Mastering Cross-Border Trade: How the FedEx Tax and Duty Invoice Transforms Global Shipment Compliance

Mastering Cross-Border Trade: How the FedEx Tax and Duty Invoice Transforms Global Shipment Compliance

Every international shipment, no matter how simple, carries a web of financial and regulatory obligations. Among the most critical documents ensuring smooth transit across borders is the FedEx Tax and Duty Invoice—far more than a billing form, it serves as both a financial ledger and a compliance gateway. For businesses navigating customs, tariffs, and diverse tax regimes, this invoice functions as a linchpin in global logistics.

Its precision shapes clearance times, cost predictability, and legal accountability, making it indispensable in today’s interconnected supply chains.

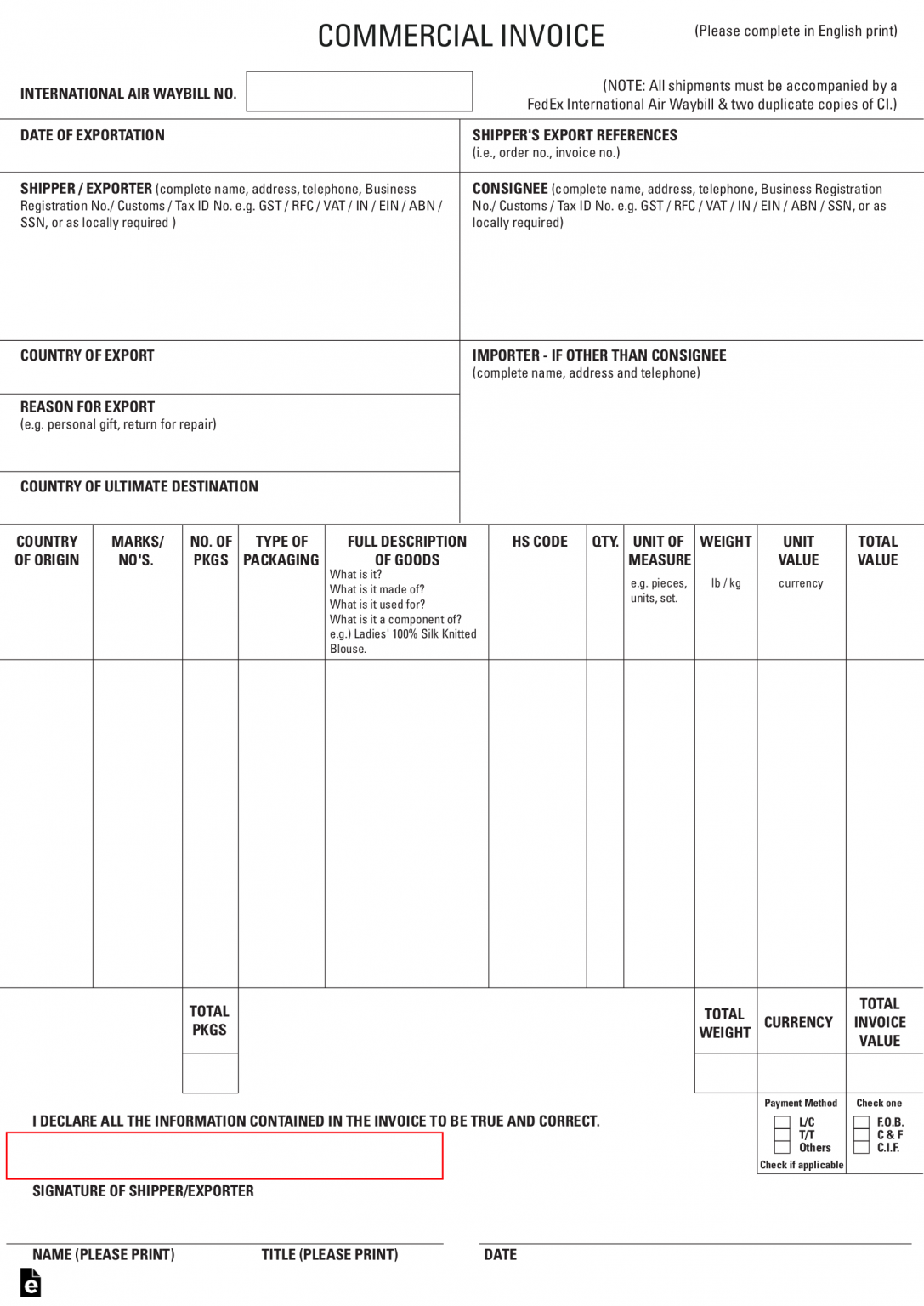

The FedEx Tax and Duty Invoice is a specialized commercial invoice tailored specifically for international shipments. Unlike standard freight invoices, it contains detailed breakdowns of customs duties, taxes, and other government-imposed charges—information essential for both the shipper and customs authorities.

It must align with international trade standards and national regulations, ensuring correct classification of goods under HS codes (Harmonized System codes) and proper valuation for duty assessment. "Accuracy on this document isn’t just recommended—it’s mandatory," says Clara Mendez, a global trade compliance expert at FedEx Freight. "A single misclassification can trigger delays, penalties, or even seizure of cargo."

