NYC Property Tax A Comprehensive Guide: Demystifying the Cities Most Complex Fiscal Landscape

NYC Property Tax A Comprehensive Guide: Demystifying the Cities Most Complex Fiscal Landscape

Navigating New York City’s property tax system is less a matter of luck and more one of mastery—where evaluation thresholds, exemptions, and density of borough-specific rules shape real estate outcomes for millions of homeowners, landlords, and investors. With Manhattan’s sky-high valuations, Brooklyn’s evolving neighborhoods, and Queens’ sprawling diversity, understanding how property taxes are calculated, assessed, and paid is essential to financial clarity and strategic decision-making. This definitive guide unpacks the layers of NYC’s property taxation, revealing key mechanisms, common misconceptions, and actionable insights to help property owners navigate one of America’s most intricate urban tax environments.

Understanding the Core: How NYC Property Taxes Are Calculated

At the heart of New York City’s property tax system lies the assessed value of real estate, determined by local authorities using a formula rooted in fair market value, but adjusted by statutory limitations.

Every year, the Department of Finance apportions revenue needs, then allocates them across the city’s approximately 1.2 million taxable properties. Tax homeowners pay a rate expressed in mills: one mill equals $1 per $1,000 of assessed value. For example, a home assessed at $1 million in a borough where the millage rate is 10.8 yields an annual tax bill of $108,000.

The assessment process begins with the Office of the Deputy Mayor for Housing and Economic Development submitting property reports, verified through satellite imagery, public records, and on-site inspections. The assessing agency applies depreciation factors, neighborhood adjustments, and exemptions to derive the final taxable assessment. Crucially, NYS laws—especially the Real Property Tax Law and Local Law 79—cap annual assessment increases (typically 3–5% or CPI, whichever is lower), creating a stabilizing force against sudden valuation surges.

“Property taxes shouldn’t be a surprise,” says Michael Chen, a tax specialist with NYC Property Advisors. “Understanding your annual tax bill starts with knowing how your assessment is determined—especially the role of contested cases and appeal rights.”

Evaluating Rates: Municipal, Local, and Special Districts

New York City’s tax burden is never a single figure; it’s a mosaic of overlapping levies from multiple authorities. The primary rate is set by the City’s tax rates, officially mandated annually by the State Legislature and enforced by the Department of Finance.

As of 2024, the citywide base rate sits just above 1%, but this rises dramatically when combined with local taxes and special district charges. - **City Tax Rate:** Reflects overall municipal revenue needs for services like transit, policing, and sanitation. It’s the anchor, but more than half of total taxes come from supplementary layers.

- **District and Infrastructure Levies:** Special assessments fund local improvements. For example, NYC’s 2023–2024 capital plan allocated $2.3 billion across boroughs for MTA upgrades, green infrastructure, and street resiliency—costs passed directly to property owners in targeted zones. - **Exit Tax and Alternate Residence Taxes:** Non-resident owners face additional levies, including NYC’s Exit Tax on relinquished properties, aimed at discouraging tax avoidance.

- **Rent Parcel Tax (RPT):** Apply to rental properties above $2 million, calculated at a flat rate but scaled with assessed value, creating further nuance for investors. “Homeowners often overlook the sum of these layers—it’s these incremental costs that can turn a manageable $10,000 bill into $25,000,” warns tax counselor Elena Ruiz. “Every transaction, renovation, or relocation shifts your tax exposure.”

Exemptions, Deductions, and Relief Programs

While NYC’s system is demanding, it also offers targeted relief to ease burdens on vulnerable groups.

These exemptions reflect both equity goals and policy priorities: protecting seniors, stimulating homeownership, and supporting affordable housing. - **Homestead Exemption:** Applies to primary residences, reducing assessed value by up to $23,000 (progressive scale for married couples). - **Senior Tax Relief:** Seniors 65+ may qualify for deferrals or full exemptions through the city’s Abatement Program, easing cash flow as fixed incomes plateau.

- **Disability and Low-Income Relief:** Residents with disabilities or incomes below 80% of area median can receive partial or full abatements on assessed value. - **Affordable Housing Complexes:** Properties designated as affordable contribute to tax caps to support long-term rent stability. - **Historic and Artistic Property Exemptions:** Buildings with landmark status or cultural significance may qualify for reduced assessments.

