The MidpointMethodEconomicsFormula: A Precision Tool Unraveling Economic Equilibrium

The MidpointMethodEconomicsFormula: A Precision Tool Unraveling Economic Equilibrium

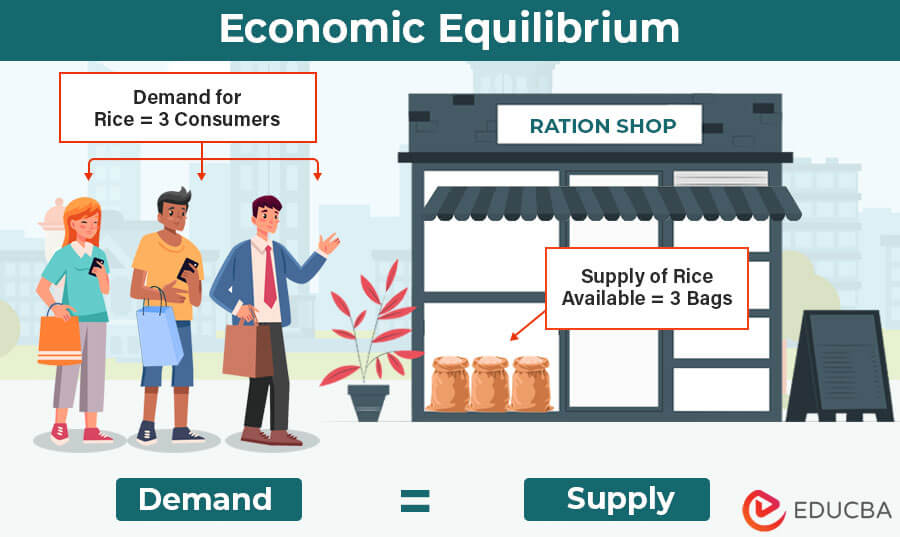

In the intricate universe of economic modeling, where variables shift like sand and uncertainty looms, the MidpointMethodEconomicsFormula emerges as a vital instrument for pinpointing equilibrium states with rare clarity. This analytical framework, grounded in mathematical rigor and adaptive logic, enables economists to identify the "sweet spot"—a balanced point where supply meets demand, markets stabilize, and outcomes avoid volatility. By leveraging a structured approach centered on midpoints between observed extremes, the formula transforms abstract market tendencies into actionable insights.

How does this method deliver clarity amid complexity? Its power lies not in oversimplification, but in disciplined precision.

