Pseiwlosse News: What’s Shaping the Tech Landscape in 2024 – Trends, Threats, and Transformations

Pseiwlosse News: What’s Shaping the Tech Landscape in 2024 – Trends, Threats, and Transformations

In a year defined by rapid innovation and shifting global dynamics, Pseiwlosse News brings you the most pressing updates and emerging trends reshaping industries from artificial intelligence to cybersecurity, fintech, and sustainable technology. From breakthroughs in generative AI to evolving digital risk landscapes and the accelerating shift toward green tech, 2024 is proving a pivotal moment for innovation, regulation, and societal adoption. This article synthesizes the latest developments, offering a comprehensive snapshot of what’s gains momentum and what demands urgent attention.

At the forefront of technological disruption, artificial intelligence continues to redefine boundaries across sectors. Based on recent market snapshots, generative AI tools have evolved beyond novelty to become core productivity engines, embedded in everything from customer service chatbots to advanced content creation platforms. “AI is no longer a future promise—it’s a current operating system,” notes Dr.

Lena Voronova, a senior AI researcher at Pseiwlosse’s Innovation Lab. “Organizations that integrate generative AI effectively are seeing measurable gains in speed, personalization, and cost reduction.” Industry reports indicate that enterprise AI spending surpassed $150 billion in 2023, with projections climbing toward $220 billion by 2025—driven largely by verticals such as healthcare, finance, and manufacturing.

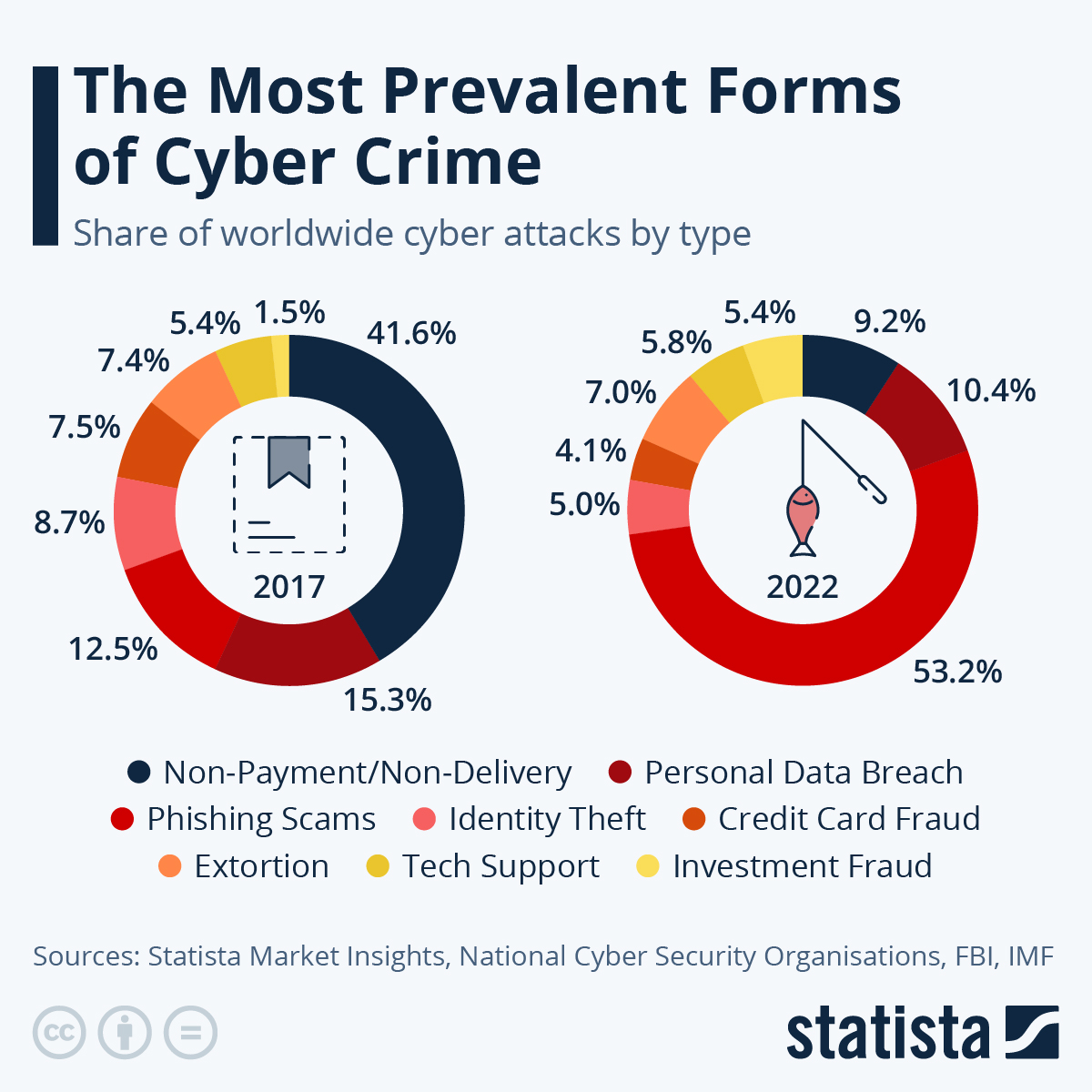

Beyond AI, cybersecurity threats have grown increasingly sophisticated, mirroring the expansion of digital infrastructure.

