Phillips Curve in Crisis: Unraveling Demand-Pull Dynamics and the Devastating Impact of Supply Shocks

Phillips Curve in Crisis: Unraveling Demand-Pull Dynamics and the Devastating Impact of Supply Shocks

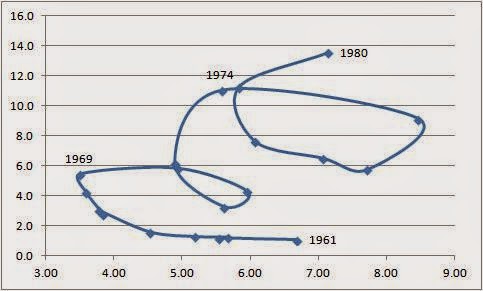

When economy churns and inflation surges, policymakers face a high-stakes puzzle: how moments of strong demand collide with sudden supply disruptions—reshaping markets, tests stability, and challenge long-standing economic models. At the heart of this struggle lies the Phillips Curve, a classic framework once seen as predicting a steady trade-off between unemployment and inflation. Yet in modern economies, that relationship has grown more volatile—largely due to demand-pull pressures and jagged supply shocks, which together warp traditional signals.

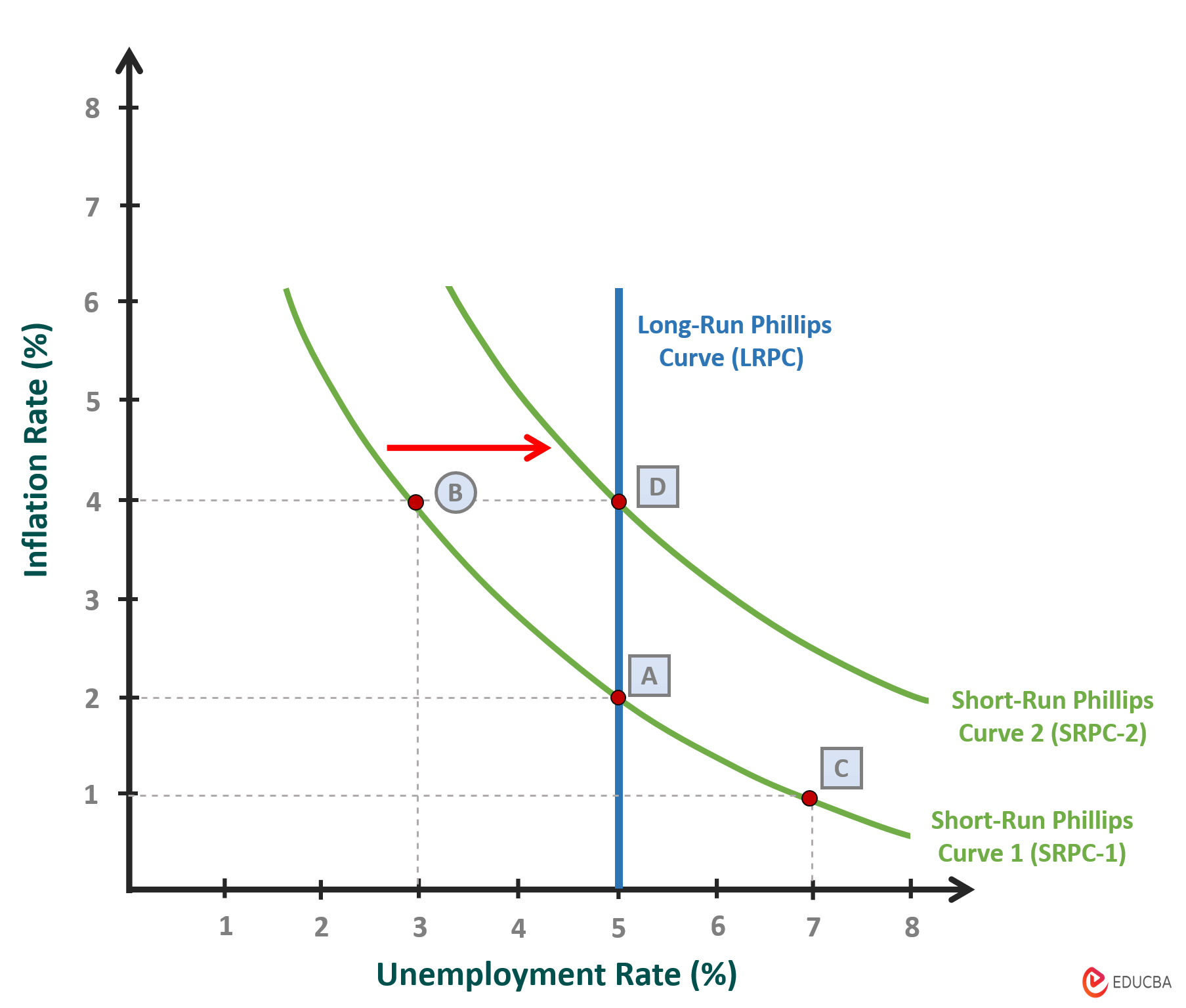

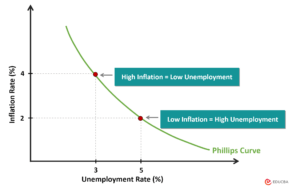

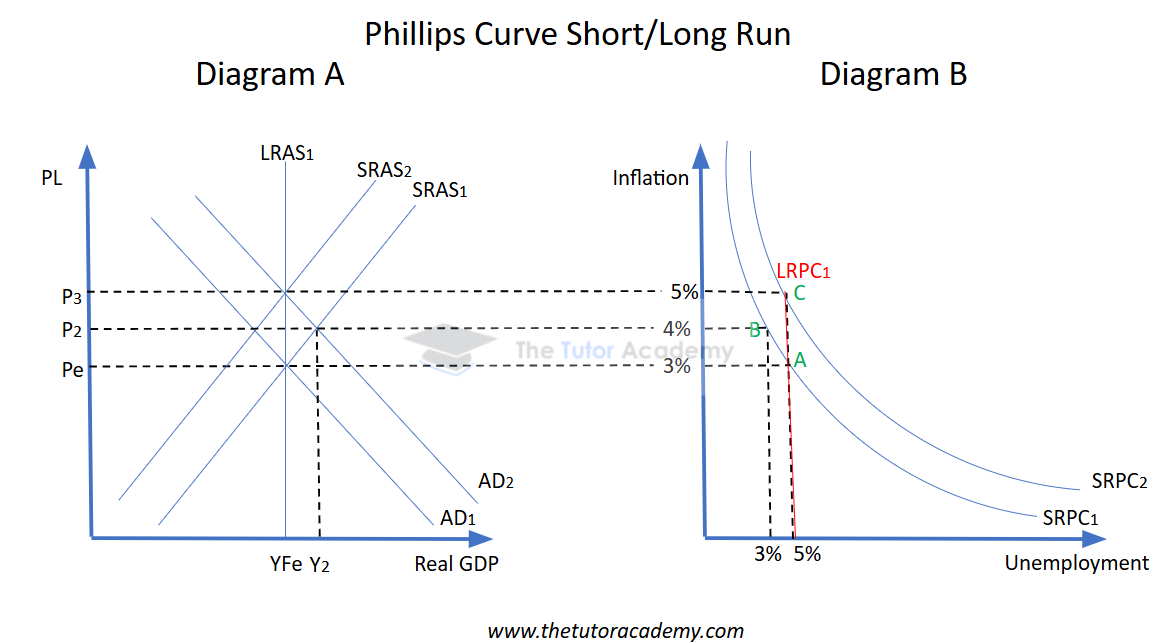

This dynamic reveals not just economic complexity, but critical vulnerabilities in how economies absorb shocks and maintain balance. The Phillips Curve, in its original form, arose from mid-20th-century observations linking lower unemployment to rising wage growth—and consequently, higher prices. Economists viewed it as a tool to guide policy: stimulate the economy, accept moderate inflation, reduce joblessness.

But as markets evolved, so did the curve. Today, strong consumer demand—fueled by fiscal stimulus, low interest rates, or pent-up post-pandemic spending—pushes hiring up and inflation upward. Yet when supply chains falter or geopolitical upheavals disrupt production, inflation spikes without a matching drop in unemployment—radically altering the expected trade-off.

Demand Pull Inflation: When Every Dollar Stirs Price Wheels

