<Redem>Redeeming the Future: How Modern Digital Redemption is Reshaping Commerce, Trust, and Consumer Behavior</Redem>

Redeeming the Future: How Modern Digital Redemption is Reshaping Commerce, Trust, and Consumer Behavior

In an era where digital transactions outpace physical ones by a wide margin, the concept of “redeeming” has evolved far beyond coupon codes and event entry tickets. Today, redemption represents a strategic lever in building customer loyalty, enhancing brand trust, and unlocking seamless experiences across industries. From retail and hospitality to fintech and gaming, the mechanics of redemption are being reimagined through advanced technology, behavioral insights, and real-time personalization.

This transformation is not just about offers — it’s about creating lasting relationships rooted in value, relevance, and trust. The mechanics of redemption today hinge on three core principles: speed, smart targeting, and frictionless execution. Consumers increasingly demand instant gratification—within seconds, not days.

A well-designed redemption process eliminates lengthy steps, auto-applies discounts, or unlocks rewards at the precise moment of engagement. This immediacy is not accidental. According to a 2024 study by Gartner, 68% of consumers switch brands within 30 days if the redemption experience feels cumbersome or delayed.

Brands that get redemption right don’t just retain customers—they turn them into advocates.

The Evolution of Redemption: From Paper Coupons to Smart Systems

Redemption has traversed a remarkable journey. In the 1980s and 1990s, physical coupons, stamps, and punch cards defined the landscape—mechanical, slow, and prone to waste.The turn of the century introduced digital coupons via email and early apps, but adoption remained limited by poor user interfaces and siloed systems. Today, redemption is powered by integrated digital ecosystems. Mobile apps, QR codes, NFC tags, and AI-driven recommendation engines converge to deliver personalized offers at scale.

For example, a coffee chain might trigger a redemption when a customer’s loyalty app detects proximity to a store, offering a free pastry based on purchase history. Such real-time, context-aware discounts boost conversion by up to 40%, according to recent case studies. > “Redeeming is no longer transactional—it’s experiential,” says Dr.

Lena Park, a consumer behavior expert at MIT’s Digital Commerce Lab. “When redemption feels effortless and thoughtful, customers associate that ease with brand integrity and reliability.” Core advancements include: - **Mobile-first interfaces** that integrate biometric authentication, minimal taps, and instant reward disbursement. - **AI and machine learning** that analyze behavioral data to predict and deliver the most relevant offers in real time.

- **Blockchain validation** to secure digital rewards and prevent fraud, especially in gaming and loyalty programs. - **Cross-platform compatibility** allowing redemption across web, mobile, in-store, and social channels. This shift reflects a deeper transformation: redemption is now a dynamic tool for embedding brands into daily routines, transforming passive consumers into active participants.

Industry Deep Dive: Where Redemption Drives Real Results

Retail is perhaps the most visible arena for innovation. Major retailers like Target and Walmart have deployed AI-powered redemption engines that adjust offers based on real-time inventory, weather, and purchase patterns. Target’s “Circle” rewards program, for instance, uses predictive analytics to deliver personalized discounts during high-intent moments—like back-to-school season—where redemption conversion rates exceed 45%.This hyper-targeting not only increases average order value but strengthens emotional bonds between shopper and brand. In hospitality, redemption fuels loyalty in an increasingly competitive landscape. Marriott’s Bonvoy program leverages mobile check-in integration to trigger instant award redemptions, eliminating long queues and enhancing guest satisfaction.

A 2023 Inside Hospitality Report revealed that members who redeem points frequently spend 32% more annually, underscoring redemption’s role in customer lifetime value. The gaming sector exemplifies another domain where redemption creates persistent engagement. Titles like *Call of Duty* and *Genshin Impact* reward players with in-game currency, skins, or exclusive content redeemable through gameplay milestones or real-world purchases.

These systems blend intrinsic motivation with extrinsic rewards, fostering communities that redeminate not just items—but loyalty, time, and passion. Travel and travel ancillary services leverage redemption to reduce friction during booking and travel. Airlines use redemption fuels—bonus miles, lounge access, or priority boarding—to steer choices toward premium products, increasing ancillary revenue by up to 25%.

