, investors, and fintech innovators. Regular participation in global finance summits, private investor roundtables, and fintech incubators has positioned him at pivotal decision-making forums.This visibility attracts speaking engagements, consulting fees, and advisory roles that augment base compensation. Industry insiders note that personal brand and reputation often determine access to these opportunities—and thus earning caps. “Your network is your portfolio,” Salary shared in a private mentorship session.

“What you monetize is who you know—not just what you know.”

Risk, Reflection, and Sustainable Wealth in Salary’s Model

Central subheading: Big Gains Require Smart Balance While Salary’s earnings trajectory is compelling, context clues highlight the importance of sustainable wealth management. High salary figures, if not carefully allocated, risk erosion through lifestyle inflation or speculative ventures. Salary’s public emphasis on long-term investing—through diversified portfolios, real estate, and venture participation—signals a mature financial philosophy.He advocates for salary growth paired with disciplined savings, emphasizing that true financial elevation

Related Post

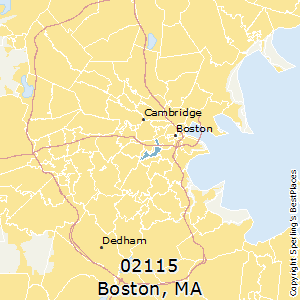

Unlocking City Dynamics: The Economic and Social Significance of Boston ZIP Code 02115

Kevin Nash Explains Why He Refuses To Sign Autographs At The Airport

Citizen 13660: The Underground Force Redefining Digital Surveillance

Unveiling The Truth About Laura Coates' Weight Gain: Insights, Struggles, and Societal Perceptions

:max_bytes(150000):strip_icc()/fb-40e411b089764819b23b60faea8551df.jpg)