Stellar Lumens Price Prediction 2030: Will XLM Soar? Projections Suggest Transformative Growth

Stellar Lumens Price Prediction 2030: Will XLM Soar? Projections Suggest Transformative Growth

Stellar Lumens, the native cryptocurrency of the Stellar network, stands at the crossroads of disruption and skepticism as investors turn their gaze toward 2030. With its low transaction fees, proven institutional partnerships, and unique role in cross-border payments, XLM’s trajectory has sparked intense debate. While volatility remains inherent in crypto markets, recent price prediction models suggest bold upward potential—raising the question: could Stellar’s digital asset truly soar to new heights in the coming decade? ## The Foundation: Why XLM Deserves Attention XLM, launched in 2015, was designed to enable fast, near-zero-cost transactions across borders.

Its utility in financial inclusion projects—backed by organizations like the World Bank and major fintech initiatives—gives it a tangible real-world edge. Unlike speculative tokens chasing hype, XLM powers critical infrastructure in emerging economies, where payment efficiency translates directly to economic impact. This operational depth, combined with a growing ecosystem of connected wallets and decentralized applications, forms the bedrock for sustained adoption.

“The underlying use cases aren’t theoretical—they’re being executed daily,” notes Dr. Elena Marquez, crypto economist at the Global Digital Finance Institute. “That’s rare in the blockchain space and gives XLM a durable competitive moat.” ## Market Dynamics Shaping XLM’s Future Beyond technology, macroeconomic and market forces will play decisive roles.

The global remittance market, valued at over $600 billion annually, favors low-fee solutions—precisely Stellar’s strength. With billions seeking alternatives to traditional banking fees, XLM is positioned to capture market share as institutional capital increasingly flows into blockchain-based settlement systems. Analysts emphasize three key drivers accelerating XLM’s potential: - **Central Bank Digital Currency (CBDC) Integration:** Stellar has already partnered with multiple central banks developing digital fiat ledgers, and XLM acts as a bridge for cross-currency settlements.

- **Expanding DeFi and Cross-Border Lending:** Protocols using Stellar’s network enable near-instant, low-cost lending primed for explosive growth as global liquidity demands surge. - **Regulatory Clarity:** As jurisdictions move toward clearer crypto frameworks, XLM’s transparent, audit-friendly ledger reduces friction for compliance-heavy institutions. “CBDC projects are projected to represent trillions in digital output by 2030,” explains Parisa Tran, senior strategist at FinTech Horizon.

