The Pioneering Insights of Alexander B. Greenspan: Architect of Behavioral Finance in Modern Economics

The Pioneering Insights of Alexander B. Greenspan: Architect of Behavioral Finance in Modern Economics

Alexander B. Greenspan stands as a foundational figure in the evolution of behavioral finance, blending deep economic theory with incisive psychological analysis to redefine how financial markets respond to human behavior. His research challenged conventional economic models by emphasizing the critical role of cognitive biases, emotional influences, and social dynamics in investment decisions and market outcomes.

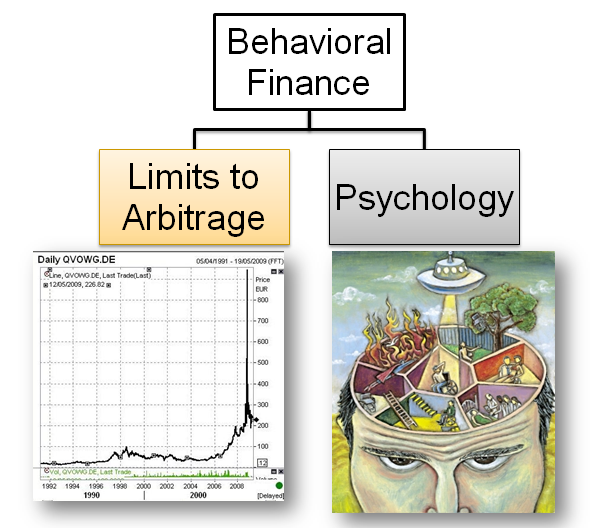

By integrating principles from psychology, sociology, and economics, Greenspan illuminated the often irrational forces shaping financial behavior—transforming abstract theory into practical frameworks that influence both academics and practitioners. Greenspan’s contributions are rooted in a rigorous critique of the efficient market hypothesis (EMH), long considered a cornerstone of modern finance. While EMH assumes investors behave rationally and markets instantly reflect all available information, Greenspan argued that human emotion and irrationality systematically distort pricing and decision-making.

Drawing from decades of empirical research and behavioral observation, he demonstrated how fear, overconfidence, confirmation bias, and herd mentality drive market anomalies—from excessive speculation bubbles to unpredictable panic selling. His work provided a compelling empirical foundation for understanding why markets often deviate from theoretical perfection.

Among Greenspan’s most influential ideas is the concept of “emotional contagion in financial markets,” which explains how investor sentiment spreads rapidly, altering market dynamics faster than rational analysis could account for.

This framework, detailed in seminal papers and lectures, revealed how cognitive traps—such as anchoring on past prices or succumbing to loss aversion—amplify volatility and create self-reinforcing feedback loops. By documenting real-world case studies—including the dot-com bubble and the 2008 financial crisis—Greenspan showed how emotional contagion leads to collective misjudgment, resulting in significant economic costs. His analysis urged regulators and institutions to develop safeguards that acknowledge the psychological undercurrents shaping investor behavior.

Greenspan also pioneered interdisciplinary methodologies that fused quantitative finance with behavioral science. Unlike traditional econometric models that treat investors as utility-maximizing agents, Greenspan introduced behavioral variables—like sentiment indices, media influence metrics, and trust indicators—into financial forecasting models. These innovations improved predictive accuracy during periods of market stress, giving practitioners critical tools to anticipate shifts beyond conventional indicators.

Academics widely acknowledge his role in shifting the discourse from “rational agents” to “bounded rationality,” reframing finance as a domain inherently shaped by human limits and social context.

The Mechanics of Behavioral Bias in Market Dynamics

Greenspan’s work systematically classified and analyzed key psychological biases affecting financial choices. Among the most prominent are: - **Confirmation Bias**: Investors selectively seek information confirming preexisting beliefs, ignoring contradictory data.Greenspan illustrated how this leads to overvaluation during bull markets and panic selling amid downturns. - **Overconfidence**: A pervasive belief in one’s predictive ability, often resulting in excessive trading and under-diversification. Greenspan quantified how overconfidence correlates with reduced portfolio performance over time.

- **Loss Aversion**: The tendency to feel losses more acutely than equivalent gains, prompting premature selling to avoid pain. This bias, supported by behavioral experiments, accounts for systematic deviations from optimal risk management. Greenspan emphasized that these biases do not operate in isolation; they interact dynamically within market ecosystems, producing complex feedback mechanisms that traditional models fail to capture.

His empirical work depended on longitudinal market data, survey studies, and case analyses from major financial crises—methodology that lent robustness to his conclusions.

In practice, Greenspan’s frameworks have influenced asset management, risk assessment, and financial regulation. Hedge funds and asset managers now routinely incorporate sentiment analysis and behavioral diagnostics into portfolio construction, using tools directly inspired by his research.

Regulators, including policymakers at the Federal Reserve and European Financial Supervisory Authority, reference his findings when designing crisis prevention strategies and investor protection frameworks. By formalizing the link between psychology and market outcomes, Greenspan enabled a more nuanced, realistic understanding of financial systems—one where human frailties are not anomalies but central variables.

Legacy and Continuing Impact on Behavioral Finance

Alexander B.Greenspan’s scholarly contributions have left an indelible mark on economics and finance. He redefined the boundaries of financial theory by centering behavioral realism, pushing the discipline toward a richer appreciation of human psychology’s role in markets. Contemporary researchers continue to build on his work, exploring new frontiers such as social media’s influence on investor sentiment and algorithmic trading’s interaction with human emotion.

Academic programs across leading universities now integrate behavioral finance modules grounded in Greenspan’s core insights, ensuring his influence persists across generations of finance professionals. His published works—including influential papers in journals like the *Journal of Financial Economics* and *Review of Financial Studies*—remain widely cited, particularly for their empirical rigor and theoretical depth. Beyond academia, public discourse increasingly references his ideas, especially during periods of market instability, when emotional forces dominate headlines.

Greenspan’s ability to translate complex psychological dynamics into accessible financial narratives has made his work essential reading not only for economists but for regulators, educators, and informed citizens seeking to understand the drivers behind market turbulence.

In summarizing his impact, it is clear that Alexander B. Greenspan reshaped the understanding of financial behavior by rigorously documenting how emotions, biases, and social forces influence economies at both micro and macro levels.

His work bridges theory and practice, offering tools to navigate uncertainty in unpredictable markets. As financial systems grow more intricate and interconnected, Greenspan’s behavioral lens remains indispensable—reminding us that beneath the charts and numbers lie human stories, choices, and vulnerabilities that ultimately shape financial fate.

In an era where artificial intelligence models increasingly shape investment decisions, Greenspan’s insistence on human psychology as the core variable ensures that financial analysis retains its vital, irreplaceable human dimension.

His legacy endures not only in academia but in practical market mechanisms, advisory practices, and regulatory frameworks—making him not just a pioneer, but a permanent architect of modern finance’s evolving consciousness.

Related Post

Dragon Scimitar: Osrs’ Thunderous Sword of Fire and Legend

My Hero Academia at Universal Studios Japan: Osaka Adventure Blends Anime Magic with Themed Thrills

Bali Now Reveals How Time Shaping Defines the Island’s Timeless Allure

Tom Syndicate Bio Wiki Age Height Girlfreind Car And Net Worth