The Invoice’s Role in International Customs Clearance

At the heart of every cross-border shipment lies the customs clearance process—a gatekeeping mechanism where freight encounters legal scrutiny.The FedEx Tax and Duty Invoice is the primary instrument enabling authorities to assess applicable duties and taxes. It includes: - Itemized descriptions of goods - Harmonized System (HS) code references for accurate tariff application - Total freight value as declared by the shipper - Details of applicable taxes, including VAT, GST, and customs duties - Certificate of origin, when required Customs officials rely on this document to verify declared values and classify products under international trade laws. Without it, clearance can stall for days—or worse—resulting in costly storage fees and delivery delays.

"A complete and precise invoice accelerates processing and reduces risk," explains James Tran, senior customs broker at Global Trade Solutions. "It’s the first line of defense against errors that can derail shipments."

The invoice’s tax and duty details directly influence landed costs. For example, shipments of electronics entering the European Union are subject to specific VAT rates and anti-dumping duties, all documented on this form.

"Misreporting classifications often leads to overpayment or underpayment, creating financial exposure," adds Tran. Businesses that master this documentation gain a competitive edge through transparency and predictability.

Structured Components: What Makes a FedEx Tax and Duty Invoice Effective

The strength of a FedEx Tax and Duty Invoice lies in its rigor and clarity. Each section serves a distinct function, ensuring full traceability and audit readiness.- **Shipper and Consignee Details**: Full legal names, shipping addresses, and tax identification numbers validate identities across jurisdictions. - **Delivery and Tariff Information**: Exact shipment date, destination, HS codes, and product specifications prevent classification disputes. - **Itemized Cost Breakdown**: Separates base freight charges from each duty or tax component, enabling easy review by customs and finance teams.

- **Customs Valuation Clarifications**: Specifies the transaction value, including invoice value, freight, and insurance—critical for accurate duty computations. - **Certification Statement**: Often signed by a customs expert or freight forwarder to confirm compliance with export regulations. adhering to global standards, FedEx mandates that these elements align with World Customs Organization (WCO) guidelines and local customs requirements.

"The form isn’t just paperwork—it’s a blueprint for regulatory alignment," emphasizes FedEx freight documentation lead, Lena Cho. "A well-constructed invoice minimizes ambiguity and reduces clearance friction."

For instance, when shipping perishable goods like fresh produce into Southeast Asia, the duty calculation hinges on tariff preferences under regional trade pacts. The invoice’s accurate product descriptions enable eligibility for reduced rates under ASEAN agreements.

A single misclassified mango as “furniture” instead of “agricultural goods” could ignite protracted customs disputes—underscoring the document’s power.

Common Pitfalls That Derail Shipments—and How to Avoid Them

Even minor oversights on the FedEx Tax and Duty Invoice can lead to significant disruptions. Common errors include: - Incomplete HS code references, inviting incorrect tariff application - Undeclared freight or insurance values, triggering spot checks and retroactive taxes - Missing customs declarations or certification, resulting in hold-ups - Discrepancies between invoice and shipping manifest, raising suspicion among authorities "Many delays stem from inconsistent data between the invoice and shipment papers," warns Mendez. "Even a minor mismatch—like a misprinted HS code—can trigger a cascade of compliance reviews." To prevent such issues, companies must implement rigorous validation protocols: - Cross-reference HS codes using official databases like the WCO’s Threat Coalition or national customs portals - Train logistics teams on current tariff classifications and duty rates - Employ automated systems to flag inconsistencies before invoicing - Secure third-party customs audits for complex or high-value shipmentsThe Broader Impact: From Compliance to Strategic Advantage

Beyond clearing borders, the FedEx Tax and Duty Invoice shapes long-term trade strategy.Accurate duty and tax reporting builds trust with customs authorities, potentially qualifying shippers for trusted trader programs—such as CEPT or AEO—that offer expedited clearance and reduced inspections. These advantages compound savings across multiple shipments. Moreover, reliable invoice practices strengthen financial forecasting and internal controls.

Detailed duty records support accurate landed cost modeling, enabling better pricing, budgeting, and margin analysis. For multinational corporations, this transparency underpins global supply chain resilience. As droughts in shipping times escalate due to geopolitical shifts and trade policy updates, the invoice transforms from a compliance task into a strategic asset.

In an era where border delays cost millions daily, the FedEx Tax and Duty Invoice emerges as both a shield and a catalyst. It doesn’t just report duties—it protects shipments, optimizes costs, and accelerates movement across continents. For businesses committed to seamless global trade, mastering this document is not optional.

It’s a prerequisite for competitiveness.

Related Post

Navigating Global Trade: Understanding the FedEx Tax and Duty Invoice

Download & Install Scarlet iOS Like Never Before: The 2024 Step-by-Step Guide

Alan Ritchson: Standing Tall at 6’2" and 205 lbs — A Physical Profile of a Rising Star

Decoding Life’s Blueprint: Mastering Biological Classification Through the Pogil Model 2 Approach