Texas Oag Child Support: The System That Shapes Family Responsibilities Across the Lone Star State

Texas Oag Child Support: The System That Shapes Family Responsibilities Across the Lone Star State

Managing child support in Texas is a cornerstone of family law, balancing financial accountability with the goal of safeguarding children’s well-being. At the heart of this system lies the Texas OFFICIAL Accounting of Government child support (Oag Child Support), a critical mechanism that ensures contrasts are accurately calculated, enforced, and adjusted over time. Managed by the Texas Department of Family and Protective Services (DFPS), Oag Child Support serves not merely as a collection tool but as a dynamic framework designed to adapt to changing family circumstances, income fluctuations, and custody arrangements.

Its design reflects a deep commitment to fairness and long-term stability, even amid life’s most unpredictable shifts. Understanding the Oag System: More Than Just a Payment Tracker Texas Oag Child Support is formally known as the Official Accounting system under Offical Accounting Government (Oag), a specialized unit within DFPS tasked with calculating, monitoring, and verifying child support obligations. Far from a static database, Oag functions as a comprehensive tracking ecosystem that links income verification, custody modifications, and payment history into a single, enforceable record.

This holistic view ensures that child support determinations reflect current realities, preventing systemic inequities that could arise from outdated data or incomplete information. Key components of the Oag system include: - Automatic income reporting by paying parents through electronic filing, reducing uncertainty. - Real-time updates when custody or employment conditions change, triggering recalculations.

- Integration with state databases and local enforcement offices to halt earning capacity if necessary. “Oag isn’t just about collecting payments—it’s about ensuring every dollar supports a child’s future,” says a DFPS child support specialist who works directly with the system daily. Each monthly calculation under Oag compares actual income to the fair share determined under Texas law—typically 20% of the non-custodial parent’s disposable income, adjusted for custodial time and support owed to other children.

This precision matters: incorrect calculations can distort family economies and strain fragile post-separation relationships. How Texas Oag Works: The Mechanics Behind Every Payment The Oag system operates through a seamless cycle of data input, validation, and enforcement. When a parent registers or updates records—such as a job change, relocation, or new custody agreement—the system immediately flags necessary adjustments.

For instance, if a payor’s income rises, Oag may increase the required support amount; if income drops due to unemployment, assistance programs like temporary waivers or modified schedules protect families from hardship.

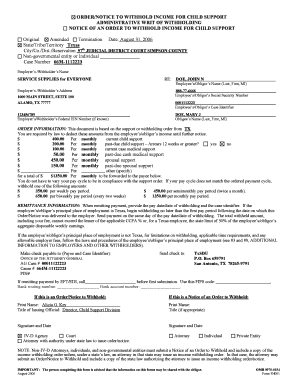

- Initiation: Parents submit or verify income reports via the DFPS online portal or through county clerks.

- Validation: Oag cross-checks submitted data against payroll records and tax filings to confirm accuracy.

- Calculation: Using TX Department of Taxation guidelines, Oag computes the legally mandated support amount, factoring in custody time and any shared parenting expenses.

- Notification and Enforcement: Paid orders are electronically updated, and non-compliance triggers alerts, wage garnishments, or driver’s license holds.

- Modification: Custody or income changes prompt automatic reevaluation, ensuring dynamic responsiveness.

Meanwhile, relocations—whether domestic or international—require formal notifications, so the system evaluates the impact on support obligations under presumptive guidelines. Real Stories: The Human Impact of Oag Child Support Consider the case of Maria Lopez, a Dallas resident whose custody battle began with high tensions but shifted toward stability thanks to Oag’s responsiveness. When her ex-husband’s unexpected promotion increased his income mid-case, Oag recalculated support within days, shielding Maria’s family from sudden financial shocks.

Conversely, after losing her job in 2023, the system flagged reduced earnings and triggered a temporary payment adjustment, placing undue stress on a parent already navigating grief and custody changes. Such scenarios underscore Oag’s dual role: balancing strict accountability with compassionate realism. Local advocates stress that transparency in Oag’s process builds public trust.

