National Bank of America: Price of Trust in America’s Financial Backbone

National Bank of America: Price of Trust in America’s Financial Backbone

From commanding one of the largest banking footprints in the United States to serving millions of customers with trusted financial solutions, the National Bank of America stands as a defining force in American banking. With over 3,800 branches nationwide and a digital platform catering to evolving consumer needs, the institution merges century-old legacy with modern innovation. This comprehensive guide unpacks National Bank of America’s history, services, technological edge, financial performance, and enduring role in American economic life—offering readers a detailed roadmap through its vast and influential operations.

Origins and Evolution: From Regional Roots to National Powerhouse

Founded in 1859 as the First National Bank of Brandon, Vermont, the institution that would become National Bank of America grew through strategic mergers and steady expansion. What began as a small regional bank gradually transformed under the stewardship of evolving leadership, absorbing key players like Security National Bank in the 1980s and later absorbing numerous smaller institutions throughout the 1990s and 2000s. These moves positioned the bank to compete on a national scale, culminating in the formal branding under the National Bank of America name—symbolizing both scale and stability.By today’s standards, National Bank operates not just as a retail bank but as a multifaceted financial services provider with commercial, corporate, and investment arms. Its resilient evolution mirrors broader shifts in American finance, adapting to regulatory changes, technological disruption, and changing customer behaviors.

Core Services: A One-Stop Financial Solution

National Bank of America’s service portfolio is broad, designed to meet the diverse financial needs of individuals and businesses alike.Key offerings include: - **Retail Banking**: Checking and savings accounts, mortgages, auto loans, and personal lines of credit, backed by personalized customer service and competitive interest rates. - **Commercial and Institutional Banking**: Tailored lending solutions, cash management, trade finance, and structured investments for mid-sized to large enterprises. - **Wealth and Investment Management**: A suite of private banking, retirement planning, and portfolio management services for high-net-worth individuals and institutional clients.

- **Digital Banking**: A user-friendly mobile platform and online banking tools enabling real-time transactions, bill pay, budgeting, and secure account access. “A one-stop bank where every financial need is met with speed, security, and expert guidance,” says a 2023 internal statement. “Whether you’re financing a home or growing a business, National Bank delivers both reliability and innovation.”

Technology and Innovation: Powered by FeatherDale and Beyond

At the heart of National Bank’s competitive edge lies a robust technology infrastructure.The bank invested heavily in what’s known internally as the FeatherDale platform—a suite of core banking systems reimagined for agility, scalability, and cybersecurity. This foundation supports real-time transaction processing, omnichannel experiences, and advanced data analytics that inform personalized customer engagement. Key technological strengths include: - **AI and Machine Learning**: Used for fraud detection, credit risk assessment, and chatbot-driven customer support, reducing response times and enhancing security.

- **Mobile-First Design**: The bank’s app consistently ranks among the top-rated in usability, offering features like fractional investing, instant deposit scanning, and AI-driven financial planning tools. - **Cloud and Data Integration**: Multi-cloud environments ensure resilience and flexibility, while centralized data insights empower smarter decision-making across lending, marketing, and compliance. “Technology is not just an enabler—it’s the backbone of trust,” notes a senior executive.

“By embedding intelligence at every layer of our operations, we don’t just follow trends; we shape them.”

Financial Resilience and Performance

National Bank of America demonstrates enduring financial strength, reflected in its capital adequacy, asset quality, and consistent profitability. As of its most recent annual report, the bank reported total assets exceeding $800 billion and a Tier 1 capital ratio well above regulatory minimums—benchmarks indicating robust financial health. Credit quality remains a focus area: portfolio loan loss provisions are closely monitored, with diversified lending across consumer, commercial, and securitized markets mitigating risk.Recent earnings highlight steady revenue growth, driven by fee income from investment services and interest margins that benefited from the Federal Reserve’s steady rate policy over recent years. Financial analyst Jamie Reynolds Comments: “National Bank balances size and efficiency better than most regional peers. Its diversified revenue streams and disciplined risk management position it strongly for sustained performance through economic cycles.”

Customer Trust and Community Commitment

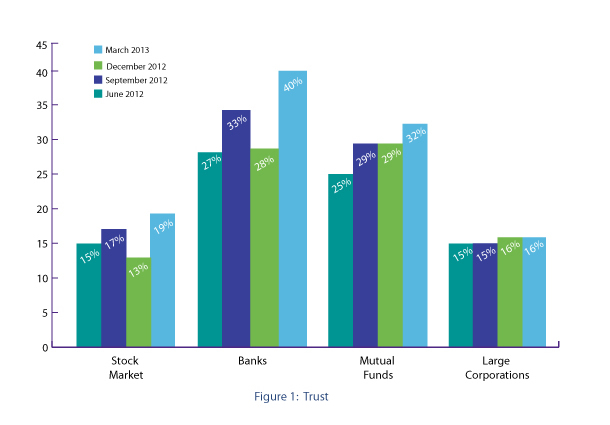

Beyond balance sheets and market share, National Bank of America cultivates trust through community investment and ethical banking practices.Through its $1 billion Community Renewal initiative, the bank supports affordable housing, small business development, and financial literacy programs across underserved markets. Local branch staff frequently lead neighborhood workshops on credit management and homeownership—bridging the gap between digital change and personal finance education. “Trust isn’t built in boardrooms—it’s earned in community interaction,” observes a branch manager in a field report.

“When someone helps open a child’s savings account or explains a mortgage in plain language, that’s how we earn loyalty." Moreover, the bank’s commitment to ESG (environmental, social, and governance) principles influences lending priorities, favoring sustainable infrastructure and inclusive financial products.

A Legacy That Adapts: Looking to the Future

National Bank of America’s trajectory illustrates the power of continuity and innovation. From its humble beginnings to its current role as a cornerstone of American finance, the institution balances tradition with forward-looking strategy.Its verified strengths—massive but agile infrastructure, human-centered service, and community roots—set it apart in an era of rapid fintech disruption. As financial landscapes evolve, so too does National Bank, integrating emerging technologies while preserving the stability that has long defined its reputation. For customers seeking reliability, innovation, and a partner that grows with them, National Bank of America remains not just a financial institution, but a trusted steward of economic progress.

In an age where trust is both currency and challenge, National Bank of America stands resilient—proof that enduring value comes from listening, adapting, and delivering consistently.

Related Post

Discover the Game-Changing Secret to the Perfect Mayocue Sauce That’s Revolutionizing Dipping Forever

David Sandlin: The Rising Star in Digital Media — Age, Height, Family, and Career Backstory

Crayator Bio Age Wiki Net worth Height Real name Girlfriend

Nick Clicker’s Mind-Blowing Journey: From ClickMadness to Champions of Quirky Gaming