Demand-pull inflation occurs when aggregate demand outpaces the economy’s capacity to produce goods and services. This imbalance, rooted in strong consumer confidence, aggressive government spending, or corporate over-investment, creates sustained upward pressure on prices. In Phillips Curve terms, with low unemployment, workers gain wage bargaining power; their higher incomes fuel further consumption, widening domestic demand until only inflation remains.Historical examples illustrate this mechanism clearly: in the U.S. economy during 2021–2022, expansive fiscal stimulus and near-zero rates boosted spending, but supply chain bottlenecks and fluctuating energy prices constrained production. The result?

Inflation surged to 40-year highs while labor markets tightened—aligning with a demand-pull expansion that stretched the Phillips Curve’s original slope. Authorities found themselves in a tight spot: taming inflation without triggering a recession. - Sophisticated models now detect demand-pull patterns through real-time indicators: rising retail sales, increasing job openings exceeding long-term equilibrium, and surging credit growth.

- Wage pressures amplify the effect; as labor becomes scarce, firms bid up prices to maintain margins. - Central banks face a painful trade-off: aggressive rate hikes cool demand but risk unwinding fragile job markets—exposing the curve’s now-flatter slope during stagflation periods. The Phillips Curve, once a beacon of predictable policy levers, reveals its limits when demand surges collide with weak supply—a friction that reshapes economic outcomes far beyond mere statistical correlation.

Supply Shocks: Unexpected Disruptions That Flip Economic Comparative Advantage

No force reshapes the Phillips Curve more abruptly than supply shocks—s

Related Post

Jimmy Kimmel Unleashes the Unfiltered Demolition of Stephen Colbert’s “Ste 보고” at the Colbert Show

RJ Barrett’s NBA Journey: A Statistical Deep Dive into a Rising Star’s Performance

Meliodas’ Stellar Arc in Seven Deadly Sins: What Fans Need to Know

How Google Fiber Customer Service Delivers Unmatched Responsive Support in a Competitive Market