SpaceX Stock Price Forecast: 2025 Awaits Record Growth Amid Ambitious Mars Ambitions

SpaceX Stock Price Forecast: 2025 Awaits Record Growth Amid Ambitious Mars Ambitions

SpaceX, the pioneering aerospace endeavor helmed by Elon Musk, continues to redefine commercial spaceflight—and its stock price trajectory is under intense scrutiny as 2025 draws near. With a combination of breakthrough launch systems, expanding satellite internet markets, and aggressive Martian colonization plans, analysts and investors are dissecting what the future holds for SpaceX’s public valuation. While volatile and speculative, the near-term forecast reflects growing confidence in the company’s execution, technological edge, and long-term scalability.

At the core of SpaceX’s stock price outlook in 2025 lies a confluence of triumphant milestones and strategic expansions. Founded in 2002, SpaceX has evolved from a risky startup into the world’s leading launch provider, dominating the global satellite deployment and commercial crew markets. Its reusable Falcon 9 rockets have drastically reduced launch costs, enabling consistent revenue streams and attracting major defense and commercial clients.

This operational consistency has laid a solid foundation for investor optimism.

The Catalysts Driving SpaceX’s 2025 Valuation Outlook

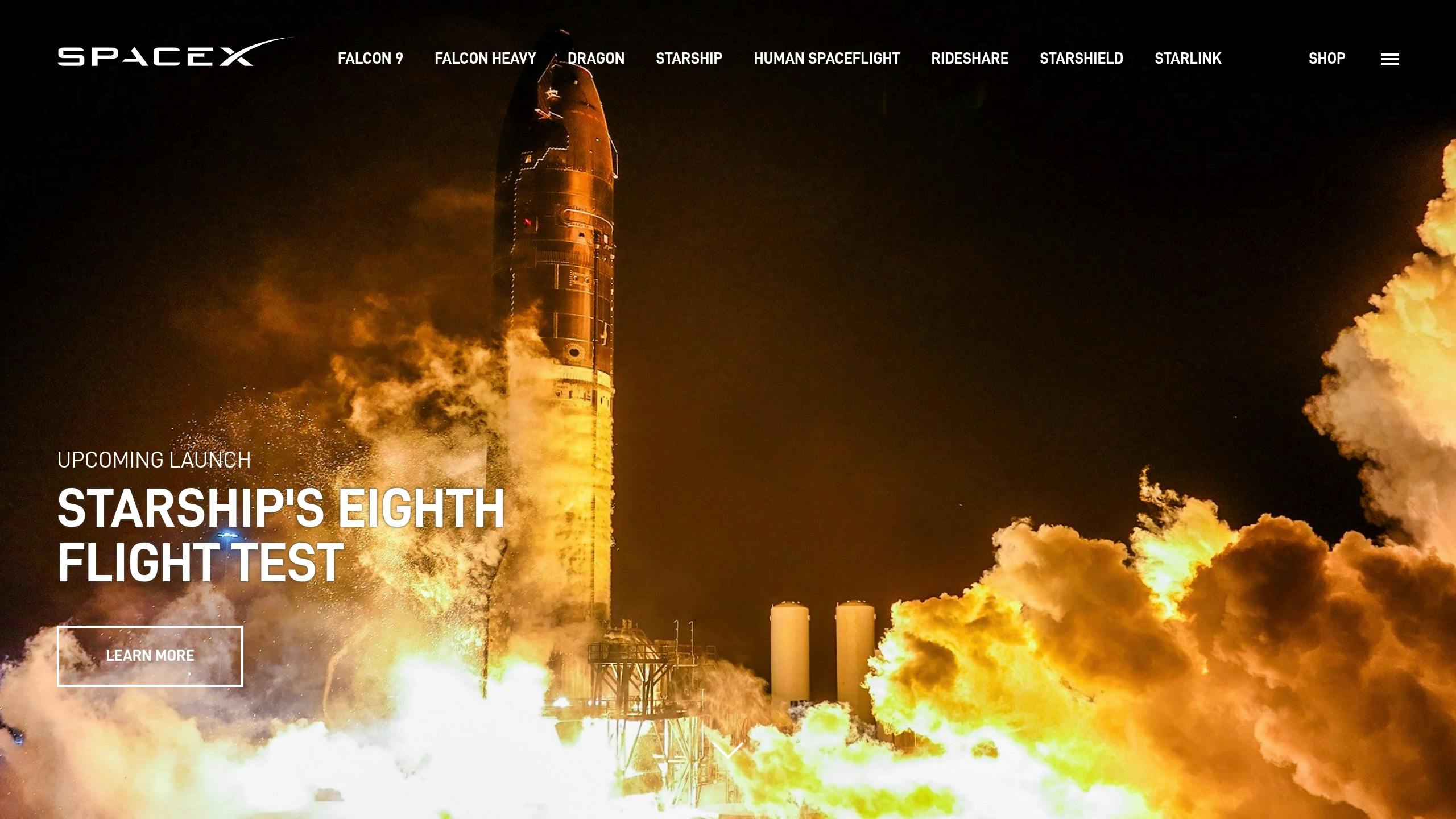

Several interlocking factors are shaping the trajectory of SpaceX’s stock price over the coming year:Mars and Starship: The Foundation of Long-Term Value Central to SpaceX’s ambitious vision is the development of Starship, the fully reusable super-heavy launch vehicle designed for deep-space missions. Successful orbital test flights and rapid iteration have accelerated progress—each successful or even productive test flight acts as a bellwether for investor sentiment. If Starship achieves operational readiness by late 2025, it could unlock unprecedented revenue from satellite constellations, commercial astronaut trips, and, crucially, NASA contracts for lunar and Mars missions.

