One Chf in Indian Rupees: The Rigorous Currency Metric That Shapes Every Transaction

One Chf in Indian Rupees: The Rigorous Currency Metric That Shapes Every Transaction

Every currency conversion carries invisible weight—especially when crossing borders between major economies like India and France. For daily trade, travel, and investment, the exchange rate between the Indian Rupee (INR) and the Euro (EUR), particularly worth noting at 1 CHF (CHF IN INR), anchors prices, expenses, and economic expectations. At current levels—where 1 CHF equals approximately ₹91.70—the value of a single Swiss Franc in Indian currency reflects more than just foreign exchange mechanics; it reveals trade balances, demand dynamics, and macroeconomic health.

Understanding this 1 CHF–INR exchange rate reveals how deeply global financial flows permeate even the most localized economic interactions across India. When Indian consumers purchase French luxury goods or raw materials, or when foreign investors compute returns on Indian equities, the conversion rate acts as a silent determinant. While direct transactions rarely involve CHF alone, the implications of currency values ripple through import costs, export competitiveness, and inflation visibility.

INR’s strength or weakness against the Euro directly affects trade flows—weaker Rupee prices French products for Indians, while a stronger Rupee makes European imports more affordable, boosting demand. This economic interplay underscores why monitoring CHF in INR matters far beyond publishers’ headlines.

Current exchange benchmarks show 1 CHF ≈ ₹91.70, a figure derived from real-time forex markets at venues like the Reserve Bank of India’s intervention zones and major swap desks.

This rate fluctuates within a narrow band—typically ±3%—driven by differential interest rates, inflation trends, and geopolitical developments. For instance, when the European Central Bank signals rate hikes to combat inflation, the Euro strengthens, making CHF more valuable against EUR. Conversely, rising inflation in India can weaken the Rupee, thus lowering the CHF’s purchasing power within Indian markets.

Tracking these movements helps businesses and households anticipate costs and set budgets in a globally linked economy.

For the average Indian buying imported consumer goods—from French wines to industrial machinery—the CHF–INR rate translates foreign prices into tangible rupee costs. A product priced at €100 becomes ₹9,170 at current rates, influencing spending behavior and market competitiveness.

Importers must hedge currency risk carefully; even a 2% fluctuation can shift profit margins significantly. On the flip side, Indian exporters to Europe benefit when the Rupee weakens—their EUR-denominated goods become cheaper abroad, potentially increasing sales volume. This dynamic interplay highlights the strategic importance of currency valuation in global trade ecosystems.

Investors and economists monitor the CHF–INR ratio as a barometer of market sentiment toward India’s macroeconomic stability. A rising Rupee against the Euro often signals improved investor confidence in Indian growth prospects and fiscal discipline. The Reserve Bank of India (RBI) observes these movements closely, intervening through forex reserves to maintain exchange rate stability and avoid disruptive volatility.

For retail investors, understanding this link allows sharper analysis of currency-linked ETFs, hedging instruments, and cross-border investment returns. In this light, 1 CHF in Rupees transcends a simple numerical figure—it encapsulates complex financial narratives.

Measuring the Exchange Rate: Precision Beyond Spot Rates

The official rate cited—1 CHF → ₹91.70—is the spot rate, the price at which currencies exchange instantly in spot markets.However, in practice, exchange values fluctuate across banks, brokers, and platforms due to bid-ask spreads and service fees. Retail transactions may occur at rates 1–2% below the official spot, especially for smaller amounts or international transfers. Financial institutions, importers, and tourists should compare rates carefully to minimize costs.

Large corporations often use forward contracts or swaps to lock in favorable CHF–INR rates, reducing exposure to volatility.

Impact on Daily Life and Business Strategy

For millions of Indian travelers, digital nomads, and small exporters, exchange rates directly shape budgets and decision-making. A business importing Swiss components for pharmaceuticals must factor CHF depreciation into long-term cost projections.A tourist purchasing French cheese may find their budget stretched if the Rupee weakens against the Euro. Local e-commerce platforms selling European fashion must dynamically adjust prices based on real-time forex data to maintain margins. These micro-decisions collectively fuel macro-level economic resilience and market responsiveness.

Technical Insights: Currency Pair Mechanics and volatility

The EUR/INR pair, represented as CHF in INR in informal usage, reflects currency pairs formed through cross-rate conversions. While direct CHF–INR trading is rare, market participants compute it via intermediate EUR–INR conversion. The Euro’s liquidity and global reserve status influence its volatility more than the Franc’s, given the ECB’s expansive monetary policy.INR’s sensitivity to commodity prices, especially oil, magnifies exchange rate swings. Forecasting trends requires analyzing real-time data on capital flows, trade balances, and central bank interventions—elements that make CHF-INR analysis both rigorous and rewarding.