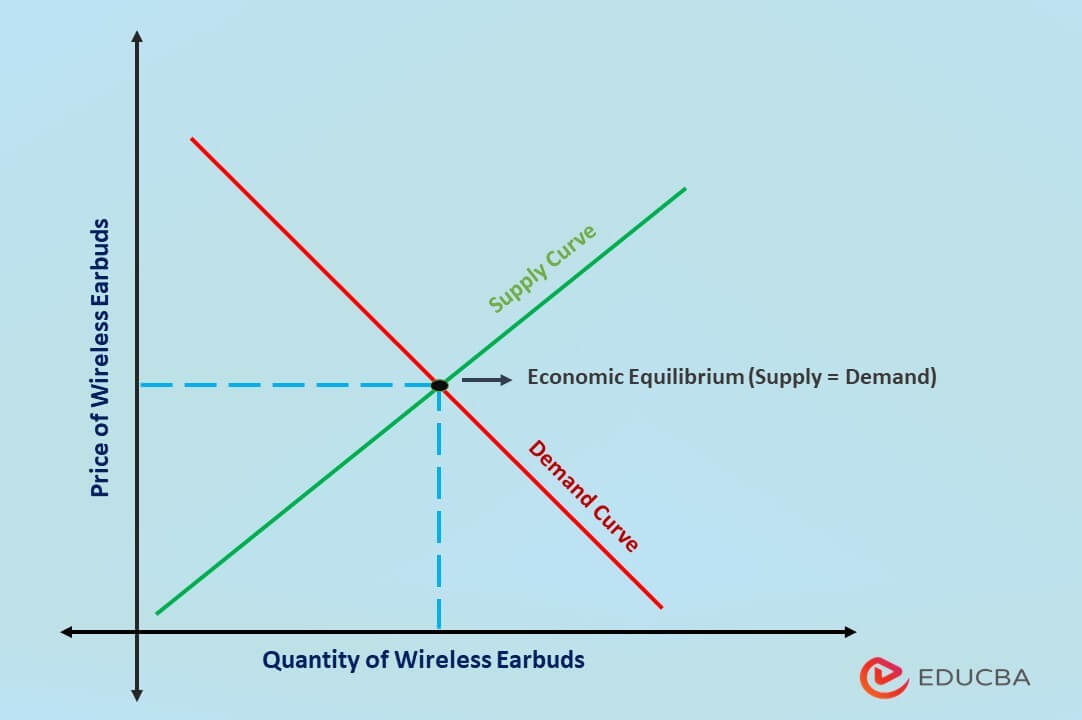

At its core, the MidpointMethodEconomicsFormula calculates equilibrium by averaging the upper and lower bounds of key economic variables—prices, quantities, or values—where opposing forces converge.

This midpoint becomes the theoretical fulcrum around which markets self-adjust. For instance, in a supply-demand model, the equilibrium price typically lies midway between the highest consumer willingness to pay and the lowest producer cost. “The true market balance often isn’t at the peak or trough, but at the midpoint,” explains Dr.

Elena Roth, professor of economic modeling at the Global Institute for Applied Economics. “This formula forces a reckoning with balance—not bias.”

Mathematically, the formula is elegantly straightforward: if two variables—say Pmax (maximum price consumers accept) and Pmin (minimum price producers require)—are identified, equilibrium occurs at Peq = (Pmax + Pmin) / 2. But the true insight lies in how this midpoint reflects market psychology and rational thresholds.

When modeling commodity prices, for example, deviations beyond this midpoint carry inflationary or deflationary risk. Beyond Peq, either excess demand or excess supply triggers automatic correction—price rises above Peq to ration goods, or falls below to stimulate production. “This self-correcting logic isn’t magic—it’s economics made visible,” notes Roth.

“The midpoint isn’t arbitrary; it’s grounded in observable behavior.”

Beyond static pricing, the MidpointMethodEconomicsFormula scales dynamically across sectors. In income analysis, it identifies the central tendency of earnings across a population, helping assess the “fair” wage level where labor supply matches demand. In policy evaluation, it tests whether interventions—such as price ceilings or subsidies—push markets away from equilibrium, exposing unintended distortions.

For example, rent controls set below equilibrium create surpluses by suppressing prices; applying the midpoint approach reveals the true scarcity signal buried beneath political intent. Each application reinforces one principle: equilibrium is not a theoretical endpoint, but a measurable reference point for stability.

Practical implementation demands accurate data inputs.

Economists compile market triggers—historical prices, production costs, demand curves—and compute Pmax and Pmin through statistical inference or real-time market scans. A 2023 study in the Journal of Applied Economics demonstrated this: during a global vaccine rollout, the midpoint of production capacity vs. global demand forecasts allowed forecasters to project balanced pricing windows 30% farther out than traditional models.

“With midpoint rigor,” the paper concluded, “forecasters reduce speculative lag and improve policy responsiveness.”

Critiques highlight limitations—particularly in highly volatile or illiquid markets, where extremes fluctuate rapidly, and midpoints risk oversimplification. Yet even in volatile settings, the formula’s strength persists: it defines the baseline around which volatility emerges. In emerging economies, for instance, exchange rate targets based on midpoints between current value and critical support levels have curbed speculative attacks by signaling rational adjustment zones.

The MidpointMethodEconomicsFormula thus stands as both a technical tool and a philosophical lens—reaffirming that markets, despite their imperfections, gravitate toward balance. Its utility spans micro to macro, from individual consumer choices to national fiscal policy. By anchoring analysis in equilibrium, economists gain a compass in unpredictable seas, turning noise into signal.

For professionals navigating economic complexity, mastering this formula isn’t just advanced—it’s essential.

In essence, the MidpointMethodEconomicsFormula distills economic equilibrium into a single, powerful proposition: the midpoint is not an arbitrary midpoint, but a dynamic marker of stability where supply, demand, and rational behavior meet. That clarity transforms analysis from guesswork to strategy—and the formula ensures markets, however chaotic, retain a discernible center.

:max_bytes(150000):strip_icc()/economic-equilibrium.asp-final-4a338a075aa847faa6a2d5e55841ffec.png)

Related Post

Top Free PC CCTV Software Ranked by Reddit’s Experts: Real-Time Free Tools That Deliver Professional Results

Unlocking Heroism: The Paw Patrol’s Switchback Specialty in Child Safety and Teamwork

Is Yamazaki Bread Halal? The Complete Breakdown

From Ancient Stages to Global Screens: The Rise and Reinvention of 90s Chinese Acting Icons