Mastering Wells Fargo Mobile Deposit: Key Limits and What Shoppers Need to Know

Mastering Wells Fargo Mobile Deposit: Key Limits and What Shoppers Need to Know

For millions of Wells Fargo customers, mobile deposit has become a daily convenience—enabling deposits from bank branches, ATMs, or even while walking down the street—yet understanding the platform’s limits remains a critical yet often overlooked factor. Whether you’re a first-time user or a seasoned saver, knowing the Wells Fargo Mobile Deposit Limit shapes how effectively you can manage your cash flow without delays or failed submissions. This article cuts through the complexity to deliver a clear, actionable guide to the key restrictions, eligibility, and best practices that define mobile deposit success on the Wells Fargo app.

Wells Fargo does not impose a blanket “one-size-fits-all” limit on mobile deposit requests, but rather a tiered system influenced by account type, verification status, and device type. At its core, mobile deposit relies on secure image capture of check images, paired with bank account verification—processes governed by both user behavior and corporate policy. “Deposit limits are designed not just to prevent fraud, but to ensure reliable access when you need your funds most,” explains financial services expert Clara Reyes, senior analyst at Digital Banking Insight.

“Users must understand the boundaries to avoid interruptions in their financial workflow.”

Core Mechanics of the Mobile Deposit Limit: What the Numbers Really Mean

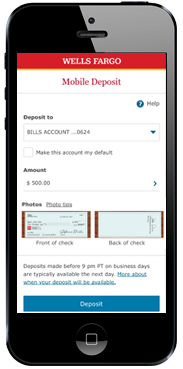

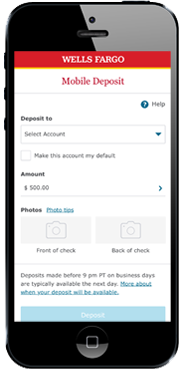

Wells Fargo’s mobile deposit functionality operates under a framework shaped by three main parameters: account type, verification status, and device compatibility. These factors collectively determine user access and limit amounts.- Account Eligibility: Most checking and savings accounts joined with Wells Fargo are eligible for mobile deposit, though savings accounts may offer a cap—typically lower than checking limits—due to reduced cash-on-hand liquidity. Share accounts unlock slightly higher deposit thresholds, reflecting their role as primary transaction hubs.

- Verification Status: A key determinant in limit tiers, mobile deposit activation requires user verification, primarily through Know Your Customer (KYC) checks.

New users must complete identity verification within seven days; verified accounts gain temporary higher deposit limits, which scale with confirmed identity data and account activity.

- Device-Based Limits: Mobile deposits via smartphones generally carry higher daily thresholds than kiosk or ATM submissions. For example, the standard limit for smartphone deposits at Wells Fargo is $1,000 per transaction and $5,000 daily, though these figures can vary based on real-time risk analysis and account history.

What users often don’t realize is that these limits are fluid, adjusted in real time by Wells Fargo’s fraud detection systems. Sudden deposit spikes, irregular usage patterns, or geolocation anomalies may trigger temporary hold requests or reduced allowances—factors users should anticipate to avoid missed transactions.

This dynamic adjustment underscores the importance of staying informed through the Wells Fargo app notifications and account dashboards, where users can track their current deposit status and adjust verification steps accordingly.

Maximum Allowances: Breakdown by Use Case and Account Type

Wells Fargo structures mobile deposit limits across practical scenarios to balance convenience with security. Below is a detailed look at typical allowances:- General Deposit Limit: Most active accounts fall within a $1,000 to $5,000 daily deposit window, applicable to smartphone submissions. This range reflects a tiered system where verified users with consistent transaction histories enjoy uncapped flexibility inside the $5,000 threshold, while new or partially verified accounts see lower maximums.

- ATM and Kiosk Limits: Submitting via Wells Fargo’s mobile deposit kiosk or ATM often imposes lower caps—commonly $500 to $3,000 per transaction—due to additional mechanical and verification checks at the point of deposit.

- Private Deposits (e.g., checks from family or friends): While unlimited in image capture, Wells Fargo monitors these transfers for fraud risk.

Depositing cash or checks requiring third-party validation may result in temporary hold flags until the sender’s identity is confirmed, effectively acting as a soft limit until clearance.

- Business Accounts: Commercial Wells Fargo accounts, especially those with higher volume or business-class services, may access customized limits up to $25,000 daily, contingent on creditworthiness and account ownership verification.

These distinctions reveal a broader principle: the higher the transaction value or frequency, the more analytics and verification layers apply—ensuring both user safety and system integrity. “Wells Fargo’s approach is deliberately scalable,” notes Reyes. “It rewards responsible, verified usage with fewer constraints while maintaining robust safeguards for higher-value deposits.”

How Limits Are Set and Managed: Behind the Scenes

Deposit limits on Wells Fargo Mobile Deposit are not arbitrary; they stem from sophisticated risk models that integrate user behavior, account activity, and real-time fraud analytics.Customers rarely see the algorithm at work, but their actions directly influence limit tiers. Verified identity, consistent transaction volumes, and timely verification all signal reliability, prompting increased thresholds.

- Automated Adjustments: Wells Fargo’s systems continuously assess deposit patterns. A user making regular $400 smartphone deposits daily, for instance, may see their daily limit rise gradually over days as patterns stabilize.

- User-Controlled Updates: High-active users can enter account settings to request limit increases, which triggers manual verification but reduces reliance solely on automated caps.

- Limits by Region and Device: Instances exist where regional policy or mobile app version compatibility affect deposit speed and limit volume, ensuring localized compliance and technical performance.

Wells Fargo’s transparency around these factors has grown in recent years, with in-app limit trackers and real-time alerts enabling users to stay ahead of potential restrictions.

As behavioral analytics become more precise, limits evolve—not as barriers, but as dynamic safeguards calibrated to user trust and security.

When Deposits Fall Through the Cracks: Common Pitfalls and How to Avoid Them

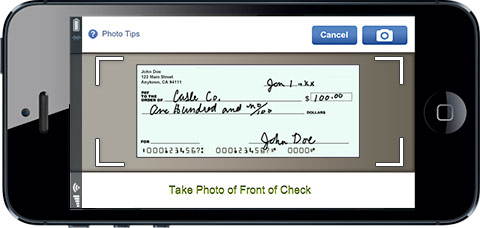

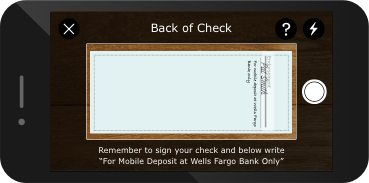

Understanding mobile deposit limits isn’t just about knowing the numbers—it’s about avoiding avoidable disruptions. Numerous users report failed submissions due to incomplete verification, image quality inconsistencies, or unmonitored account activity. To prevent such issues, follow these proven steps:Ensure your identity is fully verified—complete KYC steps within the required timeframe to unlock higher deposit thresholds.

- Use high-resolution images with clear check details;

- Use high-resolution images with clear check details;

- Automated Adjustments: Wells Fargo’s systems continuously assess deposit patterns. A user making regular $400 smartphone deposits daily, for instance, may see their daily limit rise gradually over days as patterns stabilize.

Related Post

Fearless: The Timeless Art on Taylor Swift’s Iconic Album Cover

Bob Costas HBO Bio Wiki Age Wife Son Mlb Network Salary And Net Worth

Fantastic Four 2015: A Critical Re-evaluation and Box Office Breakdown

Kalayla: Rewriting the Future of Sustainable Innovation