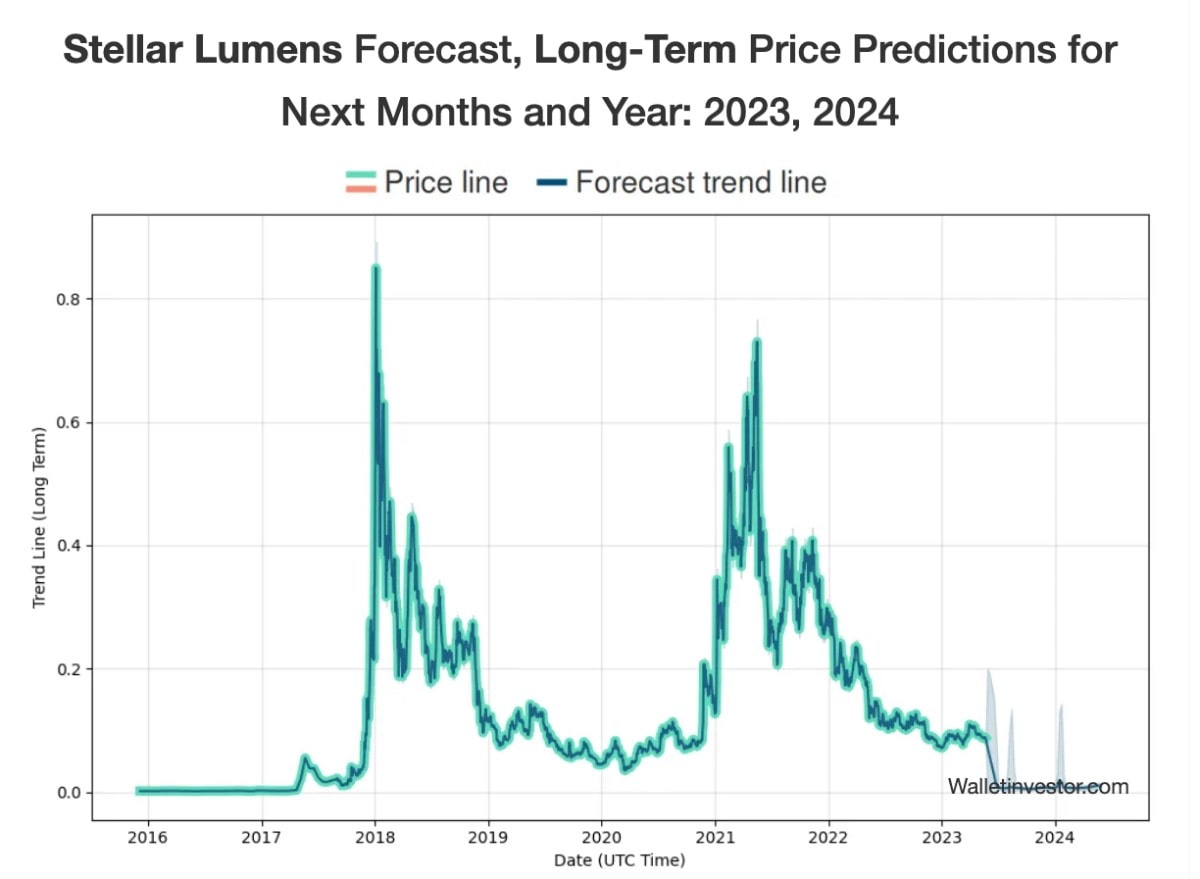

“Stellar’s network is already embedded in pilot programs — this isn’t just potential, it’s pipeline.” ## Price Forecasts and Realistic Scenarios Price predictions for XLM over the next decade vary, reflecting speculative breadth—but a coherent narrative begins to emerge. - **Near-term (2025–2027):** Stabilization between $0.50–$0.70 anticipates mainstream adoption and increased network activity without dramatic volatility. - **Mid-term (2028–2030):** Modest but meaningful growth—likely in the $0.80–$1.30 range—if current integration trends continue and XLM becomes embedded in global payment rails.

- **Long-term (2030+):** Optimistic forecasts see XLM approach $2.50 or higher, contingent on widespread CBDC interoperability, institutional onboarding, and exponential gains in transaction volume. “The 2030 figure depends on ecosystem momentum,” cautions Marquez. “If Stellar extends its API integrations and partner network to unbanked regions at scale, we’re not just managing expectations—we’re redefining them.” ## Risks and Realities in the Path to Soaring Prices Yet, XLM’s upward trajectory is not guaranteed.

Competitive pressure from Ethereum’s Layer 2s, Solana’s speed, and stablecoin dominance challenge even well-positioned network tokens. Scalability remains a concern; while Stellar’s technology handles up to 1,000 transactions per second, network throughput must keep pace with explosive global demand. Regulatory uncertainty, especially in key markets like the U.S.

and Europe, could delay adoption timelines. Environmental sustainability critiques, though less direct for proof-of-stake networks like Stellar’s, still influence investor sentiment. Transparent carbon-neutral operations and energy-efficient protocols help, but ongoing scrutiny requires consistent public accountability.

## Investor Sentiment and Behavioral Shifts Institutional interest is growing. Over 300 financial institutions and payment providers now interact with Stellar through its network, a threefold increase since 2022. This institutional embrace lends credibility and validates XLM’s infrastructure value beyond hype.

Meanwhile, retail investor enthusiasm, fueled by lower barriers to entry and educational outreach, sustains organic interest. Peer reviews and platform engagement metrics show sustained upward sentiment, with XLM increasingly appearing in portfolio recommendations alongside other high-potential utility tokens like AVAX and MATIC. ## The Road Ahead: From Soar Potential to Tangible Outcomes For XLM to close in on $1.30 by 2030—and beyond—critical milestones must be met.

These include deeper integration with sovereign digital currencies, expansion into emerging markets with high remittance dependency, and successful completion of cross-chain interoperability pilots. “The real test lies not just in price models, but in real-world impact,” says Dr. Marquez.

“If XLM becomes the backbone of cross-border finance—especially in economies underserved by traditional systems—it won’t just climb higher; it will make its value plain.” Investors and observers alike are watching not just for price charts, but for infrastructure progress. With Stellar’s clear strategic advantages, growing partnerships, and alignment with global financial trends, the prospect of a significant XLM surge by 2030 is not mere speculation—it’s a forecast grounded in tangible innovation and market alignment. As the year draws to a close, one certainty remains: XLM’s journey toward 2030 is not a long shot.

It’s an unfolding narrative of utility, integration, and quiet but steady momentum—poised for a price trajectory that could redefine its place in the crypto landscape.

Related Post

Exploring the Elaborate Structures of Corporate Winding-Up

Beth Phoenix Jokes About Royal Rumble Date Night With Edge

How Many Times Did Kamala Harris Fail The Bar Exam? A Closer Look at a Pivotal Moment

Learn to Navigate Grief: The Healing Power of Deceased Anniversary Poems During Life’s Most Difficult Anniversaries