Mastering Time: How the Fiscal Year Quarterly Calendar Transforms Financial Planning

Mastering Time: How the Fiscal Year Quarterly Calendar Transforms Financial Planning

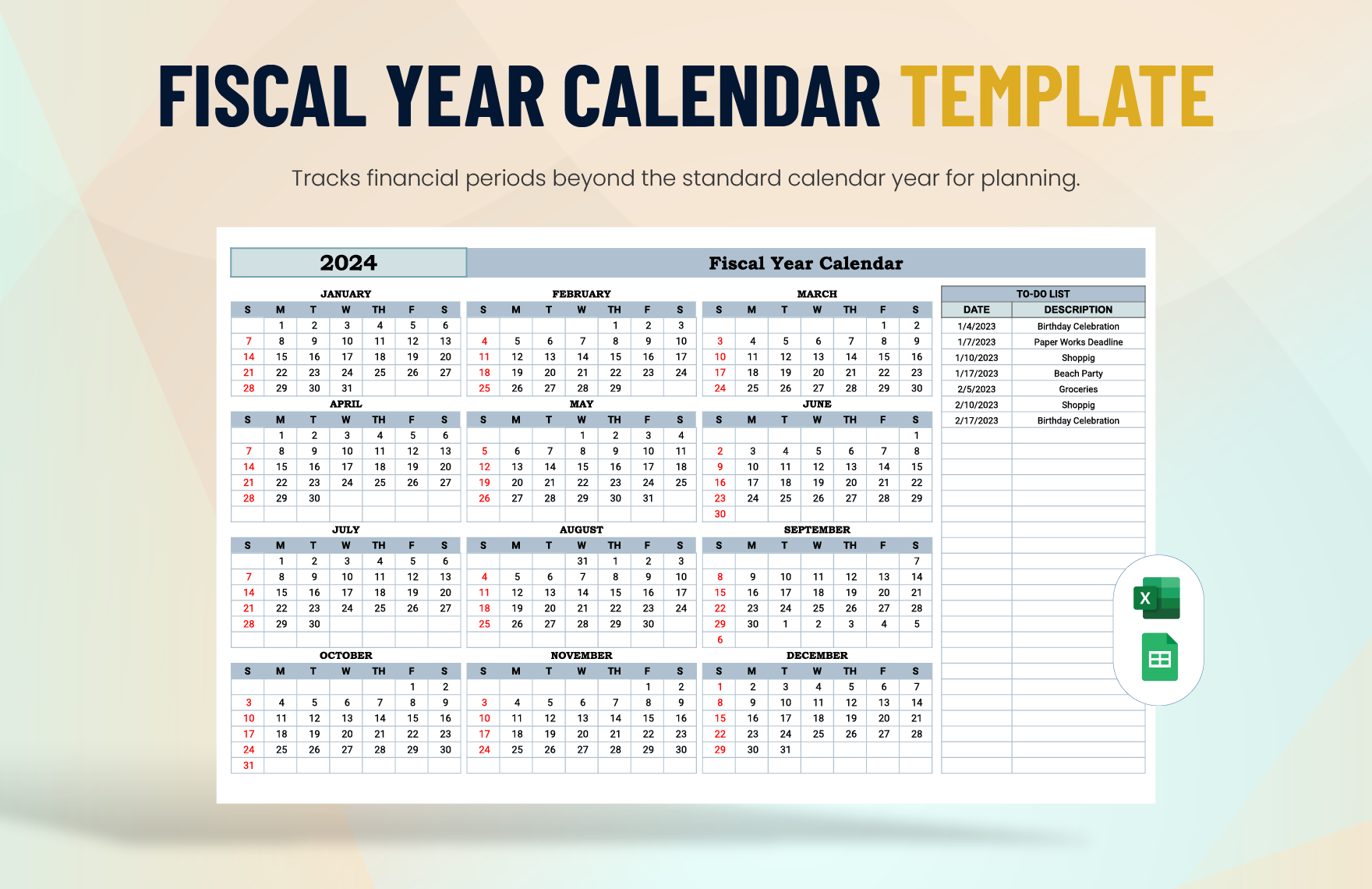

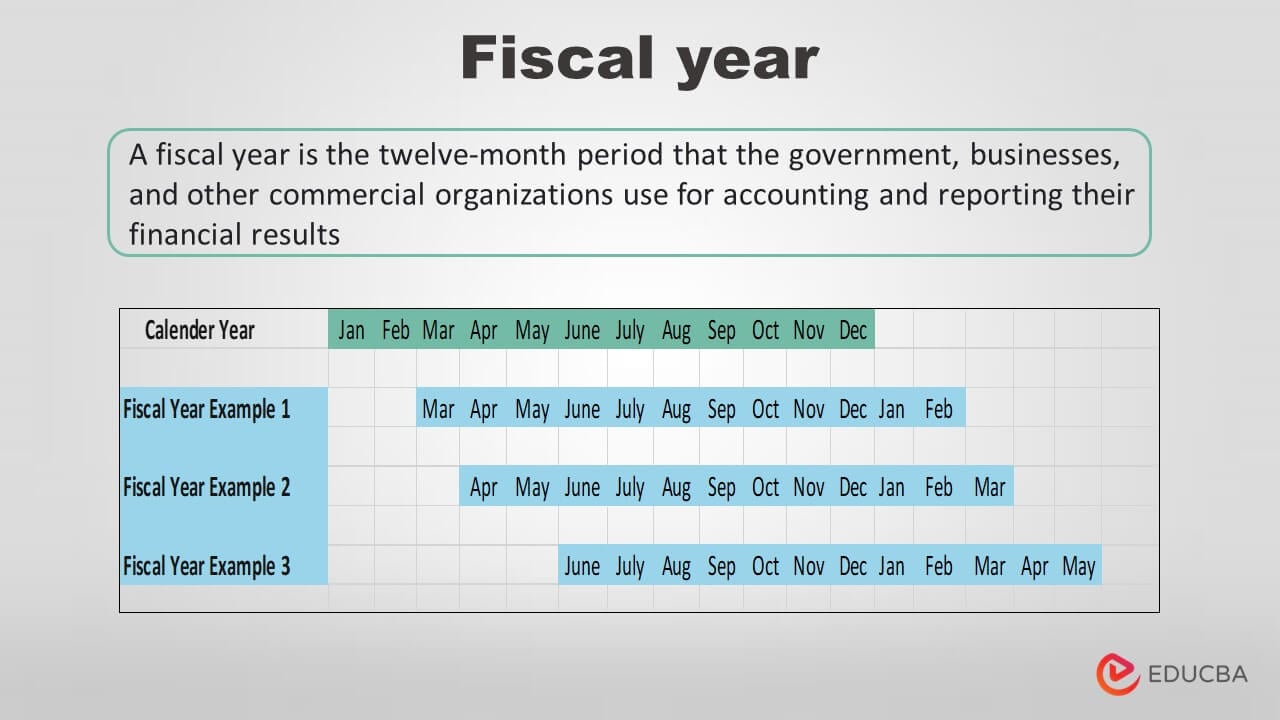

In the world of corporate finance, timing is everything—yet few tools enable precise, recurring synchronization of planning, reporting, and budgeting quite like the Fiscal Year Quarterly Calendar. Aligned with a structured fiscal year divided into four quarterly segments, this calendar framework ensures organizations maintain consistent fiscal discipline, streamline reporting cycles, and proactively manage performance across overlapping quarters. By embedding quarterly reviews into the fiscal rhythm, finance teams can detect variances early, adapt strategies in real time, and deliver more accurate forecasts—all while staying aligned with legal, regulatory, and market demands.

The fiscal year, distinct from the calendar year, is often tailored to match an organization’s business cycle, allowing for accurate tracking of revenue, expenses, and profitability. When mapped to a Quarterly Calendar, each wheel of the fiscal year becomes not just a time marker, but a strategic checkpoint. “Quarterly milestones compress our planning horizon into manageable chunks, turning long-term goals into actionable quarterly initiatives,” explains Elena Torres, Chief Financial Strategist at a leading multinational firm.

“This cycle forces focus, accountability, and agility.”

Segmental Alignment: The Core of the Quarterly Framework

The Fiscal Year Quarterly Calendar divides the fiscal year into four distinct quarters—each serving a unique role in financial governance:Q1: Budget Initiation and Year-Over-Year Benchmarking

Q1 sets the foundation for the fiscal year, typically closing in March or April. This quarter focuses on finalizing the original budget, integrating prior-year performance data, and establishing key performance indicators (KPIs). Management conducts scenario planning to identify risks and opportunities early, ensuring resources are allocated with clear strategic intent.“We don’t just plan for Q1—we lay the groundwork that echoes through all four quarters,” notes CFO Marcus Lin. This upfront rigor minimizes forecast errors and positions leadership for agile course corrections.

Q2: Performance Analysis and Mid-Year Adjustments

By mid-year in June or September, Q2 triggers formal performance reviews.Financial leaders analyze budget variances, revenue trends, and expense patterns, comparing actuals against projections. These insights drive tactical adjustments: cost containment measures may be tightened, marketing investments could be ramped, and operational improvements identified. “Q2 iswhen the rubber meets the road—we assess whether the fiscal course remains on target,” says analysts.

