Stock Definition: The Essential Guide to Understanding Investments in Modern Finance

Stock Definition: The Essential Guide to Understanding Investments in Modern Finance

Investments shape the foundation of modern wealth—yet few concepts remain as pivotal and frequently misunderstood as stocks. Defined simply as shares representing ownership in a corporation, stocks serve as both financial instruments and windows into the vitality and growth potential of businesses. In the framework of *Stock Definition: A Simple Guide to Finance*, understanding stocks means recognizing their dual role: as tools for long-term capital appreciation and as sources of income through dividends and market appreciation.

This article unpacks the core mechanics of stocks, explores their strategic importance, and clarifies how they fit into comprehensive personal finance planning.

At its essence, a stock is a tradable equity ownership stake in a company. When investors purchase shares, they become part-owners, entitling them to a proportional claim on the company’s assets and earnings.

“Stocks represent woodwork in a financial house—some platforms support structure, while others drive value,” notes financial expert Sarah Chen. This metaphor highlights how not all stocks function equally: growth stocks expand company value over time, while value stocks may trade at a discount but promise future returns. The core definition remains consistent: shares grant rights to voting, dividends, and potential price appreciation, forming the backbone of equity markets globally.

What Exactly Do Stocks Represent? Stocks are more than pieces of paper—or digital entries in a ledger. They embody a claim on future economic benefits tied to a company’s performance. Key features include: - **Ownership stakes**: Shareholders participate in corporate decisions through voting rights.

- **Profit sharing**: Eligible stocks pay dividends, distributing a portion of profits. - **Liquidity**: Most publicly traded stocks can be bought or sold on exchanges, enabling easy access to capital. - **Risk and reward**: Stocks reflect company success—performance drives price fluctuations and income potential.

This multi-faceted nature makes stocks versatile tools for investors seeking both income and growth.

The Types of Stocks: Common, Preferred, and Specialized Variants Investors encounter multiple stock classifications, each with distinct characteristics and investor appeal. Understanding these distinctions is vital for crafting a balanced portfolio.

- Common shares grant voting rights and standard dividends but are the most widely traded. - Preferred shares often come with fixed dividends and higher claim priority over common stock in liquidation, appealing to income-focused investors. - Growth stocks prioritize reinvestment over dividends, driving aggressive expansion and capital gains.

- Value stocks are undervalued by the market, promising future appreciation as pricing corrects. - Blue-chip stocks come from industry-leading, financially stable firms with consistent earnings and low volatility. - Microcap and small-cap stocks represent smaller, high-risk opportunities with higher growth potential.

These categories guide strategic investment decisions, helping investors align stock choices with financial goals, risk tolerance, and time horizons.

How Stocks Influence Personal Finance Stocks play an indispensable role in building and preserving wealth, offering avenues beyond static savings accounts. Historically, equities have outperformed traditional fixed-income instruments over long timeframes, making them a cornerstone of retirement planning.

The power of compounding—earning returns on both principal and accumulated gains—makes stock investments particularly compelling. For example, a $10,000 investment in a diversified stock portfolio averaging 7% annual returns can surpass $150,000 in 35 years, illustrating the magic of long-term ownership. Entrepreneurs often bypass venture capital to raise capital through stock issuance, enabling scaling without debt.

Meanwhile, everyday investors access market exposure via ETFs, mutual funds, or individual stocks, democratizing wealth creation. Even in downturns, historical data shows equities recover and grow, underscoring their resilience over cycles.

The Mechanics of Stock Ownership Owning stock involves more than just purchase.

Transactions occur through brokerage accounts—digital platforms connecting investors to exchanges like NASDAQ or NYSE. Stock prices fluctuate based on supply and demand, news events, earnings reports, and macroeconomic factors. Investors track key metrics: - Price movement reflects market sentiment and corporate performance.

- Earnings reports reveal profitability and guide buy/sell decisions. - Dividend yield indicates income generation, important for retirees sequencing returns. - P/E ratio helps assess valuation relative to earnings.

