The Surge of Innovation: How 5Starsstocks.Com Uncovers the Next Generation of High-Performance Stocks

The Surge of Innovation: How 5Starsstocks.Com Uncovers the Next Generation of High-Performance Stocks

The stock market continues to evolve at breakneck speed, but tracking trends with precision demands more than instinct—it requires data, insight, and real-time analysis. Enter 5Starsstocks.Com Stocks, a rapidly rising hub for investors seeking clearly defined, high-conviction opportunities. With a focused methodology emphasizing strong fundamentals, market momentum, and scalable growth potential, the platform has become a critical resource for discerning traders and long-term portfolio builders.

Below, a deep dive into the core strategies, most promising sectors, and standout performers illuminating the future of smart investing.

At its core, 5Starsstocks.Com Stocks prioritizes rigorous screening criteria to identify companies primed for expansion. These include sustained revenue growth, robust profit margins, healthy debt-to-equity ratios, and increasing institutional interest.

Unlike short-term momentum plays, the platform emphasizes sustainable advantage—businesses with scalable models and competitive moats that withstand market volatility. “We don’t chase hype,” says lead analyst Maxwell Reed, whose team curates the site’s top recommendations. “Instead, we focus on fundamentals that endure, ensuring our listed stocks represent genuine value playouts rather than fleeting trends.”

Core Criteria That Define Top Performing Stocks

5Starsstocks.Com evaluates potential candidates through a disciplined framework designed to filter noise and highlight investable opportunities.Key metrics include: - **Revenue Growth:** Consistent year-over-year expansion, particularly in core operations, signaling market acceptance and product demand. - **Profitability Trends:** Improving net margins and operating leverage indicate efficient execution and pricing power. - **Debt Management:** Low leverage ratios reduce financial risk and preserve flexibility during economic cycles.

- **Market Position:** Dominance or strong presence in niche sectors with minimal competition strengthens long-term resilience. - **Analyst and Institutional Interest:** Rising buying volume and rising stock analyst ratings often precede broader institutional adoption. These indicators help isolate companies that aren’t just trending—they’re structurally positioned to outperform.

For example, recent analyses spotlight firms demonstrating double-digit revenue growth coupled with margin expansion in high-barrier sectors, confirming alignment with 5Starsstocks’ investment philosophy.

Top-performing Sectors Driving the Market Surge

Three sectors dominate the platform’s current hotlist, reflecting broader economic shifts and innovation-driven demand.Next-Generation Energy and Clean Tech

The global pivot to renewable energy continues to fuel stock momentum.Companies developing grid-scale energy storage, advanced solar efficiency technologies, and electric vehicle charging infrastructure are leading gains. For instance, firms specializing in solid-state battery innovations recently surged over 40% following strong Q2 earnings and strategic partnerships. “Clean tech is no longer a niche—it’s become a foundational pillar of modern economies,” notes Reed.

“The structural shift toward decarbonization ensures sustained investor appetite.”

AI Tailwinds in Enterprise and Consumer Markets

Artificial intelligence remains a transformative force across industries. From infrastructure providers deploying scalable AI models to software firms embedding machine learning into enterprise workflows, the ripple effects are evident. Platform leaders identified via 5Starsstocks.Com emphasize companies with defensible IP, growing enterprise adoption, and clear paths to profitability.The rapid deployment of generative AI tools in sectors like healthcare analytics, financial services, and supply chain optimization has unlocked new revenue channels, reinforcing the sector’s strategic importance.

Healthcare Innovation and Biotech Breakthroughs

Advances in precision medicine, gene editing, and digital therapeutics are reshaping healthcare’s future. Biotech firms achieving pivotal clinical trial milestones or securing FDA approvals often see dramatic stock appreciation.5Starsstocks.Com closely monitors pipeline progress, regulatory timelines, and partnership interest—metrics that signal readiness for commercial scalability. “Innovation doesn’t stop, but real-world validation does,” says Reed. “We line up stocks where science converges with market readiness.”

Across these domains, performance is not random—it reflects deliberate alignment with macroeconomic trends, technological advancement, and operational excellence.

