The Engine of the Peninsula: Saudi Arabia’s GDP and Economic Transformation

The Engine of the Peninsula: Saudi Arabia’s GDP and Economic Transformation

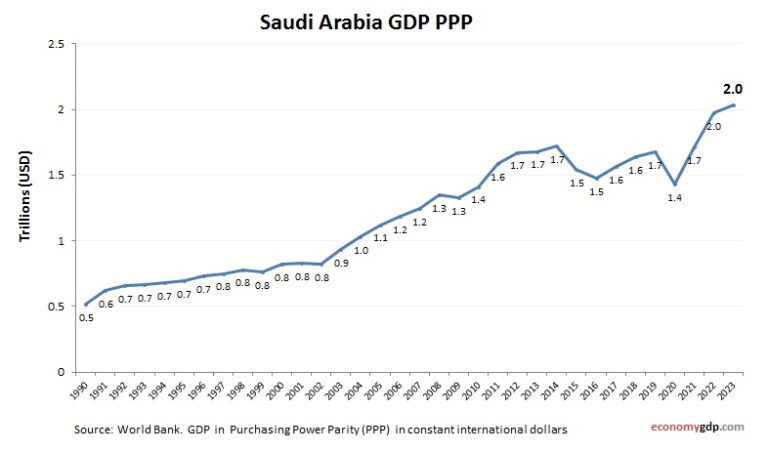

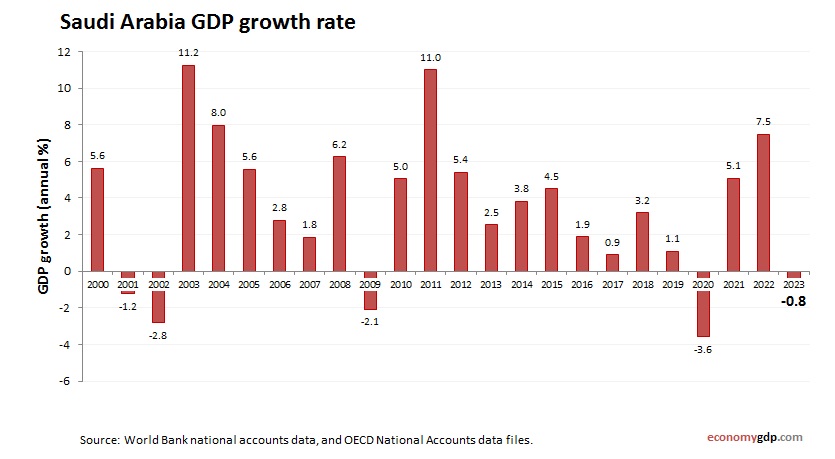

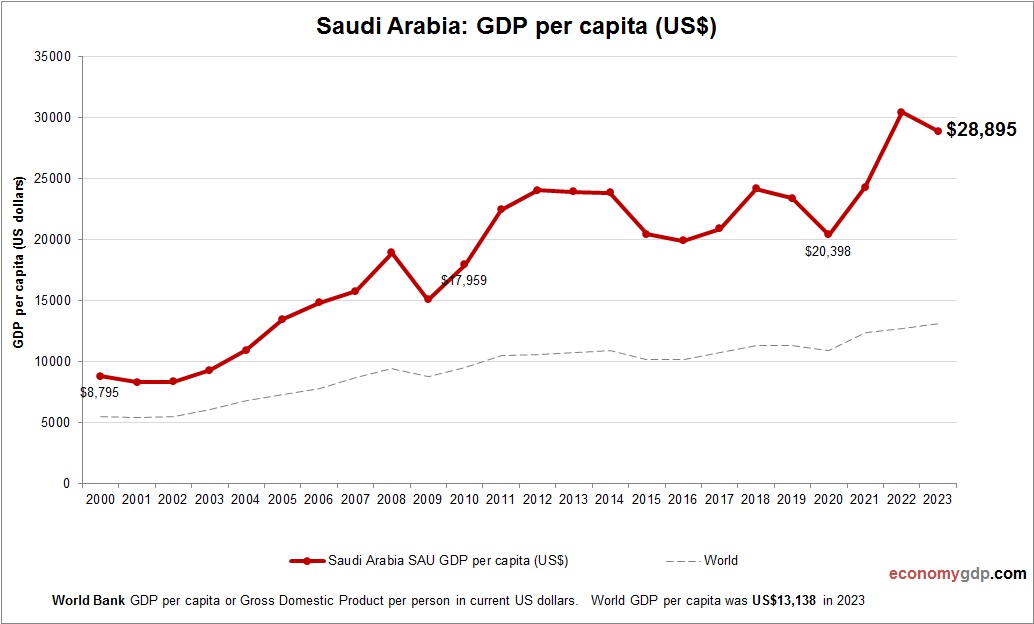

With a GDP exceeding $1.1 trillion in 2023, Saudi Arabia stands as the largest economy in the Middle East and a pivotal player in the global energy landscape. Long dependent on oil, the country is rapidly reshaping its economic foundations through Vision 2030—a sweeping reform agenda aimed at diversification, innovation, and sustainable growth. The nation’s GDP figures reflect not just raw economic output, but a calculated shift toward reducing hydrocarbon reliance and building a knowledge-based, globally integrated economy.

Saudi Arabia’s nominal GDP places it among the top 20 global economies, yet this metric only partially captures the country’s strategic pivot. Cut through the oil-linkage to reveal deeper trends: the non-oil sector now contributes over 40% of GDP, demonstrating tangible progress in building a multi-sectoral economic structure. In 2023, non-oil output reached approximately $470 billion, up from just $230 billion a decade earlier.

This transition underscores the government’s deliberate push to unlock the potential of manufacturing, tourism, technology, and renewable energy.

The scale of Saudi Arabia’s economic ambitions is evident in its sectoral breakdown. Oil and gas remain foundational—accounting for roughly 40% of government revenue and around 25% of GDP—but their share of total economic output has declined steadily since the mid-2000s.

In contrast, sectors like construction, retail, finance, and digital services have surged. The construction boom, driven by mega-projects such as NEOM, The Red Sea Global developments, and expansions of Riyadh and Jeddah’s urban infrastructure, contributed nearly 12% to annual GDP growth in 2022–2023. Meanwhile, the financial sector, bolstered by banking reforms and capital market liberalization, now represents over 15% of GDP, highlighting the success of financial sector diversification efforts.

