Social Security Number & Telephone: The Invisible Link in Identity Fraud

Social Security Number & Telephone: The Invisible Link in Identity Fraud

When a Social Security Number (SSN) becomes entangled with personal telephone information, the result is not just a data mismatch—it’s a gateway to identity theft, financial ruin, and widespread systemic vulnerability. In today’s digital landscape, where personal identifiers are routinely shared across databases, apps, and government systems, the unintended pairing of SSNs with phone numbers creates a dangerous convergence. This article explores how this pairing enables fraud, exposes individuals to risk, and underscores urgent needs for stronger safeguards—and greater public vigilance.

Understanding the RSN-Tel Connection The Social Security Number is more than a government-issued identifier; it functions as a linchpin in federal databases used for taxation, employment, healthcare, and credit. Equally critical, telephone records—especially mobile and landline numbers—serve as unofficial identifiers increasingly used in digital verification. When these two datasets link improperly—whether through data breaches, software errors, or third-party data brokers—the consequences are severe.

“SSNs and phone numbers together form a de facto identity profile,” explains cybersecurity expert Dr. Naomi Chen, a professor of digital forensics at Georgetown University. “A single SSN paired with a verified phone number makes it far easier for bad actors to impersonate someone, open accounts, or access sensitive services under false pretenses.” Linking SSNs with phone numbers often occurs during routine transactional processes—account openings, loan applications, or medical record updates—where both fields are collected.

But when one of these bits of data is compromised, the other becomes a high-value target. For example, a breach at a retail or healthcare provider may expose thousands of SSNs alongside matching phone numbers, creating a collection ripe for exploitation. Real-World Risks of SSN-Phone Linkages The exposure of Social Security numbers tied to phone numbers fuels multiple forms of identity fraud.

Identity thieves leverage this pairing to: - Open credit accounts in a victim’s name, accruing debt that damages credit scores for years. - Access medical services, bending the healthcare system through fraudulent bills or delayed legitimate care. - Leverage telecommunications services, including mobile plans and internet accounts, often undetected by victims.

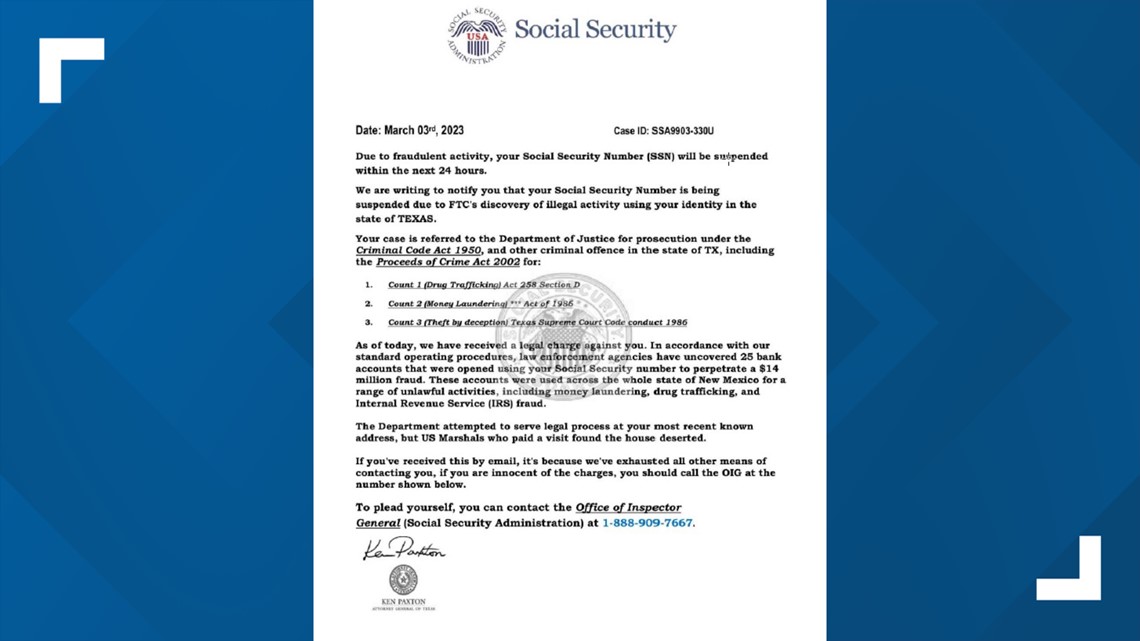

- Initiate phishing or social engineering attacks using recognized numerical patterns to gain trust. In 2021, the Federal Trade Commission reported over 1.2 million identity theft complaints tied directly to SSN exposure, with many cases involving misleading phone number disclosures or unimpeded data sharing from broken security protocols. How Data Gets Mixed Up: Vulnerabilities in the Chain Despite robust privacy laws like the Social Security Act and the Gramm-Leach-Bliley Act, systemic loopholes allow SSNs and phone numbers to accidentally combine.

Key vulnerabilities include: - **Legacy system integrations**: Older infrastructure often lacks modern encryption, increasing the risk of data leakage. - **Data broker databases**: Private firms routinely sell or share personal information across industries, amplifying exposure without user consent. - **Third-party app integrations**: Many mobile apps request permission to access SSNs and phone numbers for “verification,” yet fail to clearly disclose how data will be used or protected.

- **Breach cascades**: A single breach at one service provider can propagate sensitive records across affiliated platforms, creating chain reactions of exposure. Telephone data—once thought relatively contained—has become increasingly entangled with digital identities. From carrier location details to caller ID databases, phone numbers are often used as secondary identifiers when SSNs are unavailable or unverified, especially in cross-referencing systems designed to prevent fraud.

But this reuse heightens the danger: a compromised phone number becomes a known risk factor, easier to weaponize.

Signals for Public Awareness and Action

The growing convergence of SSNs and telephone data demands proactive measures from individuals, institutions, and regulators. For individuals, basic steps include: - Limiting the disclosure of SSNs and phone numbers to only trusted, necessary entities.- Regularly reviewing credit reports and account activity for signs of unauthorized use. - Enabling multi-factor authentication and suspected data breaches promptly through services like IdentityTheft.gov. - Using virtual phone numbers for signups to avoid tying real identities to online profiles.

Corporate and institutional responsibility is equally critical. Organizations collecting sensitive data must: - Implement strict access controls and end-to-end encryption for personal identifiers. - Minimize data retention and avoid unnecessary linkage of SSNs with phone numbers unless absolutely essential.

- Invest in real-time anomaly detection to flag and

Related Post