Pseiwlosse’s Threat Intelligence Unit recently documented a 40% surge in advanced persistent threats (APTs) targeting critical supply chains, state-sponsored actors, and emerging tech sectors. This evolution demands proactive defenses—quantum-resistant encryption, zero-trust architectures, and AI-powered anomaly detection are now imperative. “We’re witnessing a new arms race,” explains cybersecurity lead Marcus Nkosi.

“Defenders must anticipate attack vectors before they emerge, not just react to breaches.” Regulatory bodies worldwide are responding with stricter compliance frameworks, such as the EU’s updated NIS2 directive and the U.S. Executive Order on Improving Cybersecurity, underscoring the urgency of systemic resilience.

Infinitesimal progress in fintech continues to reshape financial inclusion and transaction models.

Digital banking platforms, decentralized finance (DeFi) protocols, and embedded finance solutions are expanding access to capital and services for underserved populations. Notably, cross-border payment systems powered by blockchain and real-time settlement engines now process transactions in seconds at a fraction of legacy costs. Pseiwlosse’s financial innovation tracker highlights a 60% year-over-year increase in fintech startups securing regulatory approval across Southeast Asia and Africa—areas where traditional banking penetration remains limited.

“The future of finance is decentralized, user-centric, and interoperable,” observes fintech analyst Priya Mehta. “This shift doesn’t just improve efficiency—it redraws the map of global economic participation.”

As the green transition accelerates, sustainable technology has emerged as a dominant theme across energy, mobility, and manufacturing sectors. Renewable energy adoption reached a historic high in 2024, with solar and wind contributing over 35% of global electricity generation—a rise from 12% a decade ago.

Advances in battery storage, green hydrogen production, and smart grid technologies are making clean energy more reliable and scalable. Urban centers worldwide are piloting carbon-neutral infrastructure projects, from zero-emission public transit fleets to AI-optimized energy grids. “Sustainability is no longer optional—it’s the foundation of innovation,” states climate tech expert Elena Bogdanova.

“Companies investing now position themselves at the heart of tomorrow’s economy.” Public-private partnerships, accelerated by policy incentives like carbon pricing and green subsidies, are fueling this momentum.

Regulatory evolution closely tracks technological advancement, shaping how industries scale responsibly. Across North America, Europe, and parts of Asia, legislators are finalizing comprehensive AI governance frameworks—addressing algorithmic bias, data privacy, and ethical use.

The U.S. proposed AI Accountability Act and the EU’s now-active AI Act exemplify this trend, mandating transparency, auditability, and human oversight in high-risk AI systems. “Regulation isn’t stifling innovation—it’s leveling the playing field,” asserts legal analyst Thomas Reed.

“Clear rules help businesses innovate with confidence and safeguard public trust.” Meanwhile, anti-trust scrutiny is intensifying in big tech and fintech domains, aiming to prevent monopolistic practices and preserve competitive dynamism.

Consumer behavior, too, reveals deepening preferences for transparency, personalization, and purpose-driven brands. Surveys indicate 72% of global consumers now prioritize environmental and ethical values when choosing products or services.

Digital platforms are evolving to deliver hyper-personalized experiences through AI-driven insights—while enhancing data privacy safeguards. “Customers expect brands to understand them deeply and act responsibly,” says Pseiwlosse’s Chief Digital Officer, Rajiv Patel. “This means not just collecting data, but using it ethically and enhancing trust through clarity and control.” Trust, in this context, is the new currency.

Emerging markets are proving critical growth engines, driving demand for adaptive, affordable technology solutions. Indonesia, Nigeria, and India lead in fintech adoption and mobile-first digital services, bypassing legacy infrastructure to leapfrog directly into cutting-edge tools. Startups in these regions are reverse-innovating—designing scalable, low-cost systems that later inspire global best practices.

“These markets aren’t just adopting technology—they’re redefining it,” observes Anika Desai, Regional Tech Forecaster at Pseiwlosse. “Their agility is reshaping expectations for speed, accessibility, and inclusion worldwide.”

The convergence of AI, cybersecurity, fintech, sustainability, regulation, and evolving consumer expectations forms an intricate, mutually reinforcing ecosystem. Each development influences the next, creating both challenges and unprecedented opportunities.

For businesses and policymakers alike, agility, ethical foresight, and inclusive innovation are no longer competitive advantages—they are absolute necessities.

Navigating 2024 demands a strategic lens: embracing transformation while managing risk, harnessing technology responsibly, and aligning progress with human values. As Pseiwlosse News continues to track these shifts, one truth remains clear—those who listen closely, adapt swiftly, and lead with integrity will define the future, not just survive in it.

Related Post

Melvin, Megan, and the Furtick Family: How Steven Furtick’s Personal Life Shapes His Ministry Resonance

Unlocking Mystery: What Is the 64th Floor of the Empire State Building?

The Unfinished Rivalry: Floyd Mayweather vs. Manny Pacquiao — A Legacy of Fit Guücken and Fractured Dreams