Rent To Own Homes In Trinidad: Your Achievable Path to Homeownership

Rent To Own Homes In Trinidad: Your Achievable Path to Homeownership

Trinidad’s real estate landscape is evolving, driven by rising property prices and increasing demand from first-time buyers seeking realistic entry points into homeownership. Among the most effective tools reshaping access to housing is the rent-to-own model—a structured pathway that combines lease agreements with gradual equity buildup, giving aspiring homeowners time to save, improve credit, and secure a property without voluminous upfront investment. Far from a mere stopgap, rent-to-own homes in Trinidad are emerging as a strategic stepping stone toward long-term financial stability and lasting equity.

At its core, the rent-to-own framework allows renters to gradually convert monthly lease payments into ownership rights. Typically, a portion of each rent payment—often 10% to 20%—is applied toward the future purchase price, while lease terms span three to seven years. By the end of the agreement, satisfied tenants may convert their lease into a full purchase, paying only the accumulated equity plus closing costs.

This model is transforming how Trinidadians approach homeownership, particularly amid a market where median property prices exceed $250,000, pricing many first-time buyers out of immediate purchase.

The Mechanics of Rent-to-Own in Trinidad’s Real Estate Market

Understanding how rent-to-own agreements operate is key to leveraging their full potential. Each arrangement is legally binding and structured to serve both landlord and tenant interests, balancing risk and reward. -Key Components of Rent-to-Own Agreements Rent-to-own contracts in Trinidad usually include: - **Purchase Price:** A pre-agreed amount, often 50% to 75% of the market value, locked in at lease signing.

- Rent Application to Equity: A defined percentage of each rent installment contributes toward the down payment—typically 10–20%. - Fixed Term: Agreements span 3 to 7 years, during which tenants build ownership equity. - Search and Qualification Periods: Tenants must prove financial stability, maintain good credit, and meet property requirements before purchase.

- Closing Costs Integration: Post-lease, remaining balances combine rent contributions and initial payments to fund the final purchase.

Trinidad’s existing property financing landscape, while constrained, supports these arrangements through informal partnerships between landlords, developers, and tenants, often facilitated by real estate agents specialized in flexible financing.

Why Rent-to-Own Is a Smart Strategy for Trinidadian Homebuyers

For many Trinidadians, traditional homeownership remains financially out of reach—not due to lack of desire, but due to immediate affordability barriers.Rent-to-own homes bridge this gap by reframing leasing as an investment rather than a cost. > “It’s not just a lease—it’s a slow bridge to ownership,” says housing expert Dr. Anika Nareen, a Trinidad-based urban economist.

“Rent-to-own allows people to build credit, save systematically, and learn property maintenance—all while staying housed. It’s financial education in motion.”

Benefits are tangible and cumulative:

- Financial Preparedness: Savings accumulate via rent contributions, while non-refundable fees are minimized.

- Credit Improvement: On-time payments boost credit scores, opening doors to formal loans post-purchase.

- Market Familiarity: Tenants gain hands-on experience with upkeep, property taxes, and mortgage basics before committing financially.

- Flexibility Without Risk: Unlike speculative buyouts, structured rent-to-own agreements protect renters from market volatility and financial overextension.

South Trinidad, a rapidly developing residential zone, exemplifies this trend: affordable rental units now often feature 5-year rent-to-own tracks with employer-backed partnerships, enabling public servants and middle-income families to transition smoothly into owner-occupiers.

Challenges and Considerations in Rent-to-Own Transactions

Despite its promise, the rent-to-own model is not without complexity. Potential pitfalls include: - Ambiguous Contracts: Some informal agreements lack legal clarity, risking disputes over payments or property conditions.- Rate Clauses:** Unprotected rent increases during the lease term can inflate equity costs unintentionally. - Property Condition Clauses: Existing wear-and-tear may require renters to fund repairs, reducing net equity. - Limited Lender Access: Most banks remain hesitant to finance rent-to-own agreements, as they’re seen as riskier than standard mortgages.

To mitigate these, tenants must engage qualified legal counsel, demand detailed signing documents, and ensure all terms reflect a clear path to ownership—not hidden fees or escalating liabilities.

Recent policy discussions among Trinidad’s Ministry of Housing emphasize standardizing rent-to-own frameworks, aiming to formalize safeguards and increase lender confidence. Experts predict stricter oversight will enhance trust and expand accessibility nationwide.

Real-Life Success: Rent-to-Own Journeys in Trinidad

Consider the case of the Rodrigues family, who secured a 5-year rent-to-own agreement for a 1,200 sq.ft. home in Couva. Accepting monthly rentals of $1,400, they contributed $33,840 ($1,400 x 24 monthly installments) toward equity, while maintaining a $700 net rent payment toward the final $117,160 purchase price.

After five years, with excellent credit scores and a 4% down payment, they closed on their home at 92% of market value—adding professional builder savings of $60,000 to retrofit upgrades, turning a rental journey into lasting wealth.