Looking Ahead: Trends and Challenges

Looking forward, the trajectory of CHF in INR will remain shaped by macroeconomic divergence.India’s evolving interest rate path, inflation expectations, and global capital movements all influence exchange stability. While the RBI prioritizes stability, external shocks—geopolitical tensions, energy crises, or currency wars—pose risks. Financial literacy around currency conversion is more vital than ever.

Empowering traders, exporters, and consumers with timely, accurate CHF–INR insights enables smarter choices in an increasingly integrated world. As global finance evolves, understanding even a single exchange rate becomes both a practical skill and strategic advantage. In essence, 1 CHF in Indian Rupees is far more than a number—it is a gateway to global trade economics, a marker of national financial health, and a critical factor in everyday decisions. From a traveler’s wallet to a corporation’s balance sheet, this exchange rate pulses with real-world significance, demanding attention, clarity, and insight.

Related Post

Unveiling The Intriguing James Marsden Relationship Saga

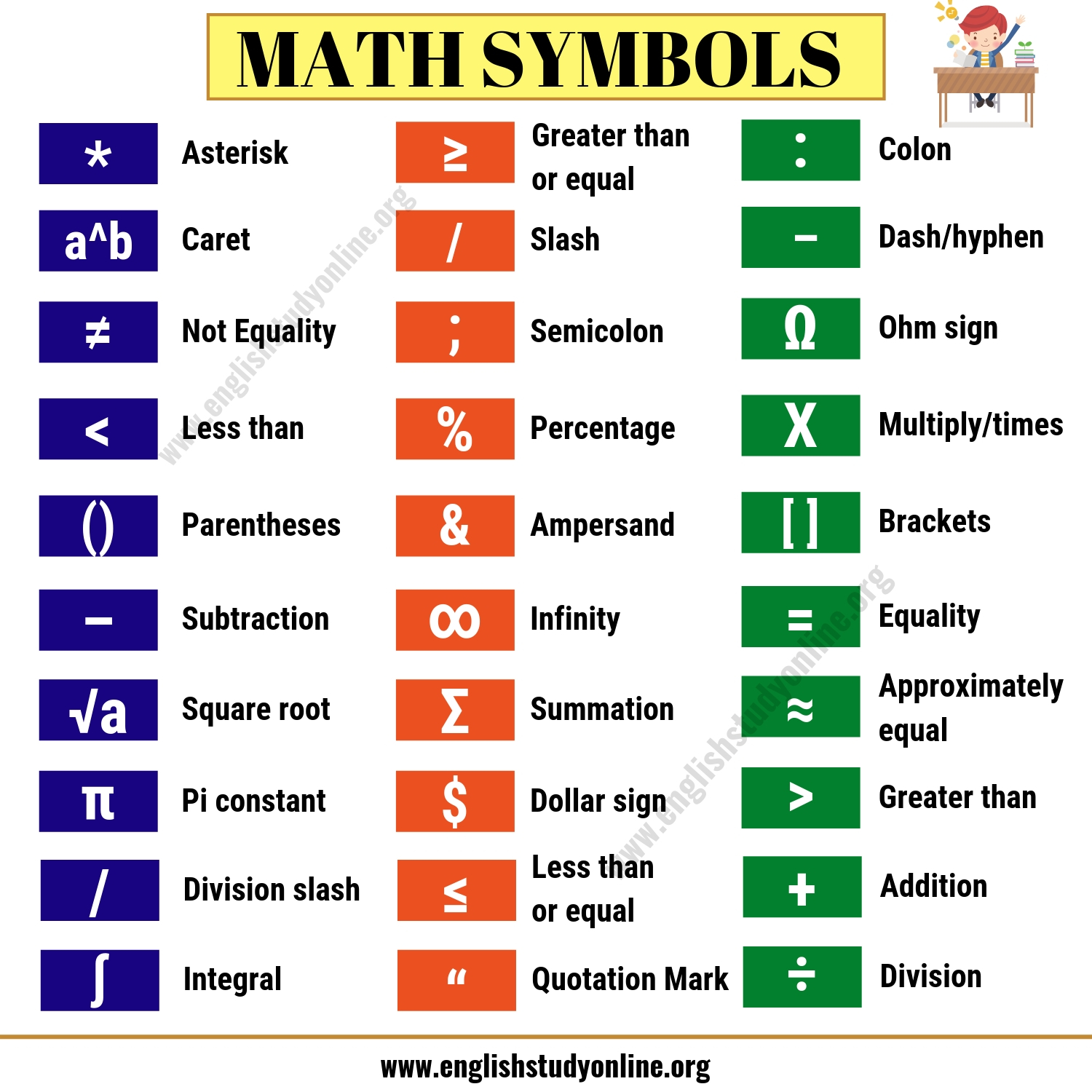

What Does N Mean in Math? Decoding One of Mathematics’ Most Ambiguous Symbols

.jpg)

From Crisis to Cuddles: The Unforgettable Bond Between Liz Landon and Baby Alina