Industry analyst Sarah Kim of Energistics predicts, “Starship’s successful deployment isn’t just a technological leap—it’s a financial catalyst that could revalue SpaceX’s market entry.”

Satellite Internet and Starlink Cash Flow Starlink, SpaceX’s global broadband satellite network, remains a key financial engine. With over 6,000 satellites already in orbit and active services in more than 60 countries, the company continues to scale subscriber numbers rapidly. Revenue from Starlink has grown exponentially—reporting double-digit annual growth—and analysts estimate its contribution could surpass $3.5 billion in 2025, significantly improving SpaceX’s path to profitability.

This steady cash machine reduces reliance on unpredictable defense contracts and bolsters long-term investor confidence.

Deep Space Contracts and NASA Collaborations SpaceX’s role in NASA’s Artemis program—supplying lunar landers and crew transport—adds strategic stability and high-value funding. The company secured multi-billion-dollar contracts for lunar surface missions, reinforcing NASA’s trust and commitment. These partnerships not only diversify revenue but also validate SpaceX’s technological maturity, reducing perceived execution risk in the eyes of institutional investors.

Market Dynamics and Competitive Landscape

The broader aerospace and space technology sector is undergoing fundamental shifts.

Private space ventures have surged, but SpaceX’s competitive moat remains formidable: its vertically integrated model, reusable launch systems, and aggressive cost pressures keep rivals at bay. Traditional aerospace giants and emerging startups face steep barriers in scale and innovation.

However, intensified competition looms. Rocket Lab, Blue Origin, ABL Space Systems, and others are advancing their own launch capabilities.

Airbus and Boeing are expanding satellite communication offerings, and scalable launch services from companies like United Launch Alliance (ULA) add downward pricing pressure. Still, analysts note SpaceX’s ability to adapt: its Falcon 9 has maintained reliability, and Starship’s reusable potential offers a paradigm shift unlikely to be matched short-term.

Financial Projections and Valuation Metrics

Using analysts’ forecasts and historical trends, SpaceX’s stock price is projected to rise dramatically by 2025. While the company remains private, public estimates based on revenue growth and market expansion project: - A trailing 12-month earnings multiple (TTM P/E) in the range of 25–35, consistent with high-growth tech firms.

- Market capitalization potentially exceeding $150 billion by mid-2025—nearly triple its 2024 valuation—driven by Starlink’s expansion and Starship’s momentum. - Earnings before interests, taxes, depreciation, and amortization (EBITDA) margins improving sharply as launch cadence and satellite revenues surge.

Investment firm Morgan Creek Capital outlines a bullish scenario: “If Starship achieves its near-term test objectives and NASA approvals accelerate, SpaceX’s stock could enter a sustained bull run, mirroring the growth seen in early-stage space ventures but at scale.”

Risks and Challenges in the 2025 Outlook

Despite the optimism, significant risks temper purely aspirational views. Regulatory hurdles, especially around space traffic management and environmental reviews, could delay launches.

Technical setbacks—such as Starship’s developmental risks—might extend timelines and inflate costs. Additionally, macroeconomic volatility, including interest rate uncertainty and potential tech sector corrections, could ripple investor appetite toward high-risk growth stocks.

Market sentiment is volatile; ETF flows and public perception shift quickly post-test successes or setbacks. Authorのを R.

Liu of FinTech Horizon notes, “SpaceX’s stock is as much a story of human ambition as it is a financial metric—one bad headline could offset months of progress.”

What Investors Should Monitor in 2025

Tracking SpaceX’s stock in 2025 demands attention to several key indicators:

- Starship Test Outcomes: Each successful orbital flight or infrastructure milestone strengthens confidence and stock resilience.

- Starlink Subscriber Growth: Sustained geographic expansion and pricing innovation directly impact near-term revenues.

- NASA Contract Milestones: Announcements of milestone deliverables and funding disbursements signal government backing and credibility.

- Market Sentiment and Analyst Upgrades: Shifts in institutional reviews and equity upgrades often precede price movements.

- Competitive Pressures: New launch capabilities or policy changes across rivals can alter SpaceX’s competitive standing.

Experienced analysts stress patience and cautious enthusiasm: “Don’t view SpaceX stock as a pure tech play or a space fantasy—it’s both. The interplay of proven operations and futuristic vision creates a high-risk, high-reward profile rarely seen elsewhere.”

SpaceX’s journey toward 2025 is not merely about rockets and satellites—it reflects a pivotal moment in humanity’s transition to a multiplanetary species. Public market valuation hinges on balancing lofty dreams with disciplined execution, as investors weigh the cost of betting on a company pressing the frontier of space.

With Starship poised to redefine launch economics and Starlink continuing to scale, the stage is set for a stock price that could surge well ahead of 2025’s halfway point— Should the trajectory hold, the year may well become a turning point for both SpaceX and global space economics.

Related Post

Bolly4u Hub Download: Your Ultimate Gateway to Bollywood’s Golden Era

Gran Turismo 7: Open World Freedom vs. Relentless Closed Courses – A Deep Dive into Doing It All