“Passive buying without understanding price drivers is speculation; smart investing requires analysis,” emphasizes finance educator Raj Patel. Knowing these mechanics enables proactive portfolio management rather than reacting to noise.

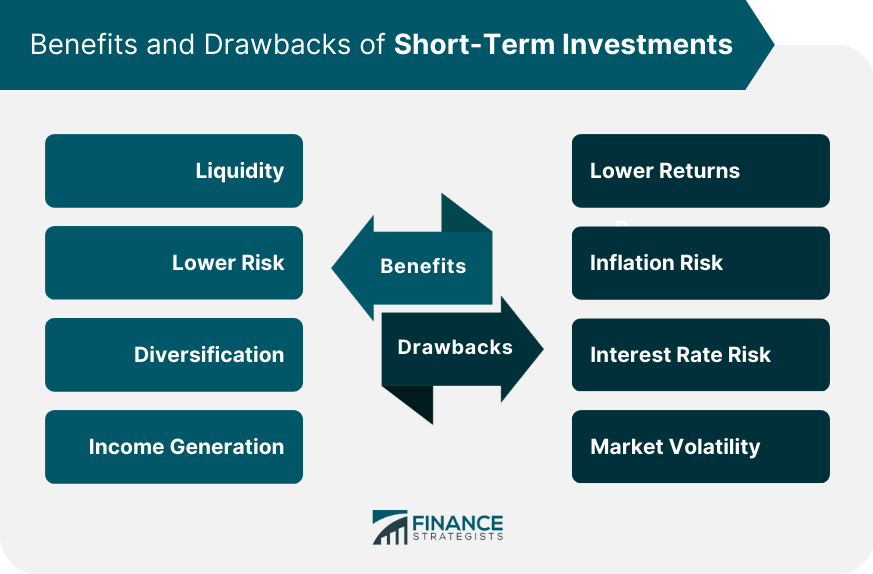

Risks and Mitigation Strategies No investment is without risk, and stocks are no exception.

Volatility—price swings tied to earnings misses or economic shifts—can test investor discipline. Market corrections, such as the 2008 crisis or 2020 pandemic plunge, test patience, while company-specific risks like poor leadership or declining demand threaten individual stocks. Diversification remains the primary defense.

Spreading investments across sectors, geographies, and asset classes reduces unsystematic risk. Time horizon also matters: longer periods allow storms to pass, smoothing volatility. Investors might pair high-growth stocks with stable dividend payers to balance llamidas.

Regular portfolio reviews and rebalancing prevent overexposure, while stop-loss orders limit downside. Education—understanding fundamentals over hype—fortifies resilience.

Stocks in Modern Financial Ecosystems The rise of digital platforms and robo-advisors has transformed stock access.

Commission-free trading, real-time data, and educational tools empower novice investors. ESG (Environmental, Social, Governance) investing reflects evolving priorities, letting shareholders support sustainable firms. Blockchain and tokenization hint at future shifts, though regulation shapes adoption.

Meanwhile, global markets connect seamlessly, enabling cross-border diversification but introducing currency and policy risks. Through *Stock Definition: A Simple Guide to Finance*, investors gain clarity on how stocks operate as vital finance instruments—not just assets, but engines of economic participation. They blend ownership rights with growth potential, demanding both understanding and discipline.

Stocks remain central to personal and institutional wealth strategies. Whether building a nest egg, funding education, or preserving purchasing power, their role is indisputable. Success hinges on aligning stock choices with goals, mastering core mechanics, and maintaining patient, informed discipline.

In an evolving financial landscape, knowledge transforms stock ownership from gambling into strategic empowerment—proving that understanding stocks isn’t just smart, it’s essential.

:max_bytes(150000):strip_icc()/investing.asp-final-9cbfccbd50344a828ddf1882a2fdc07c.png)

Related Post

Important Report: Analysis of Kelly Cobiella's Journey

Terry Bradshaw Show Bio Wiki Age Spouse Daughters and Net Worth

Centauromachy On The Parthenon: A Deep Dive Into Greek Art’s Defining Clash of Order and Order

Speculating The Imminent Discharge Date: Examining The Timeline For Charlie Tan's Parole