Michigan Sales Tax: Essential Insights Every Seller Must Master

Michigan Sales Tax: Essential Insights Every Seller Must Master

Navigating Michigan’s sales tax landscape isn’t just a regulatory obligation—it’s a strategic imperative. With rising compliance demands and frequent policy shifts, sellers must understand the fundamentals of Michigan’s tax structure to avoid costly mistakes and streamline operations. This comprehensive guide breaks down the core requirements, registration steps, exemption nuances, and digital transformation shaping modern tax compliance across the state.

Michigan enforces a statewide sales tax of 6%, in addition to local option taxes that range from 0% to 3% depending on the county and municipality. Unlike some states with complex tiered systems, Michigan’s simplicity belies hidden complexity: every transaction, from wholesale purchases to digital goods, demands precise tax calculation and reporting. For sellers, especially those operating across state lines or selling online, this precision isn’t optional—it’s critical.

Who Is Subject to Michigan Sales Tax?

Sellers in Michigan must understand the threshold rules that determine tax liability.Although Michigan does not impose a gross receipts tax, most businesses selling tangible personal property, services, and certain digital products are subject to sales tax under Michigan Public Record Act (MPRA). “Once you cross $10,000 in annual sales volume within a county, you’re required to register and collect sales tax,” explains tax compliance specialist Greg LaRue. “This threshold applies even to out-of-state sellers with Michigan customers.”

- Products and Services Triggered by Tax: Tangible goods, custom clothing, furniture, appliances, and certain repair services fall under Michigan’s tax net.

Notably, groceries are exempt; packaging and wholesale transfers are typically taxable.

- Exemptions and Exceptions: Nonprofits, educational institutions, and certain government agencies benefit from full or partial exemptions. Charitable organizations must file a certificate to qualify, and manufacturers may reclaim taxes on qualifying business inputs.

- Online Sales and Remote Sellers: Since 2019, Michigan has collected sales tax from remote sellers under the economic nexus standard. Sellers meeting the $100,000 threshold or 200 transaction rule in any county must collect tax, regardless of physical presence.

Registration and Compliance: Setting Up For Success

Proper registration is the first operational hurdle.Every required seller must register with the Michigan Department of Licensing and Regulatory Affairs (LARA) through its online portal. Key steps include: - Verifying business structure (LLC, sole proprietorship, corporation) - Submitting valid tax IDs and state-specific forms - Designating authorized resellers or tax-exempt status where applicable - Specifying geographic boundaries for collection authority

“Registration isn’t a one-time box—nowhere is it simpler,” says LARA compliance officer Lisa Tran. “But failing to maintain accurate records or miss renewal deadlines can lead to penalties, interest, and lost credibility.”Failing to register—even unintentionally—exposes sellers to back taxes and interest.

The department reports timely filings are crucial, especially when transactions cross jurisdictional lines or fluctuate seasonally.

Tax Rates: Decoding Multiplicative Complexity

Michigan’s flat 6% state rate stands as a foundation—but local option taxes transform the effective rate in many regions. For illustration: - In Genesee County (Ann Arbor), total sales tax reaches 9.25% - In Macomb County (near Detroit), rates peak around 9.375% with local surcharges These layered taxes mean sellers must apply the correct regional rate based on the buyer’s location.“Digital tools handle calculations, but understanding the mapping is non-negotiable,” emphasizes tax consultant Mark Benson. “Misapplying a 6% rate where 8% is due can cost thousands per year.” “Precision beats perfection,” says Benson. “Even a 0.25% miscalculation compounds quickly—especially with high-volume or international sales.”

