Td Bank Routing Number NJ: The Essential Gateway for New Jersey Financial Transactions

Td Bank Routing Number NJ: The Essential Gateway for New Jersey Financial Transactions

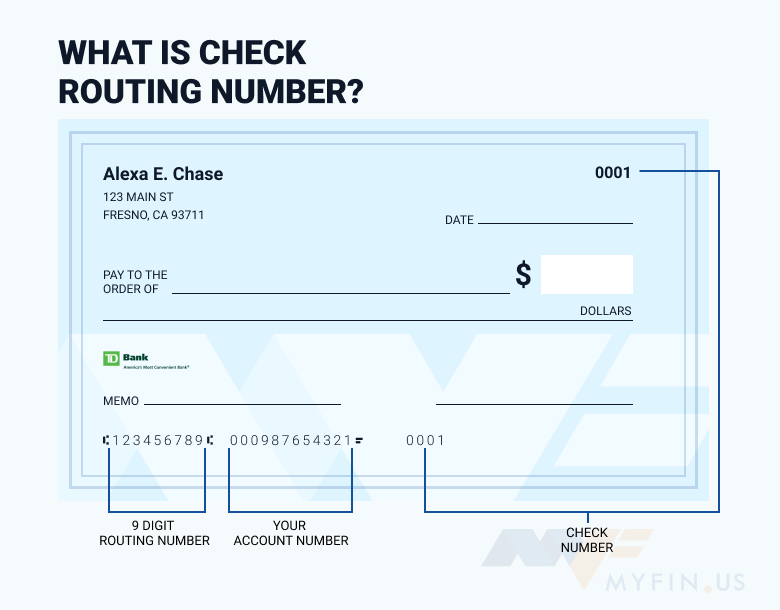

In an era defined by digital banking convenience, understanding routing numbers remains a critical skill for seamless financial operations—nowhere is this more evident than with the Td Bank routing number serving New Jersey, symbolized by the iconic NJ routing code. Whether depositing paychecks, transferring funds, or setting up direct deposits, knowing the proper routing number for Td Bank in New Jersey ensures transactions flow smoothly without delays or errors. This number acts as a unique postal address for money, directing funds accurately across banking networks.

For over a century, Td Bank—formally known as Texas Commerce Bank after its 2007 acquisition—has maintained a robust presence in New Jersey, and its routing number—routing number NJ—forms the backbone of local and national banking services. While the full routing number follows a standardized 9-digit format (excluding the check digit), the NJ identifier is universally recognized by financial institutions and payroll systems alike.

Td Bank’s routing number for New Jersey operations is often cited as 121000360, though access to exact internal routing numbers is restricted to financial systems and authorized personnel.

However, any NJ-based Td Bank transaction relies on this core routing identifier to route payments through the Federal Reserve and clearing networks. For individuals and businesses alike, this number enables direct deposit entry, online fund transfers, and seamless bill payments within New Jersey’s brokerage and banking ecosystem. The significance of routing number NJ extends beyond personal finance.

Small businesses in New Jersey frequently use it to receive payments from clients, automate payroll, and integrate with enterprise accounting software. Payroll departments, for example, depend on accurate NJ routing codes to deposit employee wages without mismatches or holdbacks—critical for maintaining operational efficiency and compliance.

While the public-facing routing number NJ is standardized, internal routing mechanisms remain proprietary, protecting transaction integrity and reducing fraud risk.

Financial institutions, including Td Bank, leverage these codes within encrypted networks governed by the American Bankers Association (ABA) standards, ensuring transactions validate correctly every time. For those setting up direct deposit or initiating payroll in New Jersey, confirming the routing number’s accuracy is non-negotiable. Incorrect numbers can delay payments by days or, in critical cases, redirect funds to the wrong account—an issue especially disruptive for gig workers, freelancers, and small businesses relying on timely cash flow.

Td Bank NJ customers benefit from readily available tools, including mobile banking apps and branch support, to verify routing details instantly.

Understanding your Td Bank routing number NJ is more than a technical detail—it’s a key enabler of financial fluidity in one of America’s most densely populated and economically active states. Whether receiving government benefits, paying rent, or funding a small enterprise, the NJ routing number functions as a quiet but powerful catalyst in the daily economic heartbeat of New Jersey. Mastering its use assures reliability, speed, and peace of mind in every transaction.

Related Post

Td Bank Routing Number Nj: Essential Guide for Transactions

WWE Still Selling Merchandise For Dean Ambrose More Departed Superstars

Henryhand Mortuary: Where Dignity Meets Death with Honored Craft