“Missing a qualifying exemption can cost thousands,” notes Ruiz.

Related Post

Florence Elsie Ellis Is Tom Ellis Daughter With Tamzin Outhwaite

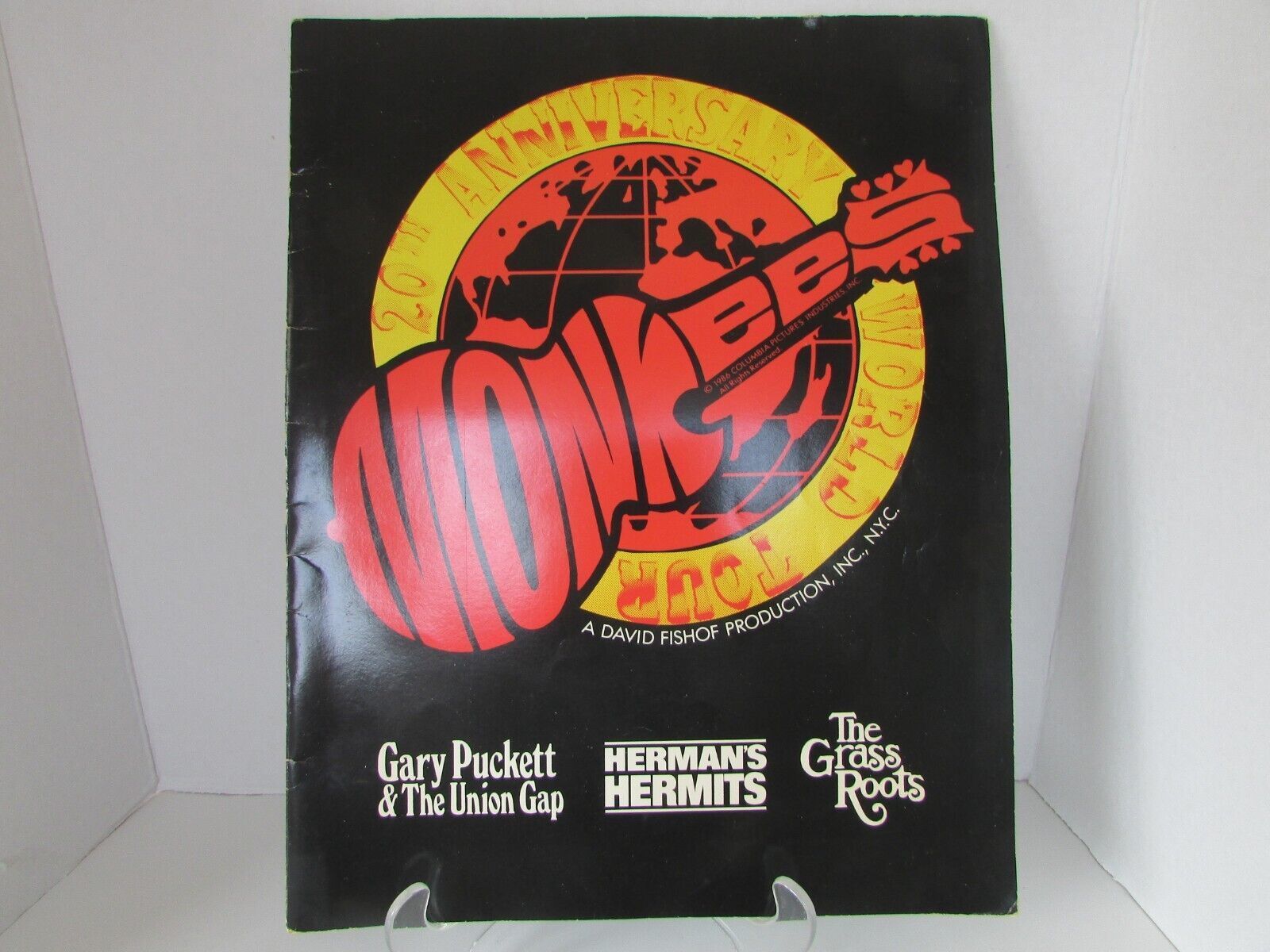

Puckett: A Name With Roots Deep in Southern Heritage and History

Bangkok Tattoo Tigers PNG: Where Urban Jungle Meets Ink and Identity

Analyzing the Vital Landscape of Temperature Controlled Storage Units Near Me