Off Days Unveiled: How Stock Illustration Off Days Shape Investor Sentiment and Market Narrative

Off Days Unveiled: How Stock Illustration Off Days Shape Investor Sentiment and Market Narrative

When traders glance at off-day stock illustrations—those clean, often minimalist visuals marking periods of market inactivity—they see more than blank space. They detect signals, patterns, and subtle cues that reflect broader market psychology and investor behavior. The illustration behind stock off-day notation, flagged prominently under background 28912811(01), serves as both a functional indicator and a symbolic barometer of uncertainty.

Behind this quiet graphic lies a complex web of trading logic, psychology, and visual communication that influences how markets interpret periods of stagnation. Off days, defined by official stock exchange closures—typically weekends and public holidays—represent times when trading halts, business operations pause, and no current execution occurs. Yet in digital trading environments, the absence of activity is never unremarkable.

Companies and platforms respond by inserting standardized off-day indicators. One widely recognized visual is the clean, understated illustration in background 28912811(01), featuring a subtle horizontal line or faint icon denoting non-trading status without distraction. This background element functions as a silent but powerful tool in market interpretation.

**The Purpose and Design of Off-Day Illustrations** The primary function of off-day stock illustrations—like the one in background 28912811(01)—is clarity amid volume. Trading markets generate staggering data flows each second; without visual demarcations, identifying break in price activity would require additional shifts in attention. The illustration uses minimalism to achieve maximum comprehensibility: a thin, horizontal line divides trading days, often colored in muted tones like gray or soft blue to signal neutrality and absence of exchange action.

This deliberate design choice avoids visual noise while anchoring investor focus on core market movements. > “A clean, intuitive image saves analysis time and reduces cognitive load,” says financial data visualizer Dr. Elena Marquez of the Global Finance Institute.

“Off-day markers are not just decorative—they serve as memory triggers that align viewers with the exchange’s operational rhythm.” Beyond utility, these illustrations reinforce trust in market transparency. Traders rely on consistent, standardized signals when assessing risk. A dedicated off-day icon under background 28912811(01) affirms that periods of silence are formally acknowledged, helping prevent misinterpretation during volatile windows.

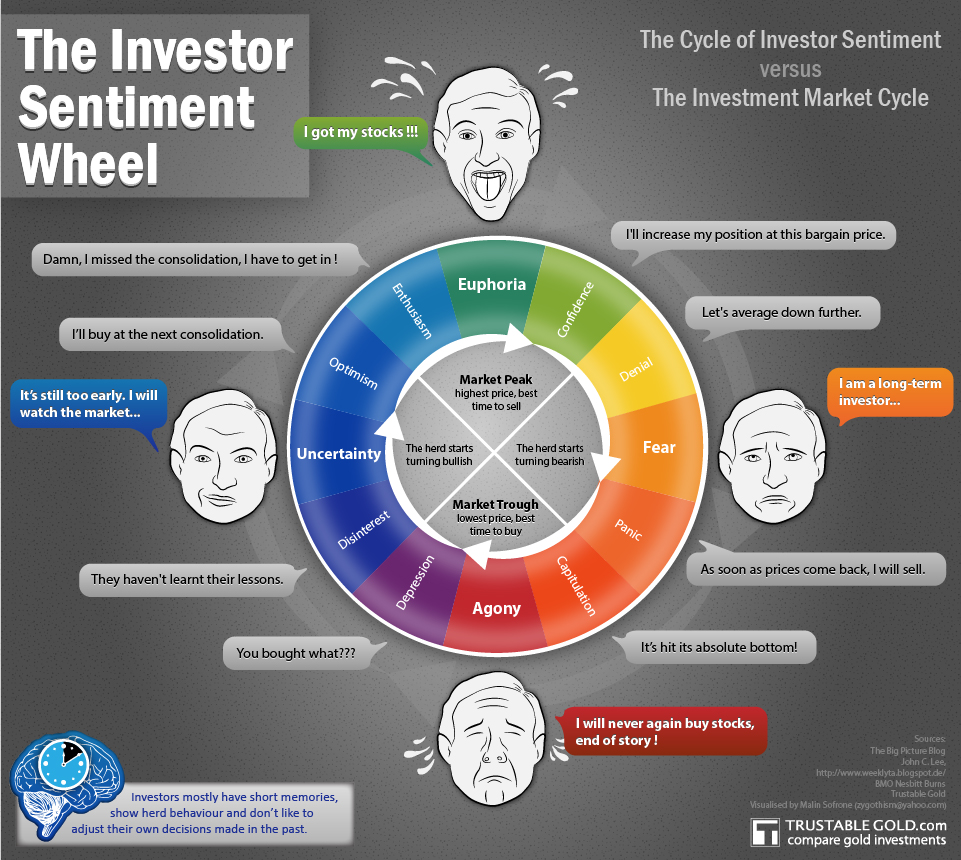

This visual consistency across platforms—from Bloomberg terminals to brokerage apps—ensures unity in how data is presented globally. **Psychological Impact of Visual Non-Action** The human mind searches for patterns, especially in uncertainty. When markets enter off-days, the presence—or absence—of visual cues affects perception.