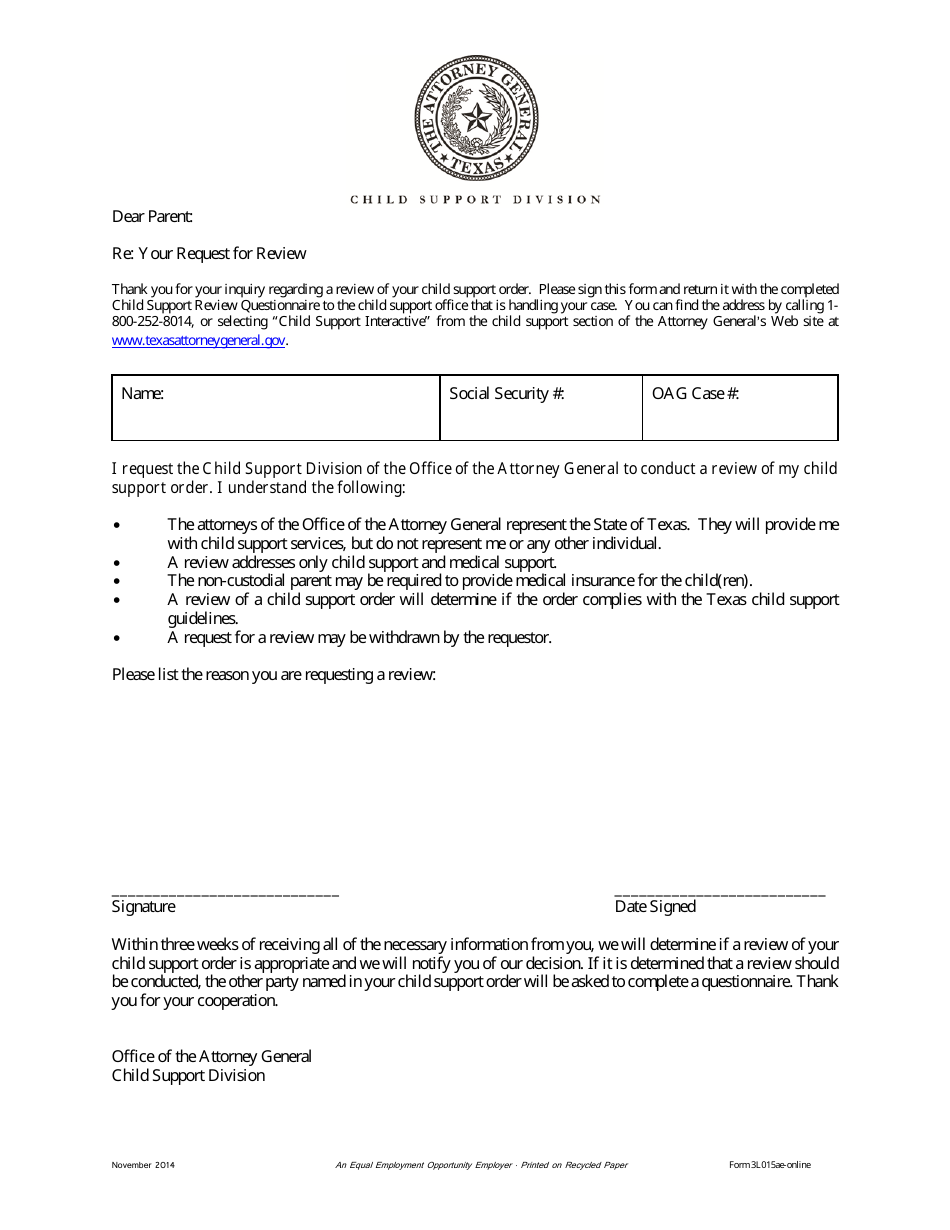

“Families need to see the system as fair and accessible,” observes Javier Morales, a child welfare advocate in Houston. “Transparency in how support is calculated—and how changes are processed—makes compliance easier and legal conflicts rarer.” Challenges and Ongoing Reforms in Oag Administration Despite its strengths, Texas Oag Child Support faces persistent challenges. Underreporting income remains an issue, with some parents underreporting earnings to reduce obligations—prompting DFPS to strengthen verification protocols.

Delays in status updates between state and local agencies occasionally hinder enforcement speed. Moreover, navigating the system can overwhelm low-income families unfamiliar with legal jargon, despite Oag’s commitment to user-friendly online tools. Recent reforms aim to address these gaps.

In 2024, DFPS expanded automatic income reporting via payroll data integration with major employers, cutting underreporting by an estimated 30%. Pilot programs in Austin and San Antonio introduced ‘Oag Navigators’—dedicated staff guiding parents through intake, paperwork, and modification requests. These efforts reflect a growing recognition that effective child support depends not just on technology, but on accessible, empathetic support.

What Families Should Know When Engaging with Oag Child Support For those interacting with Texas Oag Child Support, proactive steps ensure smoother outcomes: - Maintain accurate, up-to-date income records and submit changes promptly. - Use the official DFPS online portal or authorized county clerks to file or update payments. - When facing financial hardship, initiate formal modification requests well before deadlines—waiting risks penalties.

- Request a receipt or case number for every payment to verify receipt and track status. - Understand that custody adjustments trigger automatic recalculations; formal requests may still be needed. “Open communication with Oag specialists saves time and reduces frustration,” advises Laura White, a legal aid counselor in Fort Worth.

Families who stay informed and engaged benefit from faster resolution and fewer compliance errors. The Broader Role of Oag in Strengthening Texas Families Texas Oag Child Support exemplifies how data-driven policy can uphold family responsibility without sacrificing equity. By embedding flexibility into enforcement, validating data rigorously, and adapting to real-world changes, Oag ensures child support serves its ultimate purpose: sustaining children’s stability across shifting family landscapes.

It reflects a state-wide commitment to ensuring that market earnings translate into meaningful care—not abstract payments siphoned away by uncertainty. In an era where family structures grow more complex, Oag remains a vital institutional anchor. It proves that even the most technical systems can carry profound human meaning when built on accuracy, adaptability, and a shared dedication to children’s futures.

Taxi Oag Child Support is more than a government workflow—it is a living mechanism designed to balance legal rigor with life’s inevitable changes, ensuring every parent’s obligation aligns with their current capacity, and every child’s needs remain central.

Related Post

Suck My Dick In Spanish: Decoding a Taboo Phrase Without Shame

403 Forbidden Error on Your Phone: When Your App Can’t Access the Internet—Even When It Seems Connected

Reba The Cast: Revisiting the Enduring Legacy of a Sitcom Powerhouse

Blue Mountain State Season One: Where Humor Meets Tradition in College Combat