Technological advancement and private sector empowerment lie at the heart of Saudi Arabia’s growth strategy.

Vision 2030 prioritizes public-private partnerships and foreign direct investment, aiming to increase non-oil GDP by 50% over the next decade. The privatization and partial listing of state-owned giants—most notably Saudi Aramco’s partial public float in 2019, which raised $25.6 billion— signaled a new era of market openness. Additionally, NEOM, a $500 billion futuristic smart city, is designed to attract global talent and anchor industries such as AI, advanced manufacturing, and green hydrogen.

Early milestones include partnerships with IBM, Siemens, and Lucid Motors, reinforcing Saudi Arabia’s bid to become a regional tech and innovation hub.

A critical pillar underpinning economic resilience is human capital development. With over 36 million citizens, Saudi Arabia has invested aggressively in education and workforce training to align domestic talent with emerging industries. The National Transformation Program estimates that youth unemployment has fluctuated around 18% but is trending downward through targeted vocational programs and incentives for Saudization—mandating increased local employment in key sectors.

Women’s labor force participation, rising from 17% in 2016 to over 35% in 2023, has bolstered GDP growth and diversified economic participation. This social progress complements macroeconomic reforms, creating a feedback loop between inclusion and expansion.

Energy transition is increasingly central to Saudi Arabia’s long-term GDP trajectory. While oil and gas still dominate exports and government budgets, the Kingdom is positioning itself as a leader in clean energy and carbon management

Related Post

Is Brian Quinn In A Relationship? Unpacking the Personal Life of the Stand-Up Star

Unlocking Digital Success: How Channel NMR’s Campaign Reports Shape Today’s Traffic Strategies

QPark Age Bio Wiki Height Net Worth Relationship 2023

-1.jpg)

Toyota Kijang Innova 2005: Your Ultimate Guide Before Buying – Know Before You Commit