Furthermore, mid-year reviews support timely decision-making, such as reallocating capital or refining long-term forecasts based on real-world data.

Q3: Strategic Push and Resource Optimization

As the calendar turns, Q3—July through September—marks a critical momentum phase. This quarter demands focused execution: launching key initiatives, accelerating pipeline deliveries, and optimizing resources across departments.“Q3 is when strategy transforms from plan to action,” observes Teresa Chan, a fiscal operations expert. Companies often align major project milestones with this period to maximize productivity and ensure deliverables align with annual targets. Data-driven prioritization becomes essential, balancing innovation with efficient use of capital.

Q4: Year-End Review, Audit, and Forward Planning

Q4 closes the fiscal year in October or December with comprehensive year-end activities: final financial reporting, tax reconciliation, internal and external audits, and stakeholder briefings. Beyond compliance, the quarter is pivotal for reflecting on seasonal performance, validating forecasts, and embedding learnings into the next fiscal cycle. “Q4 closes the loop—we audit what worked, what failed, and why,” emphasizes audit lead Daniel Wu.This introspective stance strengthens institutional memory and sharpens forecasting models for the coming year.

By segmenting the fiscal year into quarterly intervals, organizations cultivate a rhythm of accountability and adaptation. Each quarter functions as both a checkpoint and a catalyst.

“This isn’t just timekeeping—it’s temporal strategy,” explains Torres. “The calendar itself becomes a planning engine, driving disciplined execution, early risk detection, and continuous improvement.” Ultimately, the Fiscal Year Quarterly Calendar is more than a timekeeping tool. It embodies a proactive financial culture, empowering leaders to anticipate shifts, optimize performance, and deliver sustained value year after year.

In an era where timely insight separates sustained success from reactive firefighting, mastering this calendar framework is not optional—it’s essential.

Related Post

Decoding the Digital Empire: An In-Depth Analysis of CoryxKenshin Net Worth and Content Strategy

Fratello Grande: The Unsung Force Shaping Modern Innovation and Influence

Decoding the Multifaceted 'Nin Meaning': Origins, Cultural Significance, and Modern Usage

The 1975 Chinese Star Sign: How One Zoding Shaped A Generation’s Destiny