Ohio Unemployment Guide: Unlocking Eligibility and Benefits Before You Apply

Ohio Unemployment Guide: Unlocking Eligibility and Benefits Before You Apply

In times of economic shift, job loss, or industry upheaval, understanding Ohio’s unemployment benefits system is not just prudent—it’s essential. Whether you’ve lost your job through no fault of your own or transitioned careers during a volatile market, Ohio’s unemployment program provides critical financial support to millions. Yet navigating its eligibility criteria, application process, and benefit amounts remains complex.

This guide cuts through the confusion, delivering a clear roadmap to qualifying requirements and tangible benefits available to Ohioans in need.

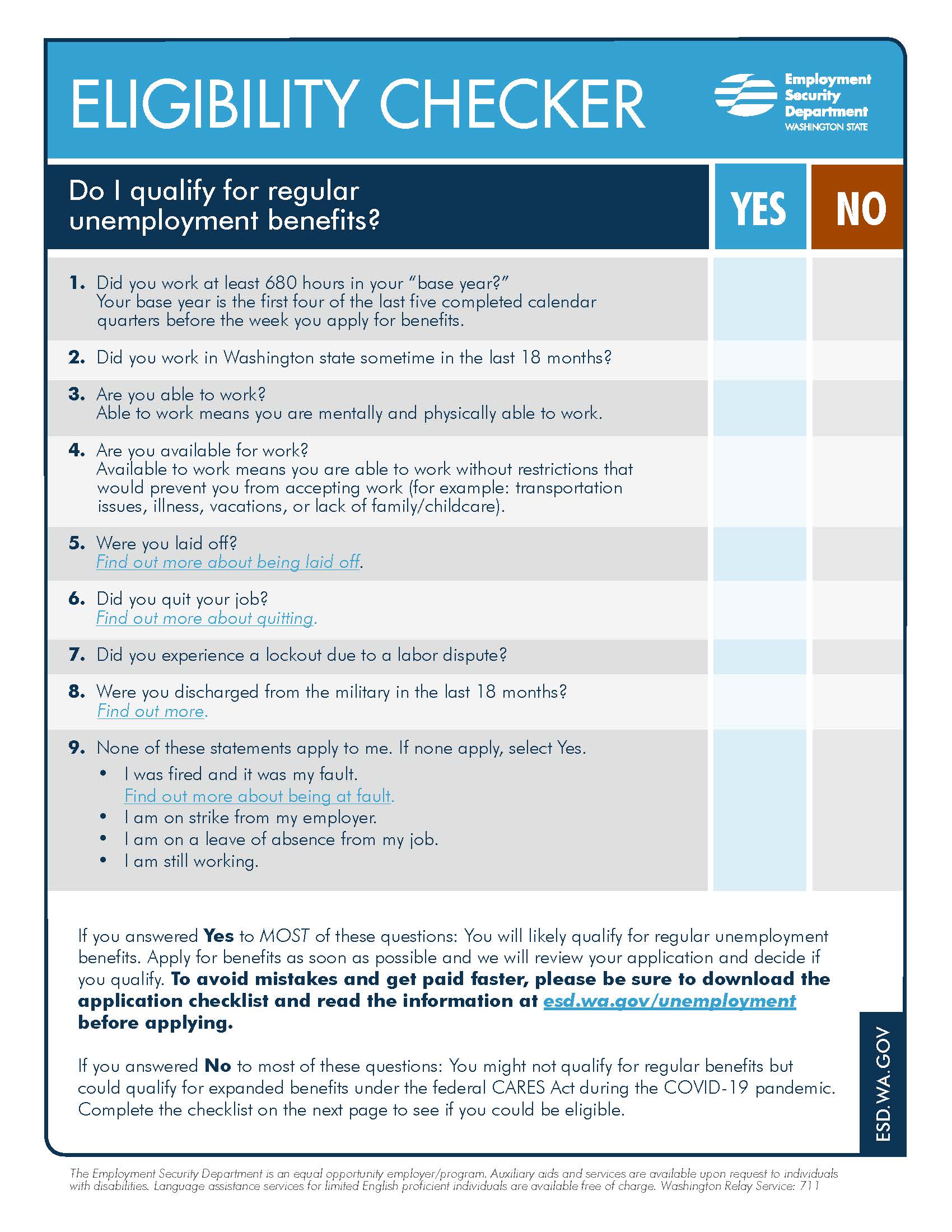

Ohio unemployment benefits are administered by the Ohio Department of Job & Family Services (ODJFS) under its extended benefits program, designed to bridge income gaps while individuals actively seek new employment. For the 2024 benefits season, eligibility hinges on five core requirements:

1.

Ineligibility due to role type—Self-employed individuals, volunteers, interns, and those terminated for cause (such as misconduct, reduction due to economic conditions, or workplace misconduct) generally cannot qualify. wage and hour laws strictly exclude those fired unlawfully.

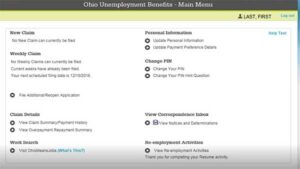

2. Job search obligation—Applicants must actively look for work, document searches, and report progress through the state portal on or before their first factory visit.

3.

Work history threshold—To qualify, individuals typically need at least 1.5 years of employment in the last 20 months, averaging at least 1,050 hours weekly—though partial work histories may still offer limited support.

4. Reasonable efforts to call a central phone line—Unemployed claimants are required to touch base with ODJFS’s unemployment hotline to verify job status and schedule interviews.

5. Residency and income thresholds—Residing within Ohio and meeting part-time or full-time income limits ensures seamless integration with state unemployment records.

The competitive nature of the Ohio unemployment system means knowing exactly what’s available can make all the difference. For eligible claimants, the benefit structure offers meaningful relief: matching 50% of eligible wages, with a maximum weekly payment capped at $578 as of 2024, based on earned income during a base period. Benefits generally last through 26 weeks, though extended periods may be granted during economic downturns or for workers facing long-term unemployment—identifiable under the program’s Special Benefit Initiative.

Workers in high-demand sectors like healthcare, IT, and manufacturing often qualify faster, reflecting Ohio’s evolving labor needs.

Step-by-Step Eligibility Requirements: From Application to Approval

To qualify, applicants must meet precise hurdles outlined by Ohio state law. Understanding these components ensures timely and accurate submissions, reducing delays.- Verify Employment Status: Ohio tracks work history via the National Employment Database and self-reported employment.

Self-employed or gig workers must provide tax records, W-2s, or 1099s to prove job tenure.

- Meet the 80% Employment Test: Claimants must demonstrate that lost work stems from a qualifying separation—unemployment caused by employer reduction, chemical discharge, or mandated layoffs tied to business closure. Wage and hour guidelines strictly disqualify those fired for performance, insubordination, or policy violations.

- Document Eligibility With Evidence: Submit pay stubs, tax returns (1040 or 1099), and employer exit letters to establish income and

Related Post

Diana Zubiri And: A Trailblazer Reshaping Modern Finance and Leadership

Colton Shone KOB Bio Wiki Age Height Wife Son Salary and Net Worth

Ashley Soriano Fox News Bio Wiki Age Married Salary and Net Worth

Jago Tree: The Sustainable Innovation Reshaping Urban Landscapes