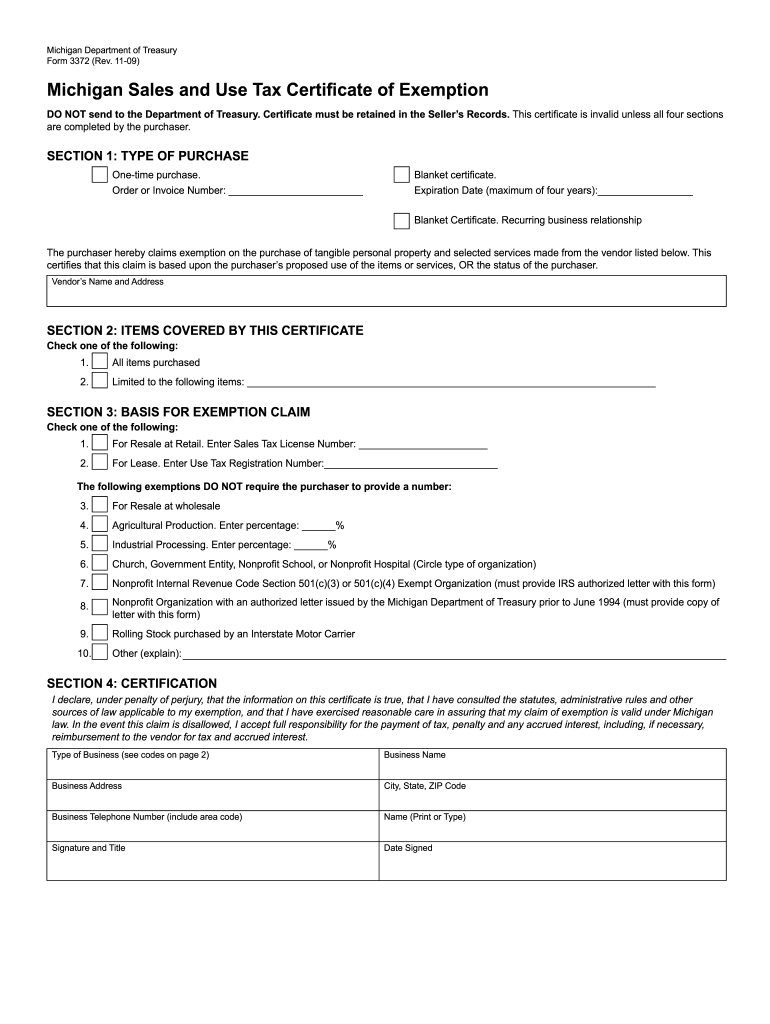

Exemptions and Documentation: Protecting Your Business

Claiming exemptions can significantly reduce tax exposure but require rigorous documentation.

Common exemptions include: - Resale certificates for B2B sellers - Medical device exclusions - Agricultural equipment - Charitable contributions

- Always request written proof from customers requesting exemption.

- Store exemption certificates securely and update records promptly.

- Verify nonprofit status with state certification to avoid audits.

The Digital Era: E-Commerce and Automation Tools

The rise of online marketplaces has redefined sales tax administration.Automated systems like Avalara, TaxJar, and TaxFortress now integrate directly with Shopify, QuickBooks, and Salesforce, ensuring real-time tax calculations and filings across jurisdictions. Key Benefits of Automated Software: - Zero manual data entry and reduction of human error - Alerts for regulatory changes (e.g., new local rates or exemption rules) - Centralized reporting for state and federal compliance - Scalable support for growing businesses or multi-channel sales

Common Pitfalls and How to Avoid Them

Despite training, sellers frequently stumble over: - Assuming all counties have the same local tax rate - Ignoring new state legislation e.g., updated exemption categories or updated threshold rules - Failing to update tax codes when relocating or expanding within Michigan - Underreporting multi-jurisdictional sales without collecting the correct mix of taxes“Most issues aren’t intentional—they’re preventable,” says LaRue. “Invest in training, use reliable tools, and schedule periodic compliance check-ups.”Regular internal audits, quarterly reviews, and collaboration with certified tax advisors turn compliance from a chore into a strategic advantage.

Looking Ahead: Trends Shaping Michigan Sales Tax Compliance

Michigan’s Department of Revenue continues refining rules to catch up with digital commerce evolution.Upcoming trends include enhanced data sharing between states, expanded nexus reporting for click-based businesses, and tighter integration with digital wallet transactions. Sellers must stay agile—what’s compliant today may shift tomorrow.

“Future readiness starts now,” advises compliance expert Mark Benson.As remote selling grows and regulations evolve, a deep, actionable understanding of Michigan sales tax isn’t optional—it’s foundational. Sellers who master these elements protect their bottom line, build operational resilience, and position themselves to scale confidently in an increasingly complex marketplace. In a state where simplicity masks strategic depth, Michigan sales tax remains a cornerstone of business accountability.“Proactively align systems with emerging standards, not reactive fixes.”

For sellers, knowledge isn’t just power—it’s the key to enduring success.

Related Post

Unblock Roblox with Website Bridge: The Ultimate Gate to Unrestricted Gaming

Unlocking the OVH S3 Pricing Puzzle: A Deep Dive into Cloud Storage Costs and Value

Kirk Cousins’ Quiet Family Life: Living Away From the Spotlight with Wife Julie Hampton

Have I Got News For You On IMDb: Decoding the Heat Behind the Comedy Giant