SC Corporation Loans 2025: AP Start Date Official Revealed, Now with Clear Timeline

SC Corporation Loans 2025: AP Start Date Official Revealed, Now with Clear Timeline

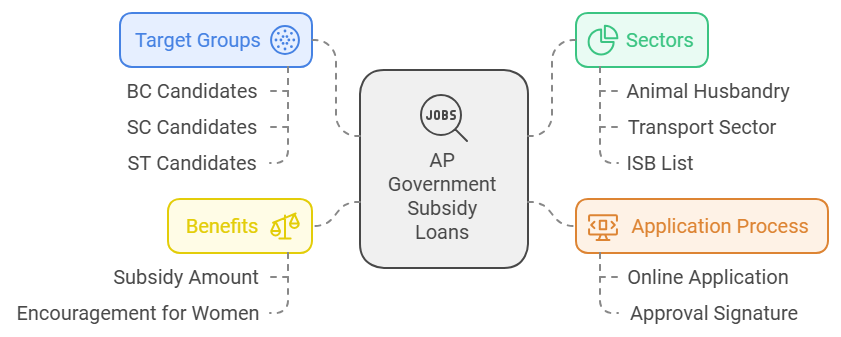

When 2025 arrives, SC Corporation’s long-awaited loan application process is finally taking off—this week, the company officially unveiled the Application Start Date, bringing clarity to entrepreneurs and businesses eager to access capital. After months of speculation and stakeholder reviews, SC Corporation Loans 2025 has launched with a transparent, data-driven timeline that marks a new chapter in accessible corporate financing. Industry insiders and borrowers alike are now able to plan with precision, knowing exactly when applications open and what documentation is required.

The Application Start Date, confirmed by SC Corporation’s official communication, is set for February 15, 2025. This date introduces a structured season for applicants: from early preparation and eligibility checks through to submission and approval milestones. The timeline is designed to streamline the entire lending process, with a clear delineation of key phases that applicants must navigate.

<

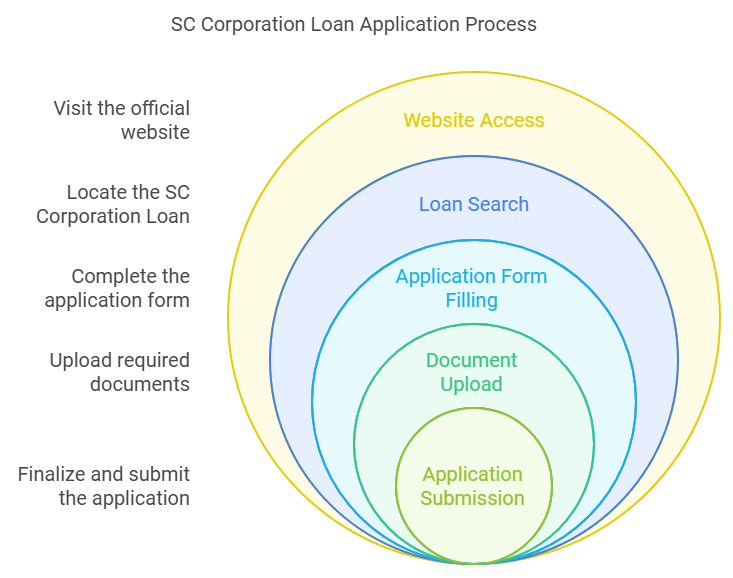

Within the first 30 days, applicants will have access to digital application portals, credit pre-assessment tools, and eligibility calculators. By mid-February, reserved slots for in-person consultations and technical support begin opening—ensuring human assistance remains available when online systems reach capacity. This phased rollout prevents bottlenecks and supports a smooth, equitable application process.

Materially supporting this timeline is a set of carefully refined eligibility criteria, now published alongside the start date. Businesses must demonstrate consistent revenue streams, a strong debt-to-income ratio, and a clear business purpose tied to SC Corporation’s priority projects—ranging from technology upgrades and green infrastructure to workforce expansion. Borrowers are advised to conduct internal audits weeks in advance to meet these standards.

The readiness window also includes proactive outreach: regional loan officers will host informational webinars starting January 28, and a dedicated support center will begin answering inquiries on January 30. This front-loaded support ecosystem ensures no applicant feels lost in procedural complexity. SC Corporation’s approach reflects a shift toward transparency and borrower empowerment.

Unlike past cycles marked by opaque timelines and sudden deadlines, this launch emphasizes preparation, preparation, preparation. Borrowers can now calendar the February 15 start date as a non-negotiable milestone, enabling disciplined financial planning and timely access to funds that can fuel growth. As the calendar edges toward the new decade, SC Corporation Loans 2025 doesn’t just restart a lending program—it redefines how corporate clients engage with capital.

With the Application Start Date now firmly anchored in time, stakeholders are positioned to convert opportunity into action. The stage is set: full digital access, clear benchmarks, and structured support awaiting those ready to move forward. <

Here’s a granular breakdown of what borrowers can expect: - **January 30, 2025**: Launch of the dynamic Apple Application Portal, including eligibility calculators, FAQs, and video guides to walk applicants through prerequisites. - **February 1–10, 2025**: Pre-application phase—documentation collection (financial statements, business licenses, tax returns), identity verification, and credit baseline assessments begin. - **February 15, 2025**: Official application opening.

Applicants submit formal requests through the portal with supporting materials; digital intake verification commences. - **February 15–28, 2025**: Initial system processing, automated credibility screenings, and assignment to regional underwriting teams. - **March 1, 2025**: First wave of applicants receive status updates via email or portal alert; shortlisting begins based on financial compliance and project relevance.

- **Mid-March to Early April, 2025**: In-depth underwriting, including on-site verification for high-priority projects and credit line structuring consultations. This phased model ensures scalability and responsiveness. Small businesses and large enterprises alike benefit from staggered processing windows, reducing platform congestion during peak submission periods.

SC Corporation has complemented the timeline with a robust support infrastructure. A dedicated helpdesk, active through February 20, offers one-on-one troubleshooting and documentation troubleshooting. Regional loan officers scheduled for January 28 will conduct targeted town halls in key markets, reinforcing confidence and outreach.

For corporate decision-makers, the February 15 start date is more than a calendar mark—it’s a strategic commitment. By aligning the launch with fiscal planning cycles and offering a roadmap of clear, manageable steps, SC Corporation delivers not just a loan program, but a framework for sustainable growth. The AP window is not merely a start date; it’s the first move in a methodical, borrower-first investment cycle, setting new benchmarks for transparency in corporate lending.

As 2025 unfolds, the focus shifts from anticipation to action. With the Application Start Date firmly established, every applicant now holds a precise compass—guiding them toward approval, financial stability, and the scalability needed to thrive.

Related Post

UTC Time Right Now: The Global Clock That Keeps the World Synchronized

Upgrade Your Ride: New Hyundai Santa Fe Tail Lights Transform Night Driving

Moviesmod.Cash: Revolutionizing Film Investments Through Player-Driven Rewards

Investigating the Journey of Atiana De La Hoya