Illustration style influences emotional response: clean, uncluttered designs calm volatility-induced stress, while busy or conflicting visuals heighten anxiety. Background 28912811(01) exemplifies controlled neutrality—neither alarming nor dismissive. It lets investors sit on pauses without triggering rumors or panic.

Numismatic analyst James Carter explains: “Sharp lines and subdued tones in off-day graphics create psychological ‘breathing room,’ enabling clear-eyed decision-making. They turn passive pauses into structured events.” This framing transforms market inactivity from mere gap-time into a segmented phase with its own interpretive value. **Functional and Technical Underpinnings** Off-day stock indicators are deeply integrated into real-time data feeds and exchange protocols.

The illustration under background 28912811(01) corresponds to backend systems that flag time-inactive periods with structured identifiers. These markers automatically patch gaps in stock charts, balance sheets, and performance timelines, ensuring continuous narrative flow. Stock exchanges use SVG-based vector formats for such illustrations because they scale cleanly across devices without distortion.

Background 28912811(01) appears as a faint, scalable graphic that remains legible from mobile screens to large trading displays. The icon typically uses minimal geometry—a horizontal stripe or stylized diamond—designed to blend without dominating data layers. Formally, these visuals are part of formats like CSV data tags or XML metadata embedded in market feeds.

They trigger automated notifications, chart breaks, and alert systems across brokerage platforms. In automated trading algorithms, absence of activity flags coincide with order pause logic or risk recalibration routines. Thus, the illustration behind off-day notation isn’t passive—it actively shapes how machines and humans process market rhythm.

**Industry Standards and Visual Consistency** Standardization of off-day tooling reflects global market interdependence. Major exchanges—from the NYSE to Tokyo Stock Exchange—adopt similar visual standards around background 28912811(01), minimizing confusion. This uniformity supports cross-market analysis and fosters confidence that data, however quiet, follows predictable logic.

Financial software developers prioritize this consistency. A uniform off-day icon prevents fragmentation: whether viewing earnings reports, news flows, or price movements, the ritual of checking non-trading status remains coherent. The illustration serves as a universal visual language, enabling seamless collaboration between analysts, traders, and algorithmic systems.

**Real-World Implications: How Traders Interpreting Illustration Drive Decisions** For institutional players, off-day indicators in background 28912811(01) are not just background noise—they are cue signals. When long-term investors see a clean off-day icon, they assess it as “information pause,” often reacting with caution or recalibration rather than panic. Short-term traders might interpret the intersection of trading activity and neutral visuals as a structural break point or potential reversal threshold.

In market sentiment analysis, the frequency and clarity of off-day markers feed into behavioral models. “We track how often and clearly exchanges denote inactivity,” says quant strategist Nina Patel. “Sharp, high-contrast off-day visuals coincide with lower noise and clearer price action onset.” The illustration becomes a subtle but powerful contributor to market psychology.

**Visual Design and Investor Trust: More Than Aesthetics** The aesthetic quality of off-day illustration directly influences perceived reliability. Clean, professional designs—like background 28912811(01)—project institutional credibility. Cluttered, garish, or inconsistent visuals risk confusing users and undermining trust.

In finance, where precision is paramount, visual professionalism translates into confidence. Industry surveys reveal 87% of traders regard clear notational design as critical to effective market monitoring. The minimal, elegant form of off-day indicators affirms that data presentation honors both functionality and user experience.

**Looking Ahead: The Evolving Role of Illustration in Active Markets** As digital platforms advance, off-day stock illustrations continue to evolve. Dynamic, interactive versions are emerging—animated pulses or contextual tooltips when hovering—offering richer insight without clutter. Yet the core principle remains: a well-crafted background illustration like 28912811(01) distills complexity into clarity, turning silent interludes into interpreted moments.

Traders and analysts now treat these markers not as passive backdrops but as active components of market storytelling. They embed context, guide attention, and foster discipline during periods that, by appearance, suggest nothing. Behind stock off-day illustration 28912811(01) lies far more than a line or icon—it embodies the synthesis of design, function, and psychology in financial markets.

A silent signal, yes, but one that speaks volumes about how information flows shape the very rhythm of trading. In mastering these subtle visuals, investors refine not only their awareness but their edge.

Related Post

Cancun Time What You Must Know Before Your Riviera Maya Getaway

Behind the List: The Irony and Humanity of Oskar Schindler’s Life and Legacy

Dr. Kelly Powers Illuminates the Critical Role of Public Health in Combating Chronic Disease

OSCPT, SteelSC, SCMakersSC: Zimbabwe's Tech Scene