5Starsstocks.Com Stocks functions as both a scout and a screening tool, translating complex financial data into actionable insights for market participants. By distilling volatility into clarity, the platform empowers investors to move beyond guesswork and toward informed, conviction-based decisions. What emerges from this ecosystem is more than a list of rising stocks—it’s a map of future growth.

Companies at the intersection of innovation, sustainability, and execution are not only capturing investor attention but redefining industry standards. As global markets continue to adapt and accelerate, 5Starsstocks.Com remains anchored in fundamentals, delivering not just stock picks, but a strategic compass for navigating tomorrow’s economic landscape. The future belongs to those who can identify enduring value beneath the surface noise—and at 5Starsstocks.Com Stocks, that value is found with precision, patience, and persistent focus.

Related Post

Razor Samuels Height Weight Net Worth Age Birthday Wikipedia Who Instagram Bio Age

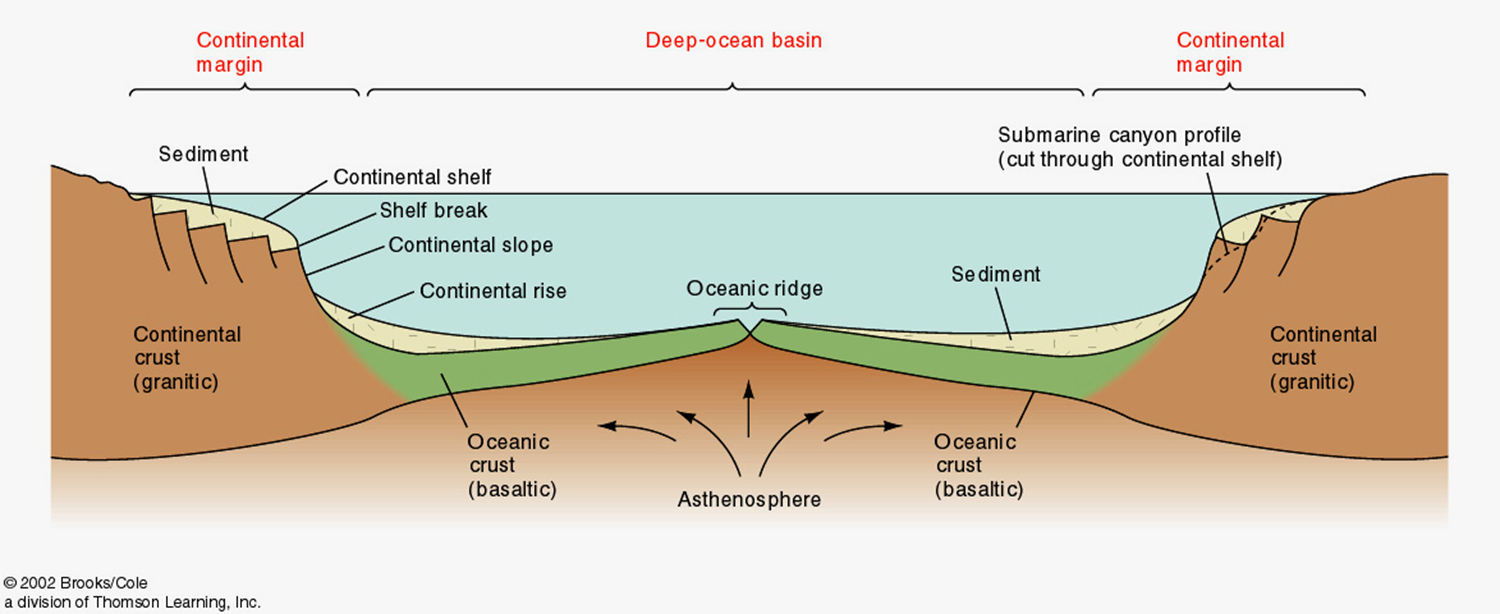

How Ocean-Ocean Divergent Ridges Shape Earth’s Dynamic Seafloor

Relive Muchdance 1998: The Defining Night When Beats Danced and Memories Were Made