These stories underscore a broader shift: rent-to-own is not a temporary fix, but a disciplined, transparent gateway to equity—resonating deeply with a new generation navigating affordability, finance, and the dream of homeownership.

Trinidad’s rent-to-own homes represent more than a housing option—they are a catalyst. By tightly linking rental contributions to ownership, they empower households to progress steadily from financial insecurity to self-sufficiency.

As market conditions evolve and supportive policies take hold, this model is poised to become a cornerstone of accessible, equitable homeownership across the island. For those ready to build a home—on their own terms—renting today may very well be the boldest step toward lasting ownership tomorrow.

.jpg)

Related Post

Radio Dolly Dots: Decoding the Lyrics and Story Behind Their Ironic Anthem

Brooklyn Frost Age Wiki Net worth Bio Height Boyfriend

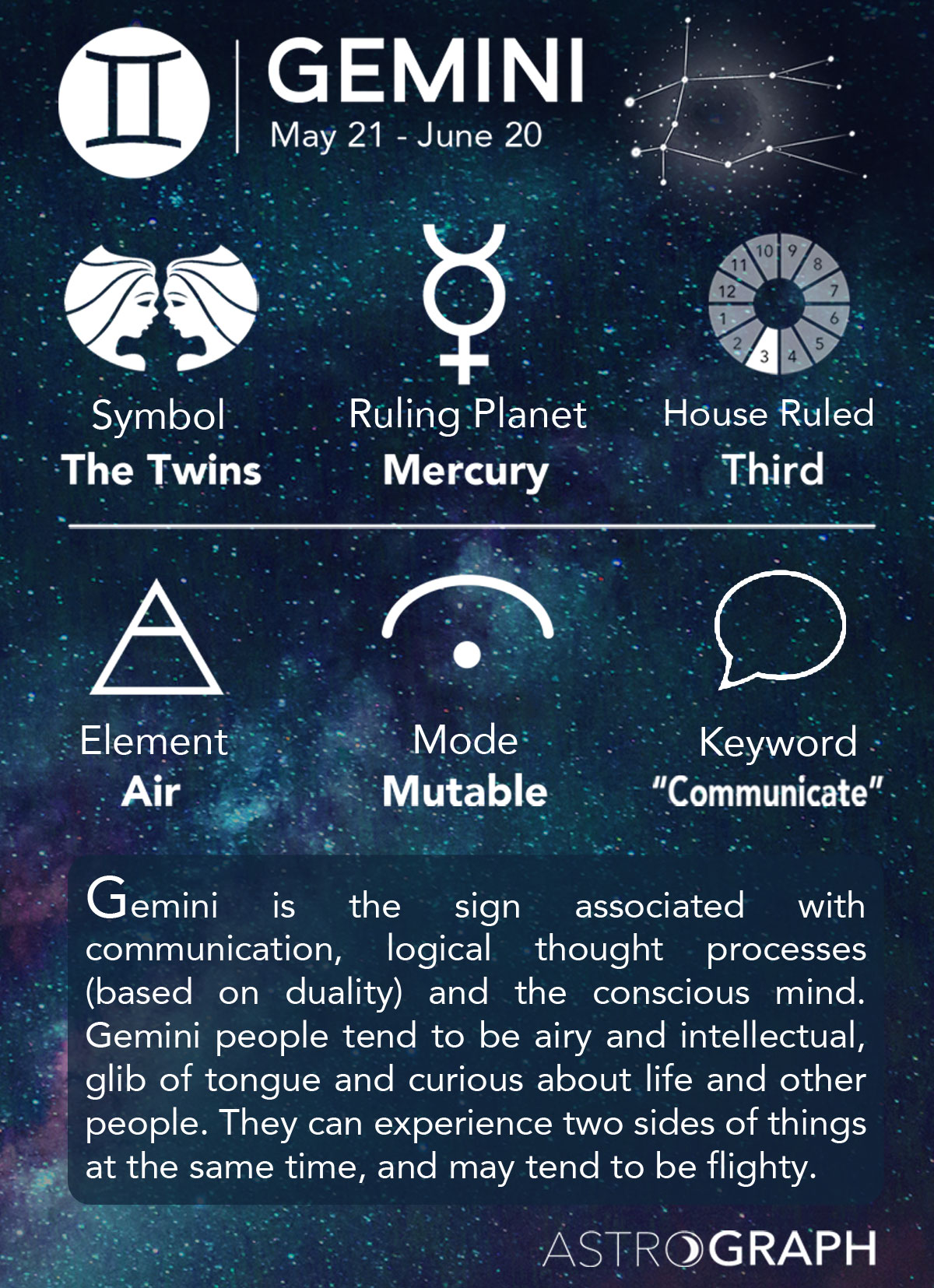

June 20 Zodiac Understanding The Unique Traits of Gemini: The Renaissance Mind in Motion

New GMC Square Body Fact or Fiction: The SUV That Redefined Utility with Proven Performance