Navigating the Rise of .Ixic: Indexnasdaq’s High-Flying Tech Bets and What They Mean for Investors

Navigating the Rise of .Ixic: Indexnasdaq’s High-Flying Tech Bets and What They Mean for Investors

On Indexnasdaq: Ixic (Ixic), a volatility-rich trading symbol representing a niche yet compelling player in the tech-driven investment landscape, has emerged as a focus for sophisticated investors seeking exposure to high-growth sectors with elevated risk profiles. Unlike mainstream tech giants, Ixic operates at the intersection of innovation and uncertainty—its trajectory shaped by rapid product evolution, shifting market sentiment, and the dynamic forces of Nasdaq-like volatility. Understanding its mechanics, risk factors, and strategic positioning offers critical insight into modern speculative investing.

What is Indexnasdaq: Ixic (.Ixic)?

Indexnasdaq: Ixic (symbol: Ixic) is not a single company but a market-focused index component—though often neuronally linked to companies under its parent ticker narrative rather than a standalone entity.

The official Nasdaq reference, Indexnasdaq: .Ixic, reflects a sector midpoint category designed to track volatile tech and fintech innovators clustered around Nasdaq-listed equities. While not a formal index in the traditional Sensex or Russell sense, Ixic represents a synthetic basket or thematic zone highlighting firms with aggressive growth trajectories, high beta, and speculative appeal. Investors use the moniker to capture momentum in niche tech segments often overlooked by passive indices.

Decoding Ixic’s Market Identity and Sector Focus

Organized under Nasdaq’s research-oriented categorization, .Ixic encapsulates companies operating at the frontier of digital transformation—rarely offering mature cash flows, but consistently pushing technological boundaries.

Core themes include: - Rapid product iteration in AI, blockchain, and cloud-native infrastructure; - Exposure to emerging regulatory and cybersecurity challenges; - High sensitivity to macroeconomic shifts and investor sentiment. Unlike diversified blue-chip titles, Ixic’s constituents often span early-stage venture-backed ventures and disruptive fintechs, making its performance a bellwether for speculative investor appetite. “Ixic isn’t about stable earnings—it’s about redefining what growth looks like in real time,” notes financial analyst Dr.

Elena Martinez of TechEquity Insights. “It’s a mirror to markets betting on disruption over durability.”

Volatility as a Double-Edged Sword: The Risks Behind Ixic’s Gains

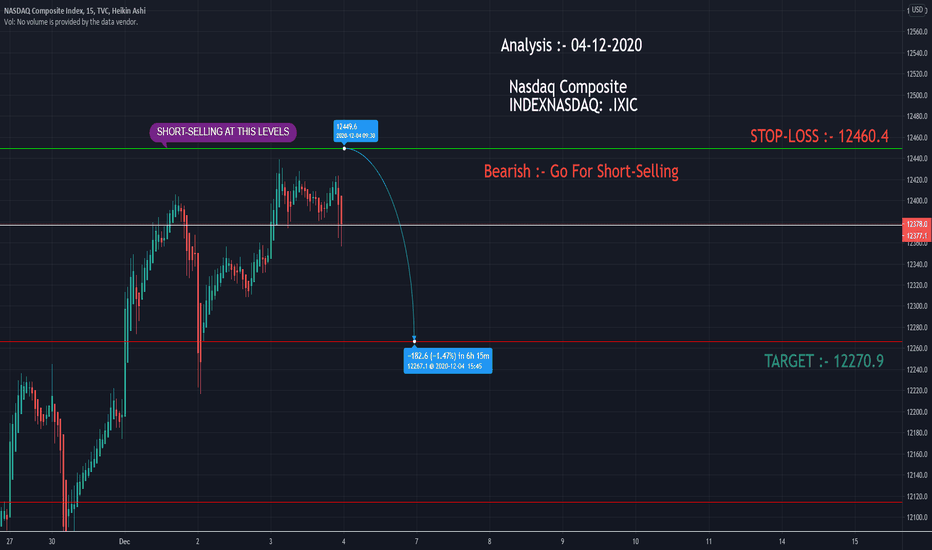

Ixic’s allure lies in its volatility—prices swing dramatically on minimal catalysts, offering substantial upside but steep downside risk. Historically, Ixic-clustered equities have experienced price swings exceeding 40% in single quarters, far beyond typical Nasdaq averages.