Meanwhile, hospitality booking platforms offer redeemable stay credits that activate after travel, extending brand interaction beyond the initial transaction. Gaming piece extends to fintech, where digital wallets and neobanks employ redemption as financial empowerment. Revolut and Chime offer cashback, instant transaction credits, or discount redeemables tied to spending habits, turning routine payments into chance encounters with reward.

This gamified approach increases user engagement and discourages disengagement, turning financial services into engaging daily rituals.

Challenges and Risks in Modern Redemption

Despite its momentum, redemption strategy faces significant hurdles. Over-reliance on digital can alienate segments lacking smartphone access or digital literacy, risking exclusion and brand fatigue.A 2024 report by Accenture notes that 38% of older adults still prefer physical redemption methods—a gap that excludes a growing demographic unless strategies diversify touchpoints. Data privacy and trust are paramount. Redemption often depends on collecting behavioral, location, and financial data.

Missteps in handling this data—accidental sharing, opaque consent, or poor security—erode

Related Post

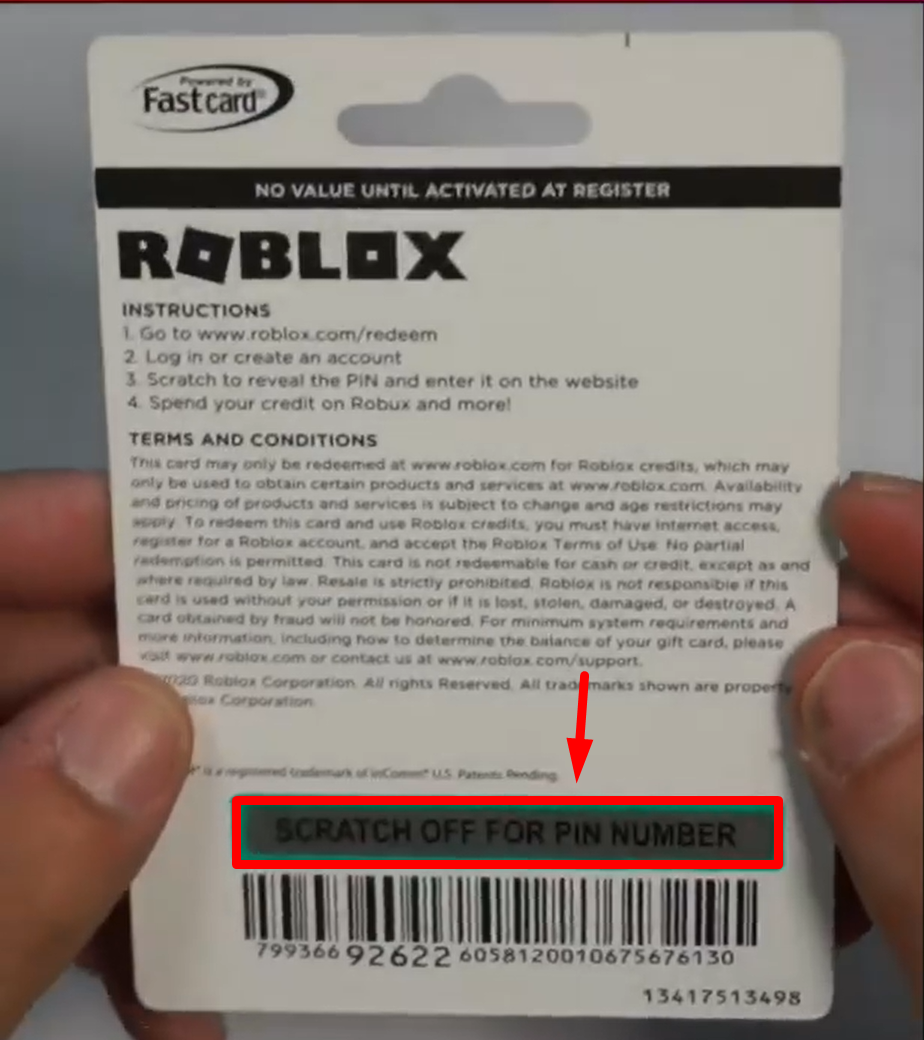

Unlock Roblox Reddem Gift Cards Fast — Here’s How the Gift Card Revolution Powers Flexible Game Spending

Star's Naked: Comprehensive Look

Decoding South Africa's Time: Understanding Time Zones, Daylight Saving, and Global Synchronization