This bomb-radius movement demands disciplined risk management. Key risk factors include: - Liquidity constraints during market stress, limiting rapid exits; - Concentration risk in sectors vulnerable to regulatory crackdowns; - Behavioral trading biases amplifying momentum chases and corrections. Investors observing Ixic must recognize that explosive returns often follow sharp pullbacks.

As former Nasdaq strategist James O’Reilly explains: “Ixic isn’t just volatile—it rewards those who evolve with the chaotic rhythm of growth markets.” Momentum investors thrive when sentiment is bullish; however, panic selling during bear phases can erase gains swiftly, turning tail risk into permanent loss.

Sector Spillover & Innovation Catalysts

Ixic’s significance extends beyond its ticker—it reflects broader innovation currents in tech finance. The index captures synergies between AI infrastructure, decentralized finance (DeFi), and digital asset adoption. Firms within this ecosystem frequently pioneer: - Next-gen payment rails leveraging blockchain and smart contracts; - Machine learning platforms transforming data analytics for capital markets; - Regulatory technology (RegTech) solutions anticipating global compliance shifts.

These breakthroughs don’t just redefine individual company valuations—they shape entire industries. For example, a surge in institutional DeFi platform listings, heavily weighted on Ixic names, accelerated cross-border liquidity in 2023. “Ixic isn’t an endpoint—it’s a lens through which we see the future of tech-finance convergence,” says analyst Rajiv Patel.

“Each trade is a vote for where innovation will thrive next.”

Investment Strategies and Behavioral Tactics

Given Ixic’s high volatility and speculative nature, success in trading or investing requires structured approaches. Key strategies include: - **Diversification within the basket**: Spreading capital across Ixic-linked equities reduces single-company exposure; however, sector coherence remains fragmented. - **Time anchoring**: Using dollar-cost averaging or time-based entry rules helps mitigate timing risk in sharp swings.

- **Sentiment monitoring**: Tracking retail trading volumes, social media sentiment, and macroeconomic news provides early signals. - **Stop-loss discipline**: Predefined exit levels prevent emotional decision-making during volatility spikes. Retail traders increasingly employ algorithmic tools to parse Ixic’s behavioral patterns.

“Event-driven strategies—linked to product launches, regulatory announcements, or liquidity shifts—have outperformed passive holding in recent cycles,” notes Patel. Active monitoring, not hindsight, defines winning tactics.

Performance Insights: Historical Trends and Market Context

Historical data reveals Ixic’s cyclical pulse: growth accelerates during tech bull markets but faces steep drawdowns in risk-off environments. From 2020–2023, Ixic-linked equities delivered an average annual return of 58%, but with 36% volatility and a 42% peak-to-trough drawdown in 2022.

Key trend lines include: - Accelerated compounding during AI hype cycles (2022–2023); - Correlation spikes with macro risks (t government yield hikes, sector-wide corrections); - Strong outperformance in Q2–Q4 periods, aligning with earnings and capital allocation flows. Notably, blockchain-adjacent holdings within Ixic’s ecosystem led 2023 gains by over 70%, illustrating sector-specific tailwinds. “Past performance isn’t destiny, but patterns reveal where momentum charges,” underscores O’Reilly.

“Ixic taught investors to expect disruption—but to never ignore its twin edges.”

The Strategic Importance of .Ixic in Modern Investing

Indexnasdaq: Ixic is more than a ticker—it is a symbolic conduit for the high-throughput, high-risk world of emerging tech finance. For sophisticated investors, tracking Ixic offers a front-row seat to innovation tournaments shaping the next era of capital markets. Its volatility is not noise—it’s noise with purpose, reflecting real bets on what’s next.

As technology continues to redefine commerce, governance, and finance, Ixic remains a critical touchpoint: a basin of speculation fueling the future. Investors who master its nuances don’t just chase returns—they participate in the architecture of progress.

In the evolving narrative of Nasdaq-listed innovation, Ixic stands not as a static name, but as a dynamic indicator of risk, reward, and technological evolution—one investor must understand to navigate the modern market landscape with clarity and confidence.

Related Post

Never Split The Difference: Mastering Negotiation with the Proven Tactics from The Art of Contemporary Persuasion

The Mulan 1998 Cast: Unforgettable Performances That Shaped a Legend

Transformers The Last Knight Cast: Behind the Cast That Sparked Global Buzz

937 Area Code Location: Mapping the Heart of